The Federal Reserve may need to signal a much more cautious outlook for interest-rate cuts in the coming year as inflation percolates and markets react to a series of uncertainties tied to President-elect Donald Trump's administration.

Trump, who was swept back into the White House early last month, will start the first half of his second term as president with narrow majorities in both houses of Congress and an ambitious economic agenda he says will deliver outsized growth and historic debt reduction.

💰💸 Don’t miss the move: SIGN UP for TheStreet’s FREE Daily newsletter 💰💸

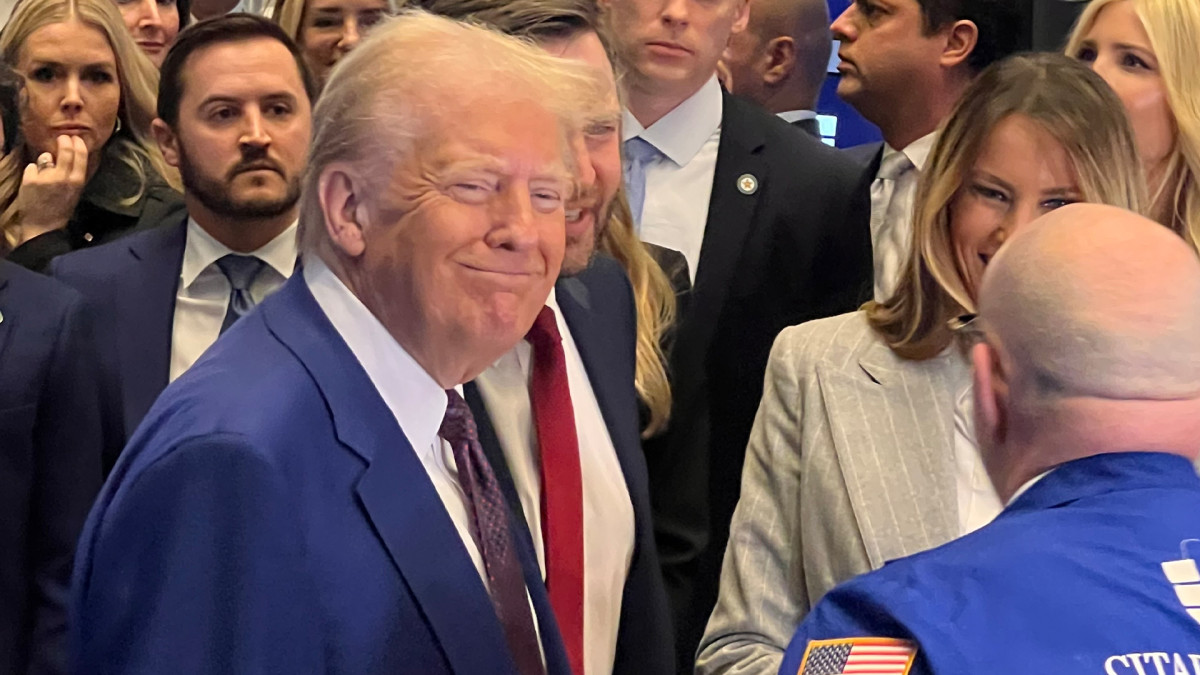

“The economy, I believe, is going to be very strong,” Trump told CNBC Thursday during an interview that followed his ringing of the New York Stock Exchange opening bell. “We’re gonna do things that haven’t really been done before. We’re gonna cut taxes still further."

The stock market appears to agree: After his comeback win, the S&P 500 topped the 6,000-point mark for the first time and the benchmark has risen around 6.3% since Election Day, adding more than $1.5 trillion to the collective value of the country's biggest companies.

Investors, however, are also starting to count the costs tied to some of Trump's proposals, including the wider budget deficits needed to pay for his promised tax cuts, the impact on the labor market of his plans for the mass deportation of migrant workers, and the added inflation pressures tied to his vow to increase tariffs.

Donald Trump's policies could stoke inflation

"There are many fiscal policy outcomes in the year ahead that we lack clarity on, such that it’s increasingly difficult for us (and the Fed) to know where inflation is headed," said Rick Rieder, BlackRock’s chief investment officer of global fixed income.

