When Crypto.com secured the naming rights in November for the arena formerly known as Staples Center, it made a very literal, straightforward statement: If you want to project an image of financial might and staying power, it’s hard to imagine anything more explicit than a $700 million commitment for physically giant signage over 20 years. But the cryptocurrency exchange was thinking about the power of metaphor here, too.

The company had already poured hundreds of millions of dollars into advertising across sports. But this was its first arena deal, and they’d deliberated over getting just the right fit, says Crypto.com chief marketing officer Steven Kalifowitz. They’d talked about perhaps going after a football stadium. But so many NFL venues sit outside downtown areas—one building amid an ocean of parking lots—and they wanted a more vibrant, connected setting. There was the possibility of a European soccer stadium, but many of those venues are used just for soccer, and the marketing team wanted to pursue something broader.

The company wanted a stadium that was home to multiple teams from different sports, and to big events outside of sports, too. It was hoping to evoke the idea that crypto was for everyone—that the community was ready to expand into the mainstream—and, just as crucially, that it was here for the long haul. Which is what led the company to the Staples Center.

Crypto Daily Cover credit: Photo Illustration by Bryce Wood; Mark J. Rebilas/USA TODAY Sports (Brady and Curry); Tim Heitman/USA TODAY Sports (Ohtani); Matthew Emmons/USA TODAY Sports (Lawrence); Kirby Lee/USA TODAY Sports (Beckham)

In other words: One of the most famous arenas in the world, in the heart of downtown L.A., known as the home of Shaq and Kobe and the Grammys, would now belong to crypto. The industry had been driving into sports with television ads and uniform patches for months, and now it had landed a crown jewel.

“There’s this element of, ‘We need to project staying power.’ Because there are plenty of people who don't get what crypto is, and they're kind of like, what is this?” says Kalifowitz. “It communicates, ‘We're here. We're not going.’ It's a 20-year deal. People know that it means something to rename a building. And in that way, we’re communicating without having to say to them, ‘We're safe.’ Because you can’t do that if you’re not a safe, solid company that's here for the long term.”

For some, that argument may be convincing. It might make others roll their eyes with the memory of, say, the 30-year naming rights deal for Enron Field that made it less than 30 months, or of Pets.com shelling out for its own commercial at Super Bowl XXXIV and then being a bankrupt punch line in someone else’s at Super Bowl XXXV.

To what extent cryptocurrencies are in fact a safe, solid investment is a matter of heated debate. Over the last year, markets have swung up and down wildly, but a sports fan could be forgiven for thinking the rocket ship has been headed straight for the moon. On top of naming-rights deals, crypto exchanges and other companies in the space have spent untold sums to secure the endorsements of the likes of Tom Brady, Steph Curry, Shohei Ohtani and Trevor Lawrence. They’ve identified sports fans—and particularly, in many cases, sports bettors—as key to their mainstream futures. And as the Super Bowl will show this Sunday, they will spare almost no expense to convince fans to look past any skepticism to see a future as solid as the foundation of an arena.

Do not be surprised if it seems on Sunday like crypto ads are getting as much screen time as Matthew Stafford or Joe Burrow. Look no further than a video shared last week by Heat forward Jimmy Butler, in which he warns against taking financial advice from athletes and other celebrities in the ads that will air during the game, even urging fans to “do your own research” … a video that was itself, naturally, an ad for the crypto exchange Binance. That the space has now reached the point of advertising against advertising seems about right: Crypto has become one of the biggest and fastest growing marketing sectors in the sports industry.

Its presence is visible on uniform patches, in television ads, all over social media and in and around stadiums. (Butler’s Heat now play in FTX Arena—a crypto naming-rights deal that came five months before Crypto.com Arena in Los Angeles.) This hasn’t sprung up overnight—remember the Bitcoin St. Petersburg Bowl in 2014?—but it’s accelerated dramatically over the last year.

“What crypto has done is basically go from something that was sort of playing at the edges into a mainstream sports sponsorship sector,” says Conrad Wiacek, head of sports analysis and consulting at the research firm GlobalData.

