/Thermo%20Fisher%20Scientific%20Inc_%20phone%20and%20site-by%20T_Schneider%20via%20Shutterstock.jpg)

Waltham, Massachusetts-based Thermo Fisher Scientific Inc. (TMO) provides life sciences solutions, analytical instruments, specialty diagnostics, laboratory products, and biopharma services. It is valued at a market cap of $202.8 billion.

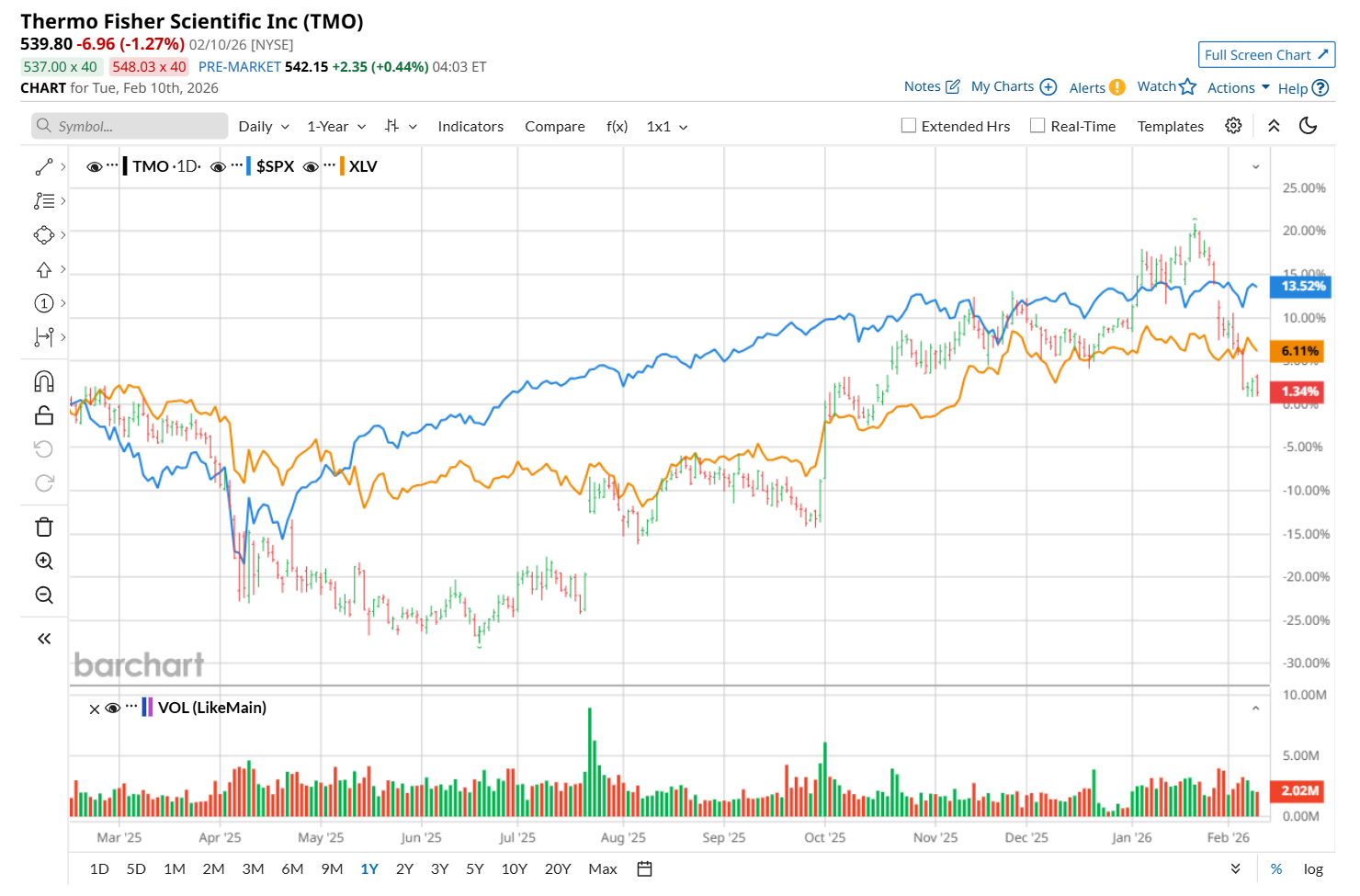

This healthcare company has trailed the broader market over the past 52 weeks. Shares of TMO have declined 2.4% over this time frame, while the broader S&P 500 Index ($SPX) has gained 14.4%. Moreover, on a YTD basis, the stock is down 6.8%, compared to SPX’s 1.4% rise.

Narrowing the focus, TMO has also underperformed the State Street Health Care Select Sector SPDR ETF (XLV), which soared 6.2% over the past 52 weeks and rose marginally on a YTD basis.

