It’s no secret that money often becomes a reason for conflict among family members, typically because of how it is shared or, in some cases, not shared.

This redditor opted for the latter when she received a 7-figure sum after the death of her stepfather. She refused to divide it and give money to her mother and her brother who demanded that she did. Instead, the young woman offered them a different arrangement, to which they said “not good enough”.

Scroll down to find the full story below, where you will also find our interview with a licensed counselor and expert in families facing transitions, Chair and Professor at the Department of Counseling and Higher Education at Northern Illinois University, Dr. Suzanne Degges-White, who was kind enough to answer a few of Bored Panda’s questions.

Following a loved one’s will can put a person in a rather complicated situation

Image credits: choreograph (not the actual image)

This woman refused to share her inheritance with her mother and her brother

Image credits: Ivan Samkov (not the actual image)

Image credits: Karolina Kaboompics (not the actual image)

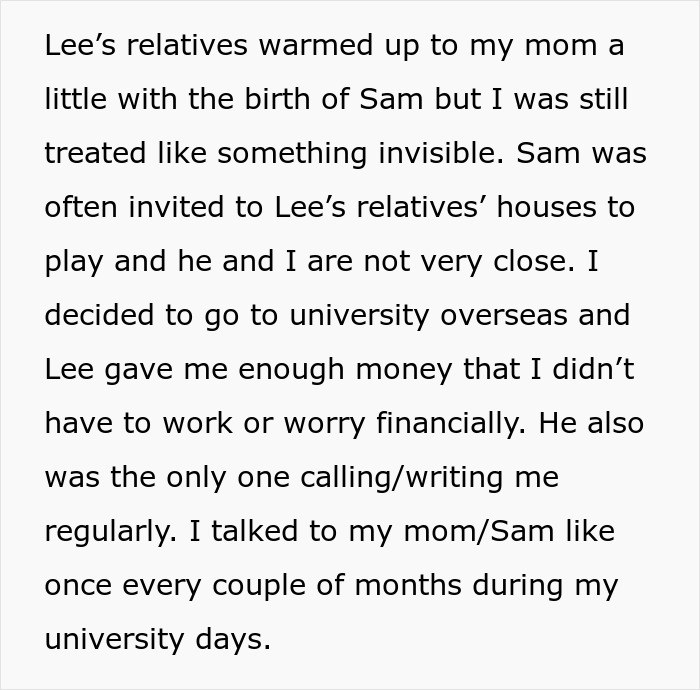

Image credits: throwaway_bubb

Inheriting significantly different amounts can drive siblings apart

According to Dr. Suzanne Degges-White, when a person dies, a lot of ‘unfinished business’ arises, which tends to especially affect their children. “It can bring up old rivalries, grudges, and feelings of resentment, when one child is left a larger inheritance than another,” she said in an interview with Bored Panda.

“While it is true that a person’s resources can be left to whoever they want to gift them to, whenever people who see themselves as equally close to a person inherit vastly different amounts, it can lead to resentment towards the other legatees along with toward the deceased.”

The expert continued to point out that if there are significant differences in the size of an inheritance among siblings, trouble is difficult to avoid. “Adult siblings may quickly regress to their childhood perspectives and sibling rivalries, and the negative feelings they held toward each other. In fact, the loss of a parent has the power to bond siblings closer or drive them apart permanently.”

Image credits: Mikhail Nilov (not the actual image)

It’s important to discuss the way you want your estate to be handled with your loved ones

While thinking about what happens when you’re gone is far from the most pleasant thing to do, it might be necessary to plan for such a scenario, which often entails having to discuss it with your partner or your family members. However, data shows that far from every person does.

According to last year’s report from The National Will Register, more than a fifth of adults in the UK have not discussed what happens with their estate after their death with anyone. That might come as no surprise bearing in mind that close to half of respondents said their parents didn’t leave instructions, either.

Roughly six-in-ten of those who have kept their wills a secret say they’re unlikely to discuss it in the future. But, according to Dr. Degges-White, people should be clear—with their partners, at least—about how they intend to leave their estate.

“This is essential so that a surviving partner can make plans for covering their expenses if their partner’s funds are a significant portion of their income. When there are ‘surprises’ when the details are learned after someone has died, that can be emotionally and financially devastating. Talking about it before it’s too late may bring up negative feelings and disappointment, but it gives people a chance to explain their decision and the legatees a chance to work through their feelings.”

