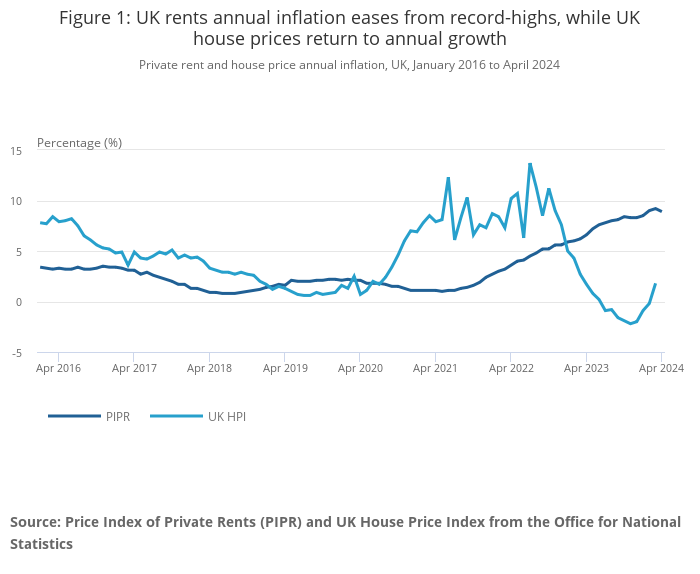

House prices in Britain have risen for the first time in almost a year, according to figures from the Office for National Statistics released on Wednesday.

Average UK house prices increased by 1.8 per cent in the 12 months to March, which represented a recovery in pricing after they had fallen by 0.2 per cent in the 12 months to February.

This has lifted the average house price across the UK to £283,000, according to the ONS.

Average house prices in England were up 1 per cent to £299,000, while properties saw a 1.3 per cent average increase to £214,000 in Wales and 6.7 per cent average increase to £192,000 in Scotland in the 12 months to March.

Average house prices in Northern Ireland were up 4 per cent to £178,000 for the first three months of 2024, compared with the same quarter a year earlier.

ONS chief economist Grant Fitzner said: “Average UK house prices grew over the year for the first time since last summer.

“House prices saw an annual rise in every nation and region, except London and the South East, with Scotland seeing the fastest annual growth.

“After two years of unprecedented and generally accelerating annual growth, private rental price rises showed tentative signs of easing.

“Most nations and English regions saw a slowdown, with a notable easing in London.”

The latest figures on average house prices come just hours after it was revealed that inflation fell to 2.3 per cent in April from 3.2 per cent in March.

It is the lowest level since July 2021 and close to the the Bank of England’s target level of 2 per cent, but the decline was smaller than expected by economists, leading to scepticism that interest rates will be cut in June.

Michelle Lawson, director at Lawson Financial, told Newspage: “On the sales front, there is definitely more activity and things are starting to pick up but we need that first base rate cut from Threadneedle Street to really get things going.

“Sadly we may have to wait a little longer after this morning’s inflation data.”

Sarah Coles, head of personal finance at Hargreaves Lansdown, said: “Buyers have finally squeezed some growth out of the property market.

“They haven’t exactly set the market on fire, but it they’ve warmed it up enough to push prices into positive territory for the first time in almost a year.

“It’s a much more comfortable place to be buying right now.”

The ONS also revealed that UK private rents increased by 8.9 per cent in the 12 months to April, as house price inflation slowed slightly from 9.2 per cent growth in the year to March.

Commenting on the rental figures, Rebecca Florisson, a principal analyst at the Work Foundation, a think-tank at Lancaster University, said: “Inflation may have dropped to the lowest rate since September 2021 at 2.3%, but near-record private rent growth of 8.9% means the cost of living crisis is continuing for millions of people.

“On average, renters in Britain are having to find £103 more a month than they were last year. This is most acute for workers in London where rents are now 10.8% higher than in 2023, and will hit insecure workers hardest as they earn on average £3,276 less than those in secure jobs.”

Additional reporting by PA

.jpg?w=600)