Tory leader Kemi Badenoch said figures showing the economy shrank in October show that Rachel Reeves’ Budget is “crashing the economy”.

She told the PA news agency on a visit to Essex: “I think it shows that the Prime Minister and the Chancellor have been making the wrong choices. They inherited an economy that was growing and now it is shrinking. Their Budget is crashing the economy and they need to reverse this

The UK economy shrunk again in October, according to official figures, putting economists on “recession watch”.

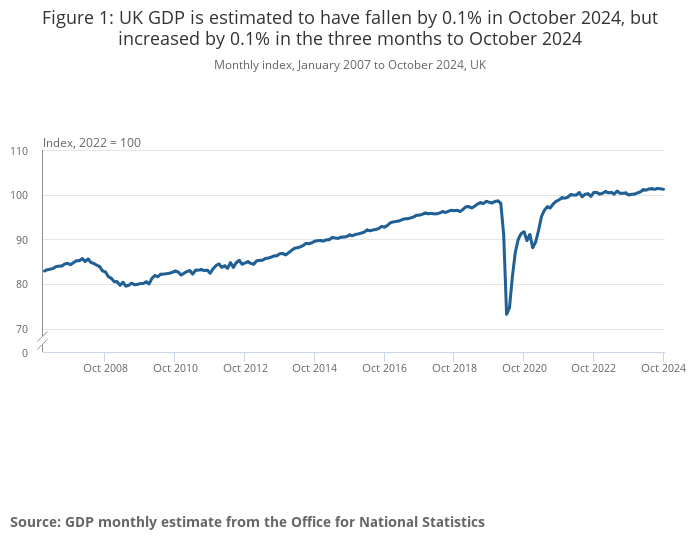

The Office for National Statistics (ONS) said output fell by 0.1 per cent following the 0.1 per cent decline recorded for the previous month.

The latest figures cover the month ahead of the government’s first budget, which saw Labour unveil £40bn worth of tax rises.

It marks a fractional shift in the outlook for the economy after it eked out 0.1% growth over the latest quarter, between July and September.

Julian Jessop, economics fellow at the Institute of Economic Affairs, said: “The second successive monthly fall in economic activity in October should put the UK firmly on recession watch. Indeed, output per head may already be falling for the second quarter in a row.

“The loss of momentum is not contained to the UK. Indeed, the manufacturing sector appears to be struggling even more in the rest of Europe, notably Germany and France.

“Nonetheless, the new government’s negative rhetoric over the summer and the anticipation of a tight Budget have damaged sentiment and encouraged many households and business to put spending, hiring and investment on hold.”

The ONS said the services sector recorded no growth in October after also stalling in September.

The Chancellor said: “We are determined to deliver economic growth as higher growth means increased living standards for everyone, everywhere. This is what our Plan for Change is all about.

“While the figures this month are disappointing, we have put in place policies to deliver long-term economic growth.”

The latest economic news comes as the government continues to face criticism over the more controversial elements of the Budget, including changes to inheritance tax and the winter fuel payment.

Key points

- ‘Oil and gas extraction, pubs and restaurants and retail all had weak October’

- Rachel Reeves calls GDP stats ‘disappointing’ but points to future

- Another blow to Rachel Reeves as GDP shrinks for second month running

The pound has fallen in value following the ONS’s update on Britain’s shrinking economy.

Sterling fell by as much as 0.4 per cent before gaining ground to trade at $1.27.

The drop provided a boost for the FTSE 100, which rose by 2 points to 8,313.8

A weaker pound makes the index’s predominantly foreign earnings more attractive.

The National Institute of Economic and Social Research think tank says it expects grind to zero in the final three months of the year, which means Ms Reeves could avoid a recession.

Construction is likely to be hit hard, the think tank said.

NIESR associate economist Hailey Low said: “A weakening export climate amid rising global policy uncertainties and declining business confidence, exacerbated by the impact of recently announced budget measures, raises concerns about sustaining the growth momentum.”

🚨 OUT NOW 🚨

— National Institute of Economic and Social Research (@NIESRorg) December 13, 2024

Our latest #GDP Tracker projects growth to stagnate in Q4 of 2024 📉 with flatlining growth in the Services and Production sectors and a slight fall in the Construction sector 🔧

Discover more in our full analysis ⬇🔓https://t.co/L7F2udZn3G

Kemi Badenoch said figures showing the economy unexpectedly contracted in October show the Prime Minister and Chancellor have been “making the wrong choices” with a Budget that is “crashing the economy”.

