Investors with a lot of money to spend have taken a bullish stance on United Parcel Service (NYSE:UPS).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with UPS, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 8 uncommon options trades for United Parcel Service.

This isn't normal.

The overall sentiment of these big-money traders is split between 50% bullish and 37%, bearish.

Out of all of the special options we uncovered, 4 are puts, for a total amount of $179,020, and 4 are calls, for a total amount of $175,368.

What's The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $95.0 to $140.0 for United Parcel Service during the past quarter.

Insights into Volume & Open Interest

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for United Parcel Service's options for a given strike price.

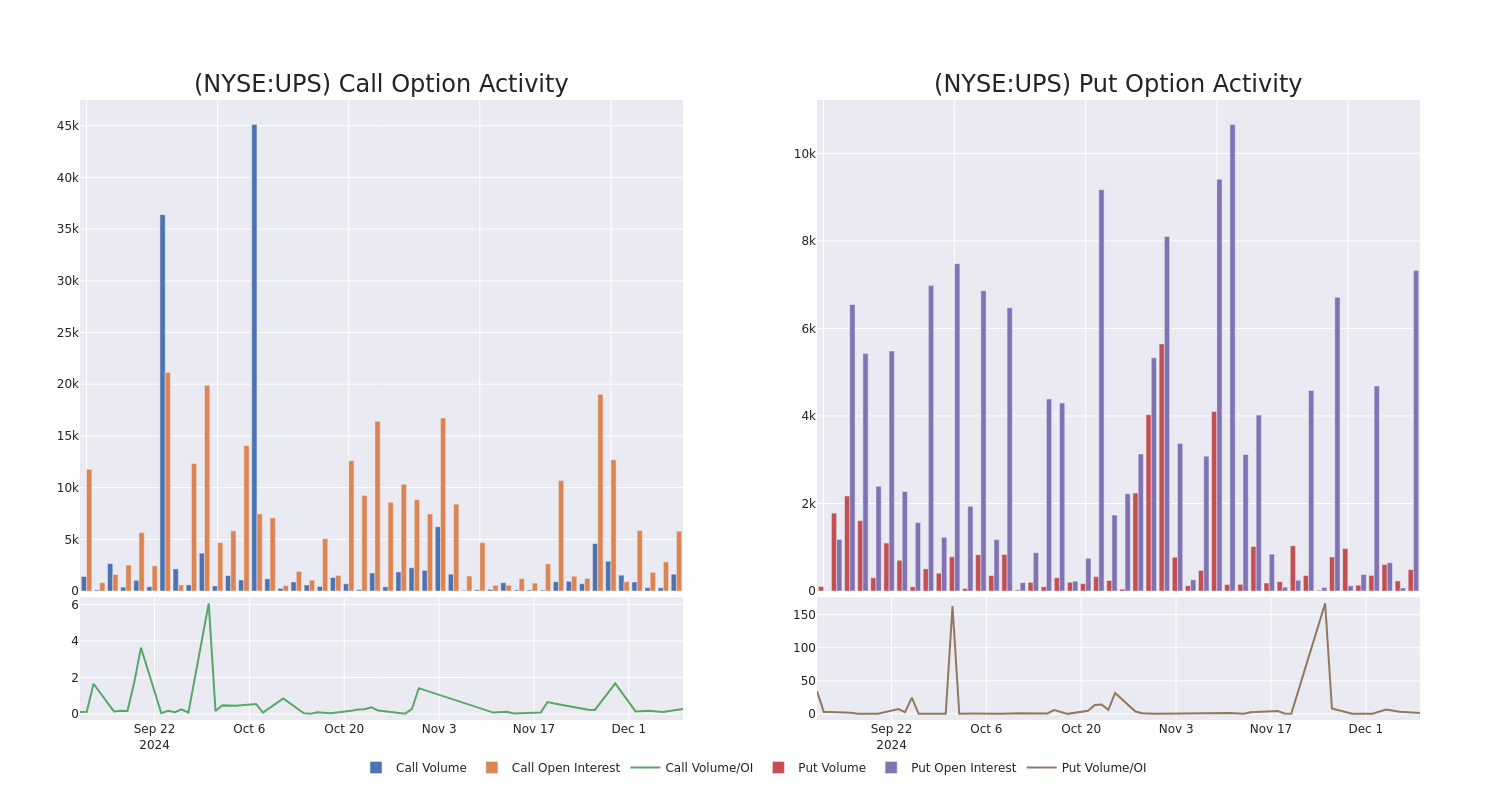

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of United Parcel Service's whale activity within a strike price range from $95.0 to $140.0 in the last 30 days.

United Parcel Service Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| UPS | CALL | SWEEP | BULLISH | 06/20/25 | $9.0 | $8.85 | $9.0 | $130.00 | $92.6K | 336 | 140 |

| UPS | PUT | TRADE | BULLISH | 06/18/26 | $5.15 | $4.8 | $4.9 | $95.00 | $73.5K | 133 | 150 |

| UPS | PUT | TRADE | BEARISH | 03/21/25 | $4.0 | $4.0 | $4.0 | $120.00 | $40.0K | 4.5K | 209 |

| UPS | PUT | TRADE | BULLISH | 03/21/25 | $4.1 | $3.95 | $4.0 | $120.00 | $40.0K | 4.5K | 109 |

| UPS | CALL | TRADE | BEARISH | 03/21/25 | $3.1 | $2.88 | $2.9 | $140.00 | $28.7K | 5.0K | 849 |

About United Parcel Service

As the world's largest parcel delivery company, UPS manages a massive fleet of more than 500 planes and 100,000 vehicles, along with many hundreds of sorting facilities, to deliver an average of about 22 million packages per day to residences and businesses across the globe. UPS' domestic US package operations generate around 64% of total revenue while international package makes up 20%. Air and ocean freight forwarding, truckload brokerage, and contract logistics make up the remainder. UPS is currently pursuing "strategic alternatives" for its truck brokerage unit, Coyote, which it acquired in 2015.

In light of the recent options history for United Parcel Service, it's now appropriate to focus on the company itself. We aim to explore its current performance.

United Parcel Service's Current Market Status

- Currently trading with a volume of 2,502,931, the UPS's price is up by 1.6%, now at $127.62.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 50 days.

What The Experts Say On United Parcel Service

Over the past month, 1 industry analysts have shared their insights on this stock, proposing an average target price of $158.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access. * Maintaining their stance, an analyst from Citigroup continues to hold a Buy rating for United Parcel Service, targeting a price of $158.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest United Parcel Service options trades with real-time alerts from Benzinga Pro.