In 2019, crypto companies landed 31 new sponsorships in sports, largely team deals in soccer, according to GlobalData. In ’20, as crypto boomed while sports were rattled by the pandemic, growth was roughly steady: 32 more partnerships. And in ’21? The market exploded. There were 201 new sports advertising deals announced with crypto companies—now representing not just deals with specific teams but with entire leagues and individual athletes, too. The lifetime contract value of crypto sponsorships in global sports is more than $3 billion; in ’21, crypto companies spent over $600 million on these deals, and, for 2022, it should be close to $750 million. And the gush of money is not slowing down, either: SponsorUnited, a company that helps connect sports organizations to advertising partners, reports that crypto is now consistently among the five sectors most searched for by major league teams, indicating “massive interest in future partnerships.”

It’s a link that has surprised few people in either sector. Crypto is appealing to the sports industry because its big players are currently flush with cash that’s much needed at a time when teams are still charting their way out of the pandemic. Sports are appealing to crypto, meanwhile, because they represent a prime opportunity for any company looking to expand its user base.

“They’re beginning to exhaust the early-adopter market,” Columbia Business School professor R.A. Farrokhnia says of crypto exchanges. “They have an incentive to try to increase the market, the number of participants, the volume of trades and so on.”

The why and how are intertwined here: If you’re trying to reach a mainstream audience, there are few safer bets in modern culture than sports.

“We wanted to do something that would get us out there really quickly in a way that would establish ourselves as a trusted partner,” says Brett Harrison, president of FTX US, the crypto exchange that has made significant deals with a slew of individual teams, with MLB and with Brady, Ohtani and Curry. “There are very few kinds of things you can do in the U.S. that reach so many people so quickly and are such an old, trusted institution as sports.”

That’s part of the reason for any sports marketing deal—reaching a large, mainstream audience that cuts across demographics. That’s especially true during the Super Bowl or MLB playoffs, when crypto advertising was omnipresent. But crypto companies are particularly interested in year-round die-hard fans, based on their interests and behaviors: A Morning Consult poll from September found that people who describe themselves as avid sports fans are far more likely than the average adult both to be familiar with crypto and to own it. Those who are sports bettors are even likelier. While 23% of the general population reported knowledge of crypto, 47% of sports fans did, and 72% of sports bettors.

“There’s an overlapping demographic of people who like sports—who like the excitement, the thrill, the risk that goes along with sports—and investing in this very new asset class,” says Harrison. “It’s being on the vanguard of technology, understanding this is a volatile place, but it could be the way that entrepreneurship takes us in the next five or 10 years.”

In other words, there is a sizable segment of sports fans—known to wager their happiness, and sometimes their fortunes, on the vicissitudes of a bouncing ball—who have an appetite for risk.

That all has led to a rush of crypto organizations trying to establish their appeal to sports fans at a time when the sector is very much still emerging. If that sounds familiar—in terms of both the sudden, inescapable uptick of advertising and the slice of fans who seem like the most obvious target—it should: “About 10 years ago, the sports betting space was a bit of this land grab,” says SponsorUnited president and founder Bob Lynch. Then daily fantasy, with its endless barrage of advertising, rushed in. “There’s a bit of that driving these initial spends.”

Yet there are some differences here. For one, many crypto companies are quick to distance themselves from any comparison to sports gambling, trying to make a distinction between investing and betting. For another, while there were two big players in daily fantasy, there are 123 current crypto brands engaged in active sponsorships, Lynch says. And finally, there is a bigger, more conceptual goal that crypto platforms have with their advertising: They’re trying not just to get people aware of their names, but to convince them that this is a worthwhile use of their cash, which can be a difficult task for a field that is so confusing for a mainstream audience.

“It was very easy to get your arms around daily fantasy when it first came out,” Lynch says. “Betting in general—it’s pretty black and white in terms of being able to understand. When you look in the crypto space … it’s quite complex, and the future of what that looks like is going to be quite complex. I think there are going to be a lot of mistakes and bets made that probably won’t pay off at the end of the day.”