The Tory leader told the PA news agency on a visit to Essex: “I think it shows that the Prime Minister and the Chancellor have been making the wrong choices. They inherited an economy that was growing and now it is shrinking. Their Budget is crashing the economy and they need to reverse this.”

Chancellor Rachel Reeves has insisted that things will pick up for the UK.

“The numbers on today’s GDP are disappointing, but it’s not possible to turn around more than a decade of poor economic growth and stagnant living standards in just a few months,” Ms Reeves said.

“But you’ll see from the plans we’ve been announcing - whether that is the energy reforms we’ve published today, the reforms to build one-and-a-half million homes that we published yesterday, the pensions reforms, the creation of a National Wealth Fund - this Government are getting on with the job of improving economic growth and driving up living standards.

“Growth is the number one mission of this Government - economic growth that results in families feeling better off with more money in their pockets - and we’re driving that economic growth and we hope that those numbers will start to improve because of the policies that we’re pursuing in the months ahead.”

Labour is hoping growth will come back with projects like green energy. But growth will come at the cost of local decision-making, energy secretary Ed Miliband has said.

“At the moment we have nationally significant infrastructure projects, which are decided by me as the Secretary of State. We don’t have that for onshore wind because it was banned from 2015 to 2024 - until this Government came to office - by the last government, leaving us vulnerable,” he told BBC Breakfast.

“We are saying that for onshore wind above 100 megawatts, as with other nationally significant infrastructure, that will be a decision made by the Secretary of State and local people will have a say, but these are nationally significant decisions.”

The UK economy isn’t the only one in the doldrums.

Germany’s economy is set to shrink for a second year in a row and only grow slowly after that, according to Germany’s central bank.

The Bundesbank now predicts that the German economy will shrink by 0.2 per cent this year after predicting 0.3 per cent growth in June while the 2025 growth outlook was cut to 0.2 per cent from 1.1 per cent.

An end to cheap natural gas from Russia and weaker demand for its cars from China has been depressing its growth for some time.

Germany is Europe’s largest economy and it relies heavily on its huge manufacturing sector which makes cars under the VW, Audi, Porsche, BMW and Mercedes brands, as well as aerospace parts and chemicals.

Germany’s output per person is $55,500 according to the International Monetary Fund, while the UK’s is $52,400.

One economist has gone a step further and said Britain is now on “recession watch”.

Julian Jessop, economics fellow at the Institute of Economic Affairs, said: “The second successive monthly fall in economic activity in October should put the UK firmly on recession watch. Indeed, output per head may already be falling for the second quarter in a row.

“The loss of momentum is not contained to the UK. Indeed, the manufacturing sector appears to be struggling even more in the rest of Europe, notably Germany and France.

“Nonetheless, the new government’s negative rhetoric over the summer and the anticipation of a tight Budget have damaged sentiment and encouraged many households and business to put spending, hiring and investment on hold.”

The drop in UK production “puts recession chatter back on the table”, one analyst has warned.

Alice Haine, Personal Finance Analyst at Bestinvest by Evelyn Partners, an online investment service, said:

“The Government’s doom-mongering about the state of the public finances in the run up to the Budget dented activity. The surprise fall in output will be worrying for consumers and business as it puts recession chatter back on the table and signals that the final quarter may be even worse than the third when growth almost stalled.

“The economy has lost momentum since the first three months of this year when it rebounded from the technical recession seen at the end of 2023,” she added. A technical recession is two consecutive quarters where the economy shrinks.

“The contraction in October will be concerning for the new Government as it offers a stark reflection of the hit to the economy from the uncertainty running up to the Budget, when consumers and businesses descended into a state of panic over what measures the Chancellor might deliver. Some of the most feared changes to personal taxation may not have materialised, but £40 billion in tax rises is a lot for an economy to get to grips with particularly when businesses are expected to shoulder most of that burden.”

Businesses are pointing to higher employment costs in their reaction to the figures that show the economy shrank.

Anna Leach, Chief Economist at the Institute of Directors, said: “October had seen the third successive decline in the IoD’s confidence measure for business leaders as businesses faced another month of damaging uncertainty in the run-up to the Budget. This provides a weak platform for Q4, and there is a risk that growth has gone into reverse in the private sector.