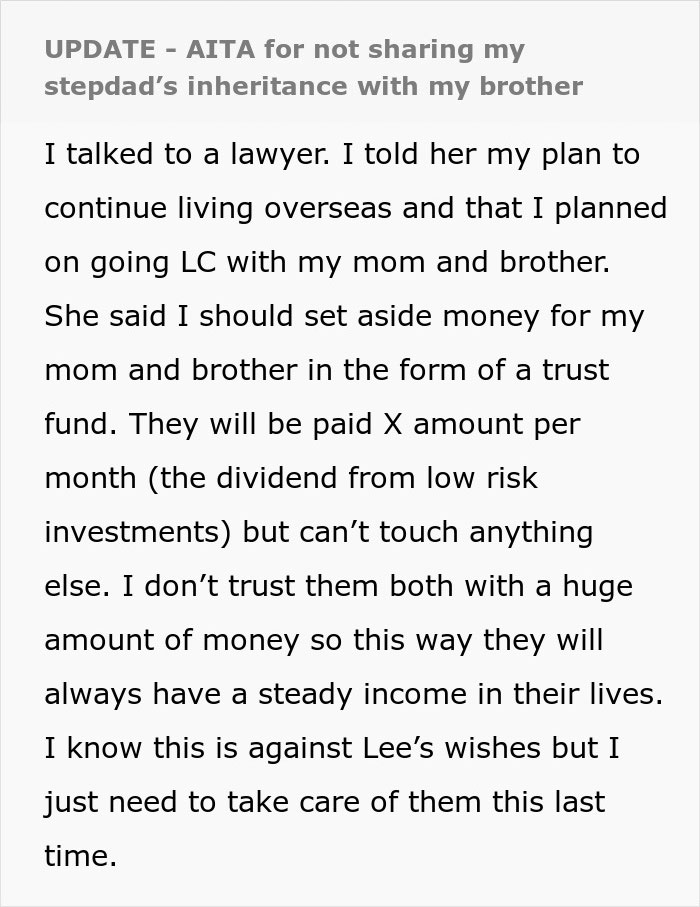

It’s unclear if the OP’s stepfather, Lee, discussed his will with his partner or children. But in an update that the redditor provided later, the young woman revealed that she has discussed her own will with the family and so they know that everything will go to charity. Scroll down to find the update in the OP’s own words below.

Image credits: Kampus Production (not the actual image)

