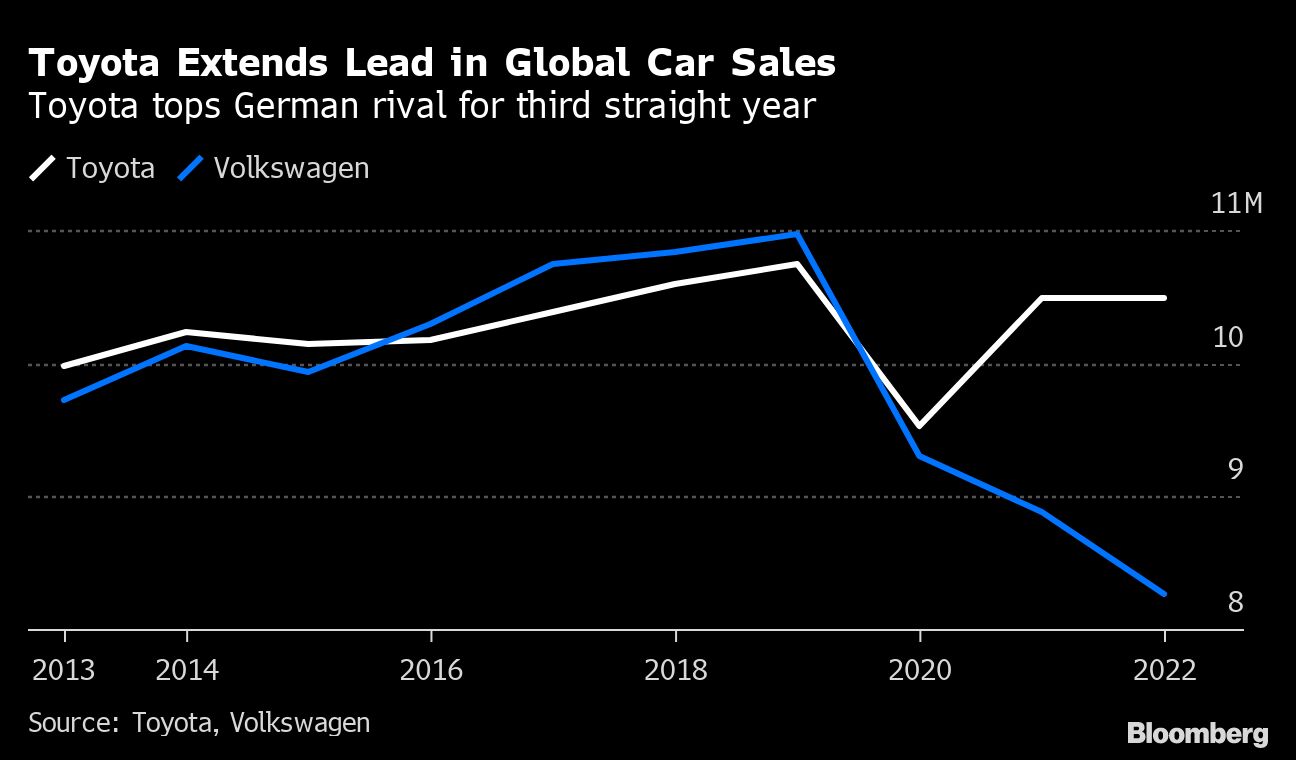

Toyota Motor Corp. kept its crown as the world’s top-selling carmaker in 2022, widening its lead over Volkswagen AG even as supply-chain disruptions continued to weigh on global automobile production.

Group sales, which include those of its subsidiaries Daihatsu Motor Co. and Hino Motors Ltd., were mostly flat at 10.5 million units for the year, the Japanese company said Monday. Volkswagen sales fell 7% last year to 8.3 million units, marking the lowest level of deliveries in 11 years.

While that marks Toyota’s third straight year of gains over its German rival, the key issue facing Toyota and other carmakers is the specter of weakening global demand. Concerns over fading appetite for new vehicles have intensified, hitting Tesla Inc.’s shares. Goodyear Tire & Rubber Co. is cutting jobs in response to the weaker economic environment and rising inflation.

Toyota, however, still says it isn’t able to make enough cars to shorten delivery times. Customers are reporting waits of months or even years for certain models. For the fiscal year beginning in April, Toyota has set an output target of as many as 10.6 million vehicles, with the caveat that final shipments could be 10% lower if it is unable to procure enough parts, especially semiconductors.

S&P Global Mobility predicts that Toyota will continue to widen its lead over Volkswagen in 2023, with 10.4 million light vehicle sales versus 7.99 million for the German carmaker. Volkswagen sales are projected to recover from 2024, while Toyota is on track to top 11 million in annual light vehicle sales by the end of the decade, according to the researcher.

“For both companies, the impact of production constraints will gradually ease,” said Yoshiaki Kawano, an analyst at S&P Global Mobility. “Overall, moderate recovery and growth are seen over the medium to long term.”

Koji Sato, 53, Toyota’s newly appointed chief executive officer, will be under close scrutiny as he seeks to deliver on the that target. An engineer by training, the new leader of the world’s No. 1 carmaker previously ran the Lexus luxury automobile division and was chief branding officer for the entire company.

A Toyota lifer who joined the company more than 30 years ago, Sato will oversee the automaker through what could be the most challenging period in its 86-year history as the twin forces of electrification and automation sweep through the industry.

The Japanese carmaker has made it clear that it believes in the need to spread its bets across different technologies — from batteries, hybrids, hydrogen and legacy combustion engines — to serve customers and successfully transition to a post-gasoline future.

©2023 Bloomberg L.P.