“As we head further into the festive season, and consumer confidence remains in the doldrums, many businesses are continuing the process of updating their business plans for the coming year to accommodate significant increases in employment costs.

She said that high borrowing costs are hitting investment decisions, which will add to the downbeat feeling in the economy.

“Whilst there are welcome policy measures on the horizon which will over time improve the economic environment – from tax simplification to planning to industrial strategy - the recent blows to businesses have made the task of achieving stronger sustainable growth harder.”

The FTSE 100 index of largest London-listed companies is up a shade, in spite of the gloomy update on the economy. The index gained a paltry 0.08 per cent.

“The Budget continued to be blamed for the UK’s fragile economic performance as official figures showed GDP unexpectedly contracted in October, having also done so in September. This led to weakness in the pound, which can be helpful to the FTSE 100 given the relative boost it affords its dominant overseas earners,”says Dan Coatsworth, investment analyst at AJ Bell.

“More positively, there was a slight uptick in consumer confidence as the Christmas trading period entered its final knockings.

“US stocks endured a modest sell-off in the latest trading session on Wall Street as factory gate prices came in hotter than expected. Given these often feed into higher consumer prices down the line, this release raised concerns about fresh inflationary pressures in the economy.”

'Bank of England rate cut seems unlikely’

09:45 , Barney DavisThe latest figures from the ONS follow a 0.1% estimated fall in September – meaning it is the first time the economy has contracted for two consecutive months since March and April 2020, during the onset of the Covid-19 pandemic.

Debapratim De, director of economic research at Deloitte, said: “Growth is expected to remain sluggish over the winter months, before the budgetary boost to public spending shows up in the GDP figures.

“Despite the downbeat assessment, a rate cut by the Bank of England seems unlikely this month as policymakers remain cautious about the inflationary impulse from the Budget and the wider geopolitical environment.”

Top economist says business hit hard by Budget and Trump’s tarriff threats

09:15 , Barney DavisRob Wood, chief UK economist for Pantheon Macroeconomics, said: “Global tariff threats, uncertainty from the Budget, a weak month for consumer spending and volatile sectors dragged GDP into another month-to-month fall in October.

“We think much of the drop in GDP can, however, be put down to erratic sectors that should bounce back in November.”

Mr Wood said there was “no doubt” the UK Budget and tariff threats following Donald Trump’s US election win “hit business sentiment hard in October and November”.

But he said weak growth was partly driven by volatile sectors and also political uncertainty which is likely to fade, meaning the Bank of England is unlikely to stray from expectations to keep interest rates unchanged next week.

EU imports rise 5% in October driven by German planes and cars from Spain

08:45 , Barney DavisThe value of imports from the EU increased by £1.2 billion (5.0%) in October 2024. This was because of a £0.5 billion rise in imports of machinery and transport equipment and a £0.3 billion rise in fuel imports (Figure 3).

The rise in imports of machinery and transport equipment was driven by increased imports of aircraft from Germany and cars from Spain. The rise in fuel imports was because of increased imports of refined oil from the Netherlands.

Production sector main contributor to the fall of 0.1% GDP

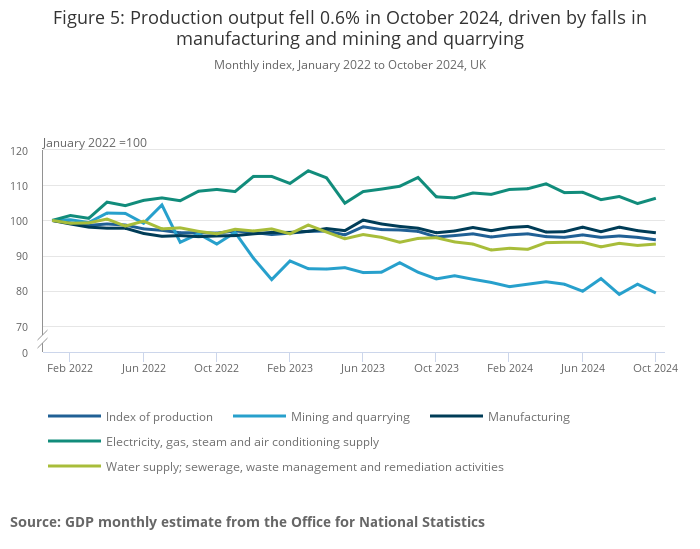

08:15 , Barney DavisThe UK’s production output is estimated to have fallen by 0.6% in October following a fall of 0.5% in September.

