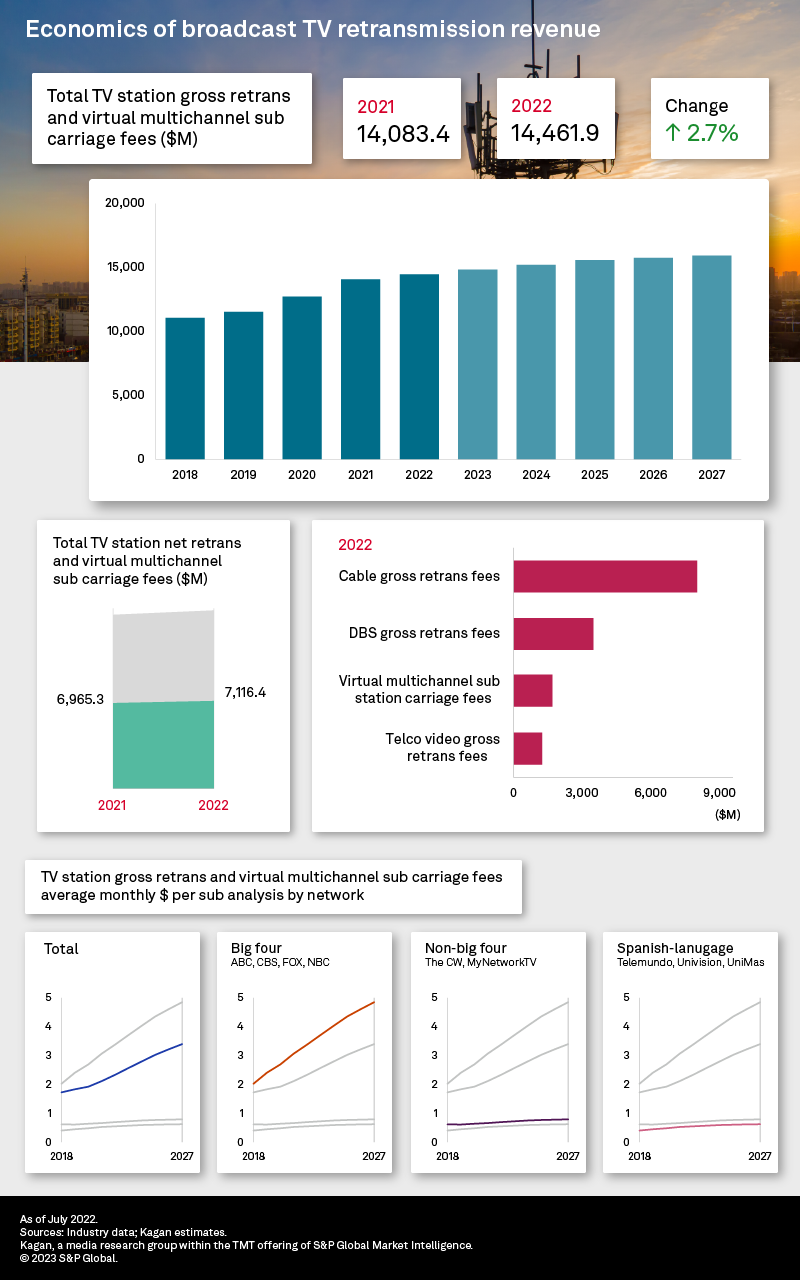

NEW YORK—Despite cord cutting and record pay TV sub loses in 2022, S&P Global Market Intelligence is reporting that U.S. TV station owners’ retransmission and carriage fees from cable, direct broadcast satellite, telco video operators and virtual multichannel providers reached an estimated $14.46 billion in 2022, up 3% from $14.08 billion in 2021.

Justin Nielson, principal analyst at S&P Global Market Intelligence explained that “Although traditional multichannel churn outpaced virtual subscriber gains in 2022, increases in average per-subscriber rates in renewals and annual step-ups kept gross retransmission revenues growing, albeit at a much slower pace than years prior.”

Similar growth is also expected in 2023, as rate hikes in renewals are expected to slightly outpace the cord-cutting trend, resulting in a 3% gain in gross retransmission and virtual subscriber fee revenues to $14.83 billion, the report said.

Longer term, these revenues will likely grow by percentages in the low single digits, to $15.93 billion by 2027.

Even so the report highlighted some worrying trends.

Generally, TV station owners have continued to be successful in securing higher retransmission fees in each renewal period, albeit with some major disruptions at the end of 2022 and beginning of 2023. But as consumers shift their viewing habits and subscription dollars to streaming, local TV station affiliates that want to be carried by virtual multichannel operators are beholden to carriage fees set by the networks, with most stations receiving less on a net basis than traditional multichannel operators.

As a result, the share that goes back to the TV stations is expected to decline slightly from about 50% in 2018–20 to 49% in 2021–24 and 48% in 2026–27, the researchers said.

Others have worried that ongoing cord cutting would eventually produce reductions in retransmission fees.