/Tyler%20Technologies%2C%20Inc_%20logo%20on%20phone%20-by%20T_Schneider%20via%20Shutterstock.jpg)

Tyler Technologies, Inc. (TYL), headquartered in Plano, Texas, provides integrated information management solutions and services. With a market cap of $19.2 billion, the company's client base includes local government offices throughout the U.S., Canada, Puerto Rico, and the United Kingdom. The software giant is expected to announce its fiscal fourth-quarter earnings for 2025 in the near term.

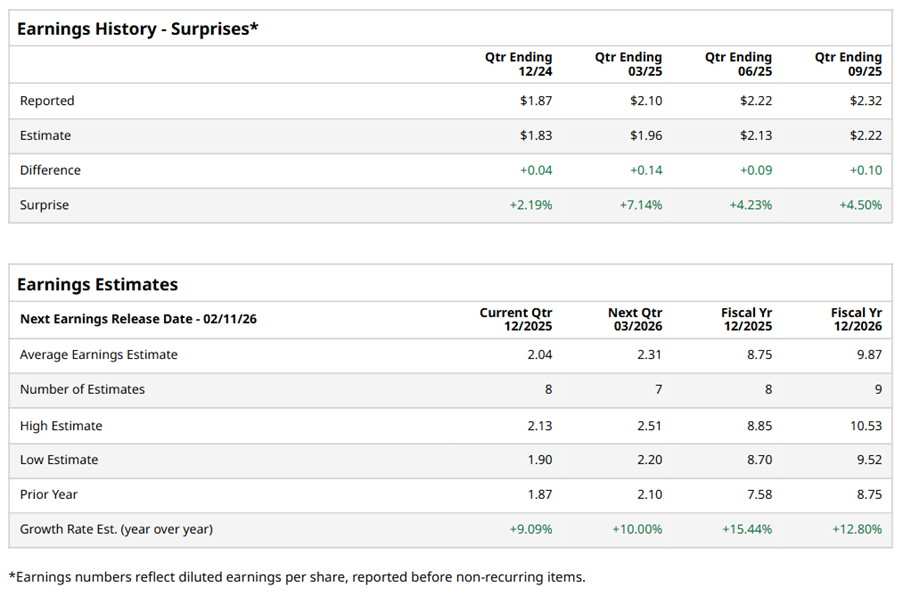

Ahead of the event, analysts expect TYL to report a profit of $2.04 per share on a diluted basis, up 9.1% from $1.87 per share in the year-ago quarter. The company has consistently surpassed Wall Street’s EPS estimates in its last four quarterly reports.

For the full year, analysts expect TYL to report EPS of $8.75, up 15.4% from $7.58 in fiscal 2024. Its EPS is expected to rise 12.8% year over year to $9.87 in fiscal 2026.

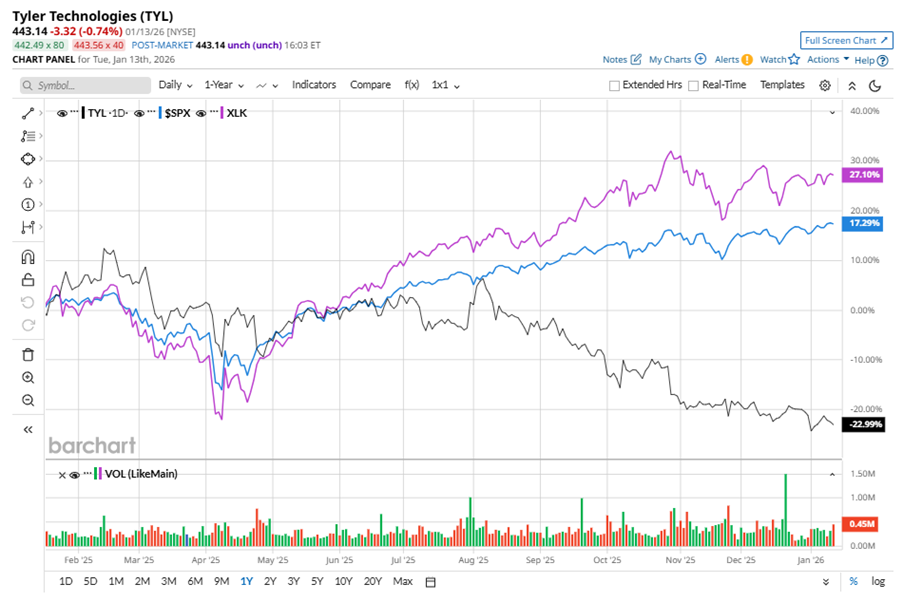

TYL stock has notably underperformed the S&P 500 Index’s ($SPX) 19.3% gains over the past 52 weeks, with shares down 21.2% during this period. Similarly, it considerably underperformed the Technology Select Sector SPDR Fund’s (XLK) 29% gains over the same time frame.

On Oct. 29, 2025, TYL shares closed down more than 6% after reporting its Q3 results. Its adjusted EPS of $2.97 topped Wall Street expectations of $2.88. The company’s revenue was $595.9 million, surpassing Wall Street forecasts of $594.8 million. TYL expects full-year adjusted EPS in the range of $11.30 to $11.50, and revenue in the range of $2.3 billion to $2.4 billion.

Analysts’ consensus opinion on TYL stock is bullish, with a “Strong Buy” rating overall. Out of 22 analysts covering the stock, 15 advise a “Strong Buy” rating, one suggests a “Moderate Buy,” and six give a “Hold.” TYL’s average analyst price target is $633.10, indicating an ambitious potential upside of 42.9% from the current levels.