Yet explaining crypto with any real depth or nuance is tricky—particularly in the limited space of a sports advertisement. And so you have partnerships that instead focus heavily on the more amorphous idea of building trust. “It's an opportunity to come in here and essentially buy that sort of credibility instantly,” Lynch describes crypto’s sports advertising. “It's a bit of a Trojan horse.”

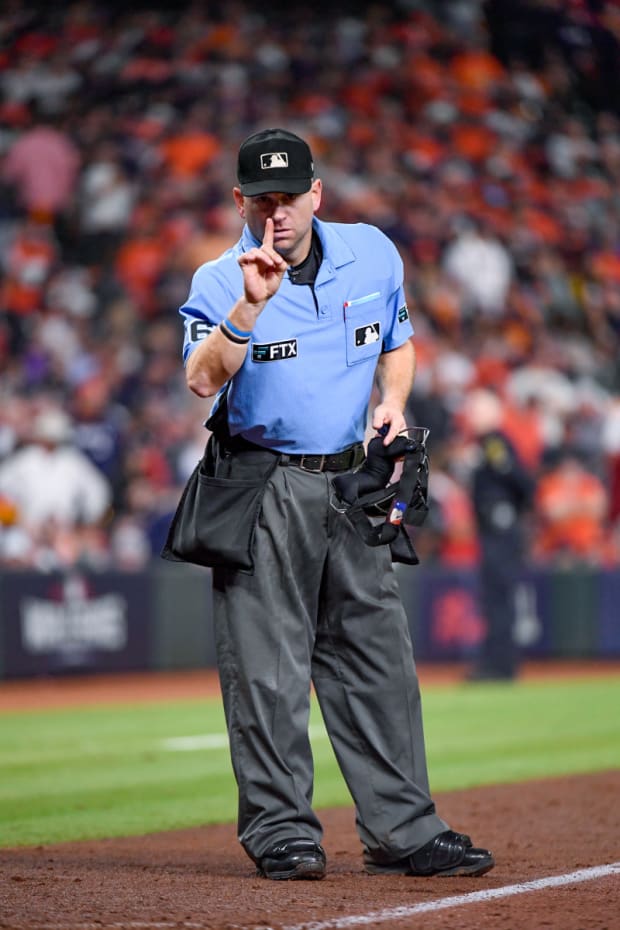

That’s a driving force in something like FTX’s partnership with MLB. It was the first leaguewide deal with a crypto exchange in major U.S. sports—announced in June, a few months before the NBA’s deal with Coinbase—and it includes, among other features, advertising patches that umpires started wearing on their uniforms midseason.

“One of the things that we're hearing from our clients in the crypto space is they are fearful of aligning with one fan base and alienating the other,” says Jessi Sanchez, senior vice president of consulting and valuation at Playfly Premier Partnerships, a sports marketing firm. “That’s why the league deals are so attractive to some of these brands. When they pick the umpire, you get your media effectiveness—because you’re getting it in every single game—but also that neutrality.”

The traditional stodginess of umpires might have otherwise seemed like an odd choice for a hot industry like crypto. But that safety was exactly the appeal. For MLB’s part, its chief revenue officer, Noah Garden, says the league did its due diligence and determined that FTX was a company “set up to sustain for the future.”

“They were a company that stood for integrity. If you think of what the umpire stands for in our game, it’s integrity. And so if you’re going to put a brand on an umpire—you know, technology aside for a second, it has to be something that is complementary to the person you’re putting that on,” Garden says. “So that’s where this really came together.”

MLB declined to share the specific terms or length of the deal with FTX.

Crypto’s foray into sports has been an attempt to reach a bigger audience, spread brand awareness and get a foothold in a new market. But there is one message that the companies are trying to spread under all that: Whatever you may have heard of crypto, ultimately, we can be trusted.

“We’re dealing with people’s money,” says Kalifowitz of Crypto.com. “And one of the things I need to communicate to people is that your money is safe with us—that we’re not going away.”

Greg Nelson/Sports Illustrated

It is, of course, much easier for a company to advertise its trustworthiness than to prove it. And in crypto—a sector that is moving quickly, with plenty of space for bad actors or scams that can seize on investors who are new to the space—that’s particularly so.