On Jan. 29, shares of TMO plunged 2.6% despite delivering better-than-expected Q4 results. Both its revenue of $12.2 billion and adjusted EPS of $6.57 topped analyst estimates. Moreover, its top line increased 7.2% from the year-ago quarter, while its bottom line grew 7.7% year-over-year. However, its adjusted operating margin declined by 30 basis points, which might have made investors jittery.

For fiscal 2026, ending in December, analysts expect TMO’s EPS to grow 7.8% year over year to $24.65. The company’s earnings surprise history is promising. It exceeded the consensus estimates in each of the last four quarters.

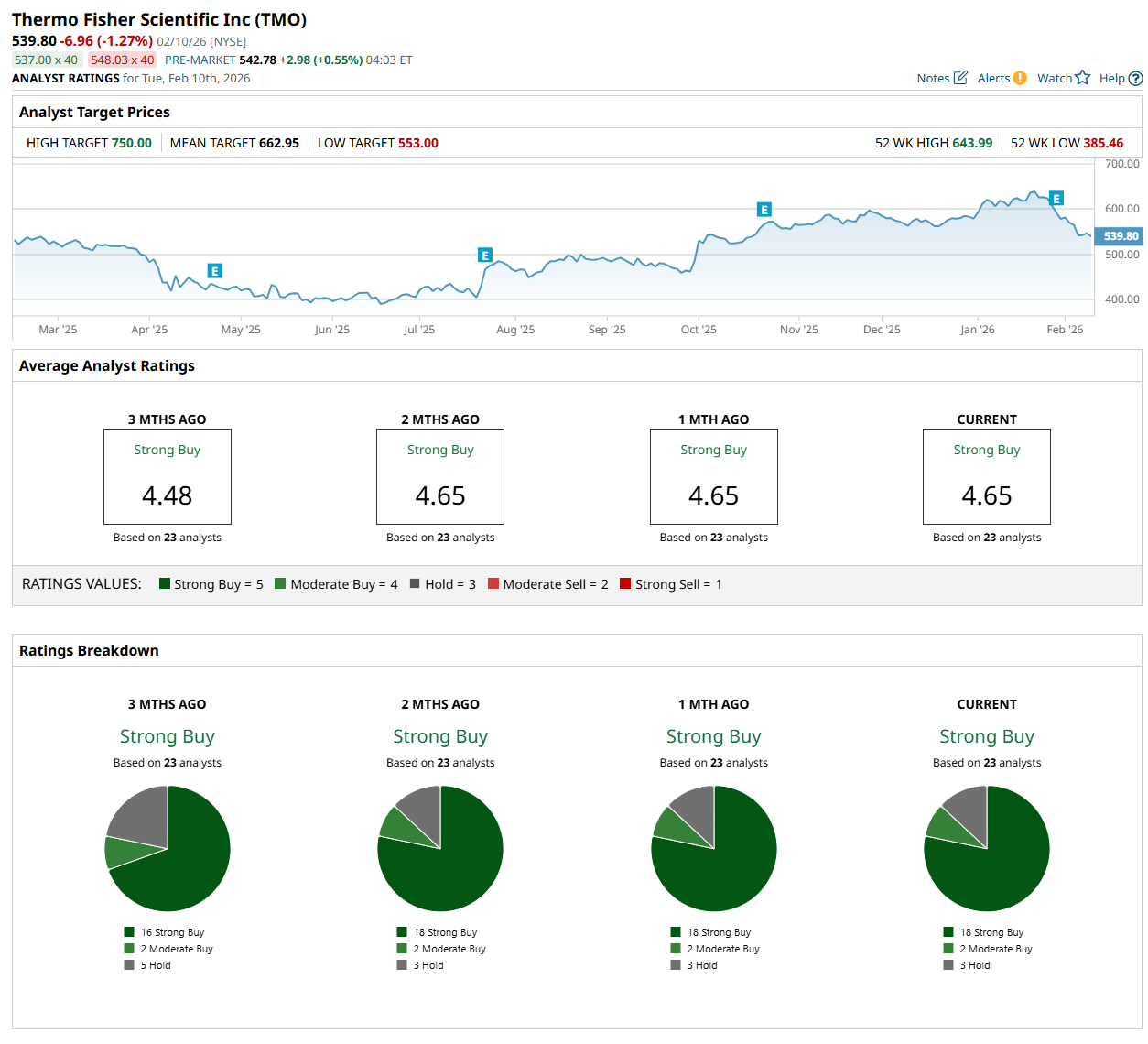

Among the 23 analysts covering the stock, the consensus rating is a "Strong Buy,” which is based on 18 “Strong Buy,” two “Moderate Buy,” and three "Hold” ratings.

The configuration is more bullish than three months ago, with 16 analysts suggesting a “Strong Buy” rating.

On Feb. 2, Casey Woodring from JPMorgan Chase & Co. (JPM) maintained a “Buy" rating on TMO, with a price target of $710, indicating a 31.5% potential upside from the current levels.

The mean price target of $662.95 represents a 22.8% premium to its current price levels, while its Street-high price target of $750 suggests a 38.9% potential upside from the current levels.