Retail stocks have been a topic of interest lately, but Bed Bath & Beyond (BBBY) had not been trending for the reasons applying to the rest of the retail sector.

Target (TGT), Best Buy (BBY) Costco (COST) and others have been in the news due to earnings. For Bed Bath & Beyond, it’s for the hope it may put itself up for a sale.

Now, a new shareholder, RC Ventures, is also making headlines for the home-goods retailer.

While no sale is imminent, the company said “we will carefully review their letter and hope to engage constructively around the ideas they have put forth.”

One of the ideas RC has broached is "a full sale of the company.”

RC Ventures has taken a 10% stake in the retailer and is backed by Ryan Cohen, the chairman of GameStop (GME) and co-founder of Chewy (CHWY).

The stock climbed as much as 85% at Monday’s high, then faded. Still, the shares are up almost 40% on the session, which comes on a particularly volatile day in the stock market.

Can the stock maintain momentum?

Trading Bed Bath & Beyond

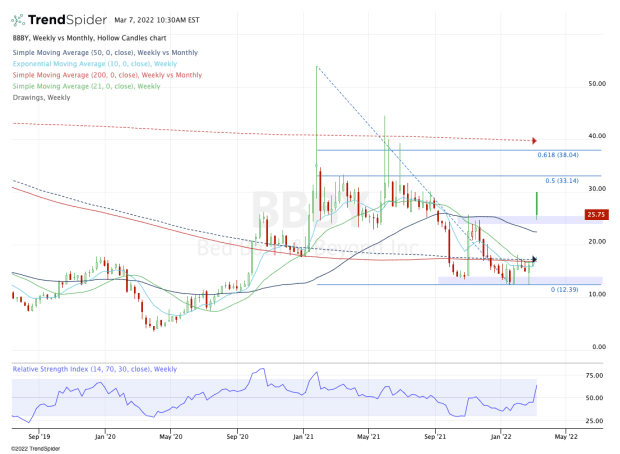

Chart courtesy of TrendSpider.com

Shares of Bed Bath & Beyond stock opened near $30, then faded. Given that the stock was nearing a double from Friday's close, the fade is not surprising. Let's look at how it might trade from here.

On the downside, the stock in the fourth quarter had trouble gaining momentum over $24. Over the course of four straight weeks, the stock was rejected by that level, which is highlighted on the weekly chart above.

If Bed Bath & Beyond stock can find its footing in this area and above the 50-week moving average, then perhaps the bulls can make a case for being long.

Below the 50-week opens the door back down to $20 a share, followed by what should be a huge area of support near $17.

Near this level, the stock finds its 10-week, 21-week and 200-week moving averages, as well as the 50-month moving average. Near $18 is the gap-fill level from last week.

On the upside, $30 is the clear hurdle. Above that opens the door to $33, then $38 and the declining 200-month moving average.

In the past, Bed Bath & Beyond became a well-known short-squeeze candidate and its moves into the upper-$30s and subsequent fades highlights that record nicely.