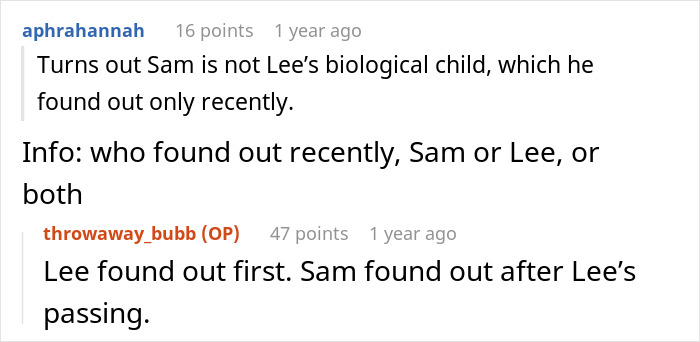

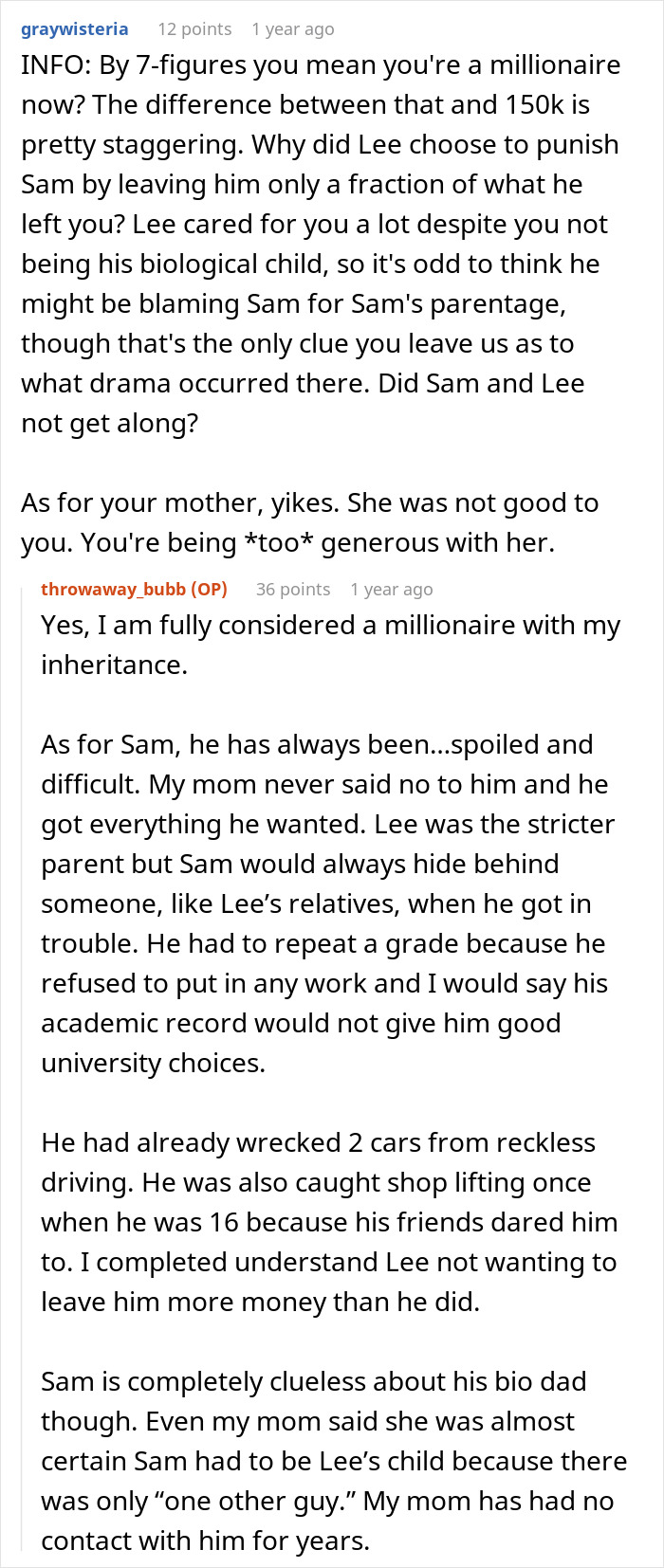

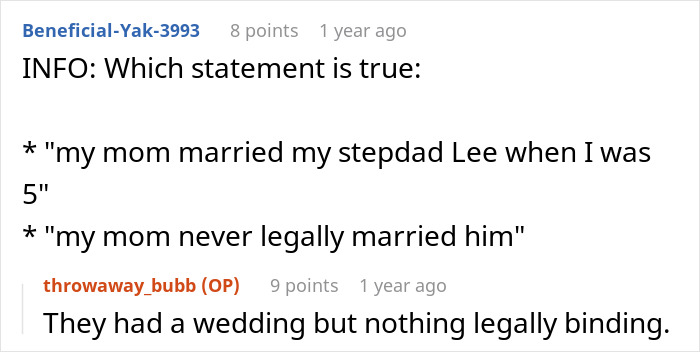

The OP provided more details in the comments

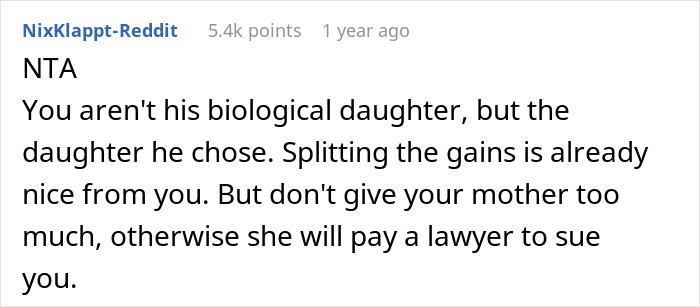

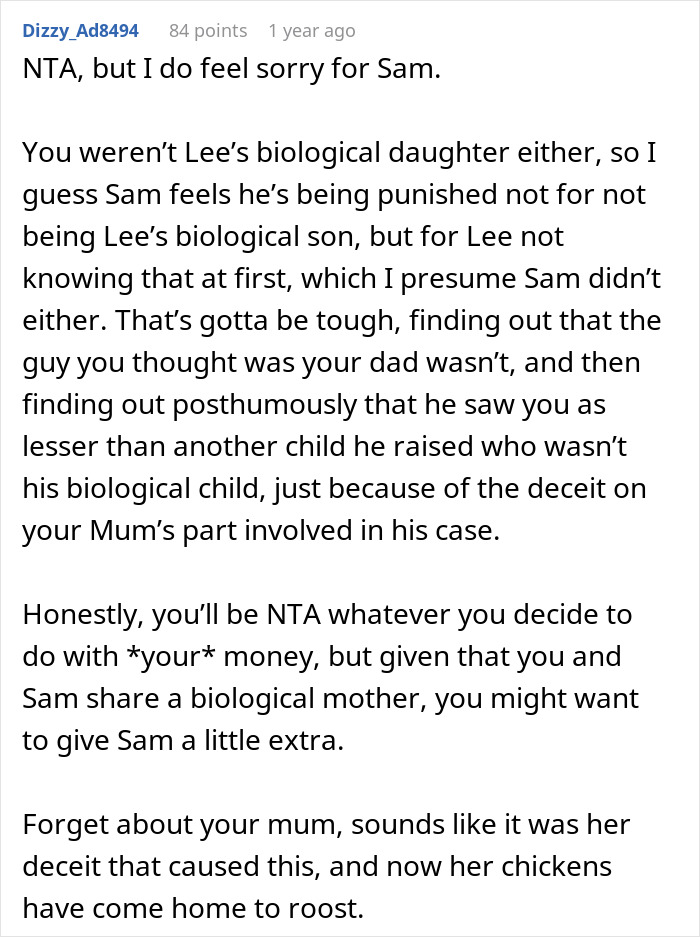

Fellow netizens didn’t think the redditor was a jerk to her family members

The woman later posted an update, sharing how things developed

Netizens shared their reactions to the update in the comments section