"The calculus for Fed policy has changed materially since the election and the Fed is likely to communicate more hawkishly through the updated Summary of Economic Projections," he added.

"Moreover, [Fed Chairman Jerome Powell] is likely to discuss the possibility of slowing the pace of rate cuts or pausing to ascertain how the economic data will unfold."

Related: CPI inflation report sparks Fed interest rate cut bets

The Fed's Summary of Economic Projections, more commonly referred to as the dot plots, is a collection of growth and inflation forecasts that Fed officials submit each quarter and is published in chart form to indicate where interest rates might be headed.

The Fed will publish a fresh round of projections next week when it wraps up its two-day policy meeting in Washington with an expected quarter-point reduction in the benchmark Federal Funds Rate.

In fact, markets are still convinced that the Fed will make its third rate cut of the year despite a faster-than-expected reading for producer-price inflation and an uptick in headline consumer-price pressures for November.

Bets on interest rate cuts in 2025 are fading

However, bets on future cuts are starting to fade as inflation remains stubbornly high into year-end, and the impact of the new administration's policies remains unclear.

CME Group's FedWatch, a real-time tracker of how traders see Fed rate moves in the near term, has locked in the chances for a quarter-point cut next week, while it shows traders paring bets on further reductions into the second half of next year.

In fact, FedWatch suggests it's now a coin flip between one and two quarter-point cuts over the first six months of 2025, when just prior to the election, the broader consensus was for at least three.

"This inflation print is unlikely to derail the Fed’s rate-cutting cycle, and we continue to expect the Fed to cut rates" by 0.25 percentage point at its December meeting, said Nathaniel Casey, an investment strategist at wealth manager Evelyn Partners.

"However, we remain vigilant of any further deviations in the inflation trajectory, given the resilience of the U.S. economy and the potentially expansive fiscal policy that could accompany the Trump presidency in January," he added.

Related: Prepare for price hikes if Trump's tariff plans are realized

Some of that concern is already playing out in the bond market, where investors shrugged off a solid auction of $39 billion in new 10-year notes and focused on data showing a record $367 billion budget deficit for the month of November.

The benchmark paper is now trading north of 4.3%, a move that could both increase the cost of debt servicing and warn markets that investors are examining the trajectory of government borrowing more closely than they have in the past.

That could play a huge role in Treasury refunding next year, as some $6 trillion of securities will mature by 2025, which is the most on record.

Budget deficits are at records and growing

Adding in the increases expected from a rising budget deficit, which is growing by $10 billion daily, the U.S. will need to find buyers for around $8 trillion in new debt next year.

Which brings us back to the Fed.

"While a lot of attention is (rightly) focused on budget deficits and the amount of Treasury supply coming to market over the next few years, the primary driver of Treasury yields is still Fed policy," said Lawrence Gillum, chief fixed income strategist at LPL Financial.

Related: Analysts rework interest rate cut forecasts for 2025

"Our base case is that the Fed will take the [Federal Funds Rate] to 3.75% in 2025. And after a few months of overly aggressive expectations, markets have generally repriced to be more in line with our expectations," he added.

"Over the next 12 months, we see roughly equal upside and downside risks to yields as the markets grapple with the true impacts of budget deficits, increasing Treasury supply and the scope of the Fed’s current easing cycle."

More Economic Analysis:

- Trump Trade puts stocks at record. Where do we go from here?

- Fed inflation gauge higher in October amid consumer spending boost

- Goldman Sachs analyst sees starting point for year-end S&P 500 rally

The signals from next week's Fed meeting will also be heard in the stock market, where analysts are forecasting another year of double-digit returns powered by AI investments, a resilient economy, solid consumer spending and lower Fed interest rates.

"Next week's Fed meeting is the next catalyst for markets, and while a rate cut is expected, the Fed is also set to provide guidance about its interest rate plans in 2025, which could help determine the trajectory of stocks next year," said Clark Bellin, president and chief investment officer at Bellwether Wealth in Lincoln, Neb.

"The interest rate picture is a bit uncertain for 2025 given the strong economy, and the Fed will have an opportunity to clarify its views about 2025."

Related: Veteran fund manager delivers alarming S&P 500 forecast