Twitter (TWTR) shares are back in the headlines as news continues to swirl around Tesla (TSLA) CEO Elon Musk, who is now going through with the $44 billion deal to acquire the company.

As noted several months ago, Musk formally proposed to buy the company for $54.20 a share.

While Twitter management was initially resistant toward the deal, they ultimately accepted the offer.

Then Musk wanted out in July. Since then, drama and legal proceedings have followed.

This week, news broke that Musk is willing to move forward with the deal again, sending shares of Twitter higher and Tesla lower.

Trading Twitter Stock

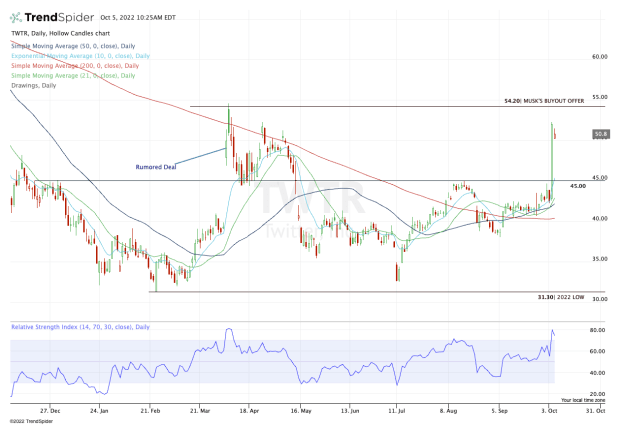

Chart courtesy of TrendSpider.com

Despite the news, Twitter stock is not trading like an acquisition is right around the corner. Instead, it’s trading with some hesitancy.

Currently near $51 a share, it’s roughly 6% below the buyout price of $54.20.

If the deal goes through, buyers at $51 will generate a 6% return in a relatively quick manner. However, that’s if the deal actually goes through.

The problem with Twitter stock now is, it sets up as a binary event. Really though, that has been the case for months.

Either the deal closes and this name shoots up to $54.20 or it doesn’t close — either because of a legal snag or Musk somehow finding a new way out — and Twitter shares plunge.

If they do pull back, I want to see how the $45 area acts. Is it support or does the stock drop into the low $40s where it was consolidating throughout September and where it currently finds the 50-day and 200-day moving averages?

Trading Tesla Stock

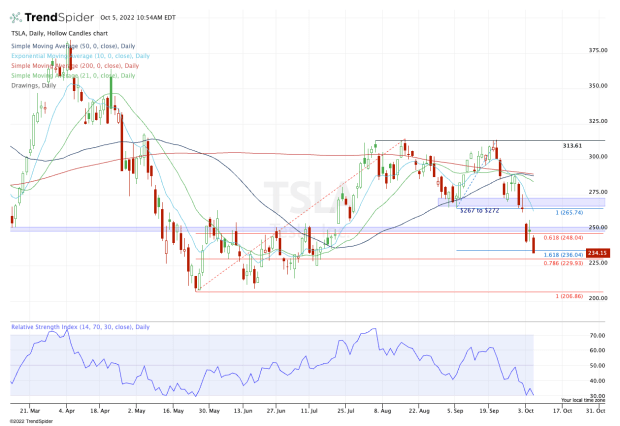

Chart courtesy of TrendSpider.com

I recently covered Tesla stock, noting how shares knifed through the $250 area. On Tuesday, it closed back near this region, but Wednesday's move lower has taken out the prior week’s low.

Now into the $230s, bulls want to see if the 78.6% retracement is enough to buoy the stock.

If it is, the $250s could be back in play. If not, Tesla stock may need to retest sub-$225, followed by the low-$200s.