This was caused by a 0.6% decrease in manufacturing and a fall of 3.1% in mining and quarrying.

The ONS said these falls were “partially offset” by growth of 1.4% in electricity, gas, steam and air conditioning supply and a 0.5% growth in water supply; sewerage, waste management and remediation activities in October.

The largest contribution to the fall was a 2.0% decrease in mining and quarrying. Electricity, gas, steam, and air conditioning supply also decreased by 1.2%.

CBI remain hopeful economy will improve in 2025

08:05 , Barney DavisConfederation of British Industry (CBI) said UK firms “remain hopeful that things will improve in the New Year”.

“It may take a few more months for firms to work through the impact of the sharp increase in employment taxes outlined in the Budget and adjust their hiring and investment plans accordingly.

“But businesses can probably still look forward to a steady, if unspectacular, economic recovery next year as the impact of the inflation shock fades and interest rates come down further”, Ben Jones, the organisation’s lead economist said.

He added: “The government can support business confidence by accelerating measures that could restore some headroom for investment.

“These include delivering flexibility to the Apprenticeship Levy, preparing a faster timetable to reform business rates and working in full partnership with boardrooms to develop a long-term modern industrial strategy that can provide the stability and certainty needed to unlock innovation, investment and grow the economy.”

Graph: UK GDP is estimated to have fallen by 0.1% in October 2024

07:56 , Barney Davis

ONS highlights GDP decline

07:53 , Barney Davis- Monthly real gross domestic product (GDP) is estimated to have fallen by 0.1% in October 2024, largely because of a decline in production output; this follows a fall of 0.1% in September 2024.

- Real GDP is estimated to have grown by 0.1% in the three months to October 2024, compared with the three months to July 2024, with growth in the services and construction sectors in this period.

- Monthly services output showed no growth in October 2024 after also showing no growth in September 2024, but grew by 0.1% in the three months to October 2024.

- Production output fell by 0.6% in October 2024, because of falls in manufacturing, and mining and quarrying output, following a fall of 0.5% in September 2024; production output fell by 0.3% in the three months to October 2024.

- Construction output fell by 0.4% in October 2024, following a growth of 0.1% in September 2024, but grew by 0.4% in the three months to October 2024.

Shadow chancellor blames Labour for ‘talking down the economy’

07:49 , Barney DavisShadow chancellor Mel Stride said the impact of the declining growth figures will be “felt by families through higher taxes, fewer jobs, higher prices and higher interest rates”.

He said: “It is no wonder businesses are sounding the alarm. This fall in growth shows the stark impact of the Chancellor’s decisions and continually talking down the economy.”

Another blow to Rachel Reeves as GDP shrinks for second month running

07:46 , Barney DavisThe latest figures cover the month ahead of the government’s first budget, which saw Labour unveil £40bn worth of tax rises.

The Independent’s Political Correspondent Millie Cooke reports:

UK economy shrinks again in another blow to Reeves, new figures show

Rachel Reeves calls GDP stats 'disappointing’

07:41 , Barney DavisChancellor Rachel Reeves, responding to October’s GDP statistics, said: “We are determined to deliver economic growth as higher growth means increased living standards for everyone, everywhere. This is what our Plan for Change is all about.

“While the figures this month are disappointing, we have put in place policies to deliver long-term economic growth.

“We have put public finances back on a stable footing, capped the rate of corporation tax at the lowest level in the G7, established a £70 billion National Wealth Fund to drive growth in our towns and cities, launched a 10-year infrastructure strategy and are creating pension mega funds to boost investment in British businesses, infrastructure and clean energy.”

‘Oil and gas extraction, pubs and restaurants and retail all had weak October’

07:39 , Barney DavisThe latest figures from the ONS come after it recorded 0.1% growth between July and September, a slowdown on the 0.4% increase between April and June.

Liz McKeown, the ONS’s director of economic statistics, said: “The economy contracted slightly in October, with services showing no growth overall and production and construction both falling.

“Oil and gas extraction, pubs and restaurants and retail all had weak months, partially offset by growth in telecoms, logistics, and legal firms.

“However, the economy still grew a little over the last three months as a whole.”