The earlier you get serious about retirement income planning, the better, whether you are in your 50s, or in your 60s but delaying full retirement. We will first distinguish between plain old retirement planning vs. creating a plan for retirement income, which this article will address.

Let’s ask an AI chatbot about retirement income first

You will find that ideas about how to approach this retirement income challenge are in short supply. Here’s what an AI chatbot recommended when I asked it, “For a 55-year-old single male who’s looking to retire in 10 years, how much income can he expect in retirement if he now has $1 million in savings?” Although relevant, I didn’t confuse the chatbot by adding that his savings are split 50/50 between his IRA and personal savings.

The chatbot answered, but erroneously. Here’s what it said:

“Determining the exact income a person can expect at retirement depends on various factors, such as the desired retirement lifestyle, inflation rates, investment returns and potential additional sources of income like pensions or Social Security. However, we can provide a general idea based on some assumptions.”

The chatbot picked the planning methodology known as the 4% rule, which is popular but flawed, that starts with a “safe withdrawal rate.” Here’s how the chatbot put it: “Taking into account the safe withdrawal rate and adjusted for inflation, the retirement income for the first year would be $40,000. For subsequent years, you can increase this amount by 2% to keep up with inflation.”

Remember that $40,000 number. Not only does the chatbot use a flawed method, its math is wrong. Don’t give up yet on retiring with a decent amount.

My goal is to protect future retirees from being led astray

Most of my writing to date has been for those who are near or in retirement. Now I am hearing from lots of people who are five or ten years from retirement and asking about the best way to prepare for, and then live through, their retirement.

Also, as long as there are chatbots or other traditional planners, I’m concerned that individuals will be led astray and end up working longer than necessary, downsizing too soon or just living with more stress than necessary.

I’m a Back to the Future kind of planner, meaning I’d like to know where I want to be before I make financial decisions in the present. So let me apply that thinking, our existing tools and new research to help those still working and not planning to retire for the next five years or so.

Pre-retirement tools for guidance and inspiration

Here are three things to consider as you plan. (Assume you’re that 55-year-old male.)

1. How much income can your savings generate at retirement (same question I asked the chatbot)?

A tool to get you started is one that we at Go2Income built: The Income Power calculator shows the amount of risk-free lifetime income you can purchase today, based on an income plan you design by setting the level of inflation protection, income for a surviving spouse and protection for a beneficiary. The graphic below shows that your $1 million in savings will produce $4.7 million in income, assuming you retire at 65 and survive to age 95.

The starting annual income is $86,000 per year and grows to nearly $200,000 at age 85. The calculations are based on the estimated current cost of purchasing income from insurance companies.

Your Income Power, however, is a benchmark, and we’re not suggesting that you use all your savings to purchase that income — and give up a legacy or liquidity. But it is a measure you can compare to other strategies, or consider as an approach to use for a part of your savings.

Remember, the chatbot said you would take $40,000, growing by 2% per year. That’s the math part the chatbot got wrong.

2. How much income can I get if I were 65 today?

Our Go2Income planning tool is the one to use when you are in retirement or about to retire. It will estimate your starting income expressed as a percentage of your current savings at retirement and project income and savings throughout retirement.

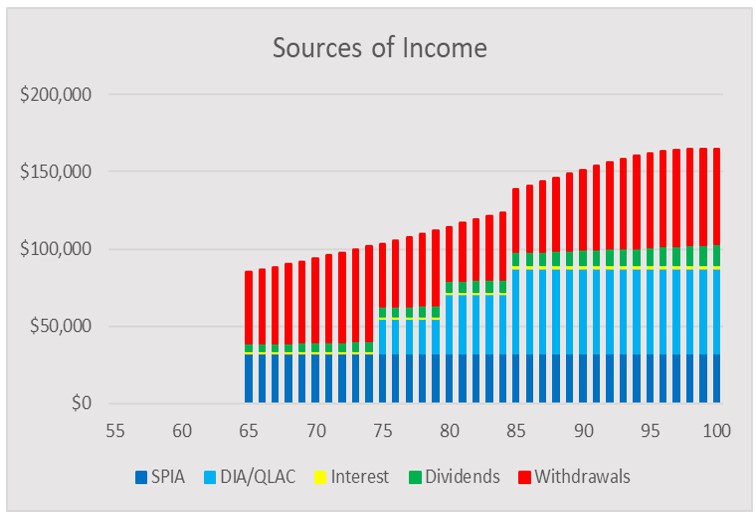

Between contributions and market return, let’s assume your savings grew to $1.5 million at age 65, with IRA savings now representing 60% of the total. Here’s the projected income under your Go2Income plan:

Quite a different picture than the Income Power calculation from 10 years earlier. Interestingly, the starting income is about the same at $85,000, but it doesn’t grow to $200,000. What happened? These two views of your plan, although they concern income, are about much more.

For instance, if you want to leave a larger financial legacy to your heirs, you would incorporate that into your retirement strategy with Go2Income. The same is true when determining how much of your money to keep liquid to pay emergency expenses, or to build health care costs into your long-term plan. None of those things is considered in Income Power.

And if after adding all the “wants,” you find that the number for annual income is too low, you can work on strategies to get your retirement income where you want it to be.

3. How do you start building a plan for retirement income that is five or 10 years away?

If a Go2Income plan like the above or similar has appeal, then you can consider what steps to take now that better prepare you for that plan. (Well, saving more and building up your 401(k) balance can’t hurt.)

There are two things, however, that can provide tax benefits now and income benefits at retirement, each one applicable to a particular form of savings:

- Personal savings. Consider the allocation of a portion of these savings to a tax-deferred annuity, indexed or variable. These savings in whole or in part can be exchanged tax-free to fund annuity payments in your plan.

- Rollover IRA savings. Consider the purchase of a QLAC, a type of deferred income annuity that will start to make annuity payments at an age you select. You will defer taxes until then, and the QLAC can provide additional income to pay for health care, long-term care or just provide a floor on your income.

Anticipating a Go2Income strategy now will make your retirement more efficient when you decide to stop working, as you can see in the chart below, which projects the fair market value of the assets within your plan.

You are seeing the early stages of our research extended to five to 10 years before retirement. Seems promising for both income and savings. Take that, you chatbot!

More income, less stress

You’ve been saving money for retirement for more than two decades. Now spend some time thinking about how you want that money to pay for your retirement.

Income Power gives you a benchmark today. Go2Income today tells you what income you can expect at retirement and how to match all your financial goals.

You can explore a Go2Income plan here to get a start on your future.