As of Nov. 25, 2025, two stocks in the consumer discretionary sector could be flashing a real warning to investors who value momentum as a key criteria in their trading decisions.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered overbought when the RSI is above 70, according to Benzinga Pro.

Here's the latest list of major overbought players in this sector.

Ross Stores Inc (NASDAQ:ROST)

- On Nov. 20, Ross Stores reported better-than-expected third-quarter financial results and raised its fourth-quarter GAAP EPS guidance. "We are pleased with our third-quarter sales results, which accelerated from the prior quarter. Our merchandise assortment of compelling brand name values resonated with shoppers, and our new marketing campaign drove excitement and higher customer engagement," Jim Conroy, CEO, commented. The company's stock gained around 10% over the past five days and has a 52-week high of $177.32.

- RSI Value: 80.5

- ROST Price Action: Shares of Ross Stores rose 1.4% to close at $176.50 on Tuesday.

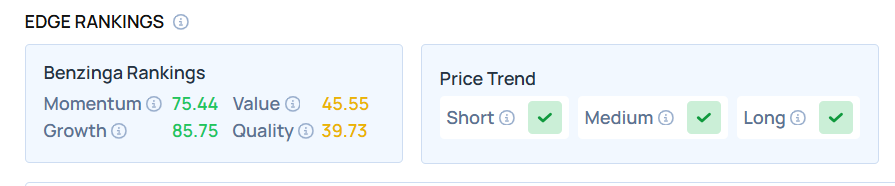

- Edge Stock Ratings: 75.44 Momentum score with Value at 45.55.

Citi Trends, Inc. (NASDAQ:CTRN)

- On Aug. 26, Citi Trends reported second-quarter sales of $190.75 million (+8% year over year) on Tuesday, beating the analyst consensus estimate of $188.397 million. "Our second quarter results underscore our recent success executing our key initiatives, which drove comparable store sales up 9.2%, our fourth consecutive quarter and 12 straight months of consistent comparable sales gains," said Ken Seipel, Chief Executive Officer. "I am also pleased year-to-date sales momentum has continued into the important August back to school period." The company's stock gained around 25% over the past month and has a 52-week high of $45.63.

- RSI Value: 77.3

- CTRN Price Action: Shares of Citi Trends rose 3.1% to close at $45.17 on Tuesday.

Learn more about BZ Edge Rankings—click to see scores for other stocks in the sector and see how they compare.

Read This Next:

Photo via Shutterstock