“This is an industry where there’s been a lot of noise from the very beginning, because like any new, extremely fast-growing industry—and there’s very little that’s really rivaled crypto on that front—there are going to be people who try to take advantage, people who try to create scams and get-rich-quick schemes,” says Harrison, the president of FTX US. “And that has given some of the earlier crypto a bad name. But it doesn’t detract from the enormous promise that this new technology can bring.”

That naturally makes some organizations more reticent about partnering with companies in the space. Even with as much money as crypto has poured into sports, many pro teams do not have official sponsors in the industry—and, in many cases, it’s not for lack of trying on the part of the crypto companies.

“What’s happening now—and this has kind of happened in other emerging categories—is there are half of the participants playing the wait-and-see game,” says Lynch, the SponsorUnited president. “The NFL, for instance, typically is not the first mover in these sorts of spaces.”

While MLB has FTX and the NBA has Coinbase, there has been no similar move yet to sign an official crypto exchange for the NFL. Much as The Shield was the last of the major men’s leagues to align with a daily fantasy partner, it seems to be taking a more careful approach here, too. Soccer clubs in Europe have largely taken the opposite approach—and some teams have ended up looking like cautionary tales.

“They went for the mad dash, and it just was not always done well,” says Sanchez.

That played out with teams like reigning Premier League champs Manchester City. The club announced a partnership with a crypto startup called 3Key in November… and suspended it just a few days later after The Guardian reported that the executives named in the press release had no digital footprint and could not be identified or otherwise located. The same week, FC Barcelona had to drop its NFT marketplace partner, Ownix, after one of the executives was arrested for cryptocurrency fraud.

The potential downfalls of advertising here apply just as much to individual athletes as they do teams and leagues. In many cases, athletes are being employed as the faces of crypto companies, which makes for a very personal connection to the brand—and stakes their credibility on it. (A third of crypto companies use athletes and other influencers for promotions, according to SponsorUnited.) That has left some athletes hesitant as others have jumped right in.

For FTX, a particular turning point was its partnership with Brady, who took an equity stake in the company along with his wife, Gisele Bündchen, in June. Brady was so all-in that he altered his Twitter avatar to have red laser eyes—a popular meme signifying bullishness on crypto.

“Now the door was wide open for all these other partners to come in and say, ‘Well, if Brady trusts you, we trust you,’” Harrison says. “That really enabled us to go out to these different megastars and talk to them, and they wanted to talk to us, too.”

Three months after Brady partnered with FTX, Curry did, too. Ohtani followed two months after that.

Apart from athletes partnering with crypto exchanges, there are many, many players who have promoted specific coins or spoken publicly about their investment strategies in the space. (That includes those who are converting their salaries to crypto—a move that is hardly a sure thing, as it can lead to players losing significant amounts of money depending on the timing, as reportedly has been the case with Odell Beckham Jr.) This can create a situation where athletes—often with their own skin in the game—are giving fans what looks like advice about investment in these especially volatile markets. At worst, it can lead to something like a lawsuit that was filed last month: A group of celebrities including retired NBA star Paul Pierce and boxer Floyd Mayweather were sued for allegedly making misleading statements about a cryptocurrency they promoted called EthereumMAX. The suit alleges that the celebs pumped the price of the coin with their social media posts about it and then dumped it—leaving investors alone in the red.

“This is not the same thing as getting a fee for sending out a tweet about a handbag or about a brand-name tennis racket,” Farrokhnia says. “You’re dealing with people’s money. And you’re dealing with a whole different level of emotional consideration and psychological impact and so on—a financial impact, for sure.”

Rich Fury/Getty Images

There’s another factor pushing crypto companies into sports: the belief that the partnerships they’re setting up now might be especially important (and lucrative) in the future as leagues engage more with blockchain technology. Blockchain—a public ledger of transactions kept on an open-source network—is the basis for cryptocurrency tokens. But people in the sector believe that it also offers the potential for a new, decentralized vision of the internet, often referred to as Web3, which could impact sports with everything from ticketing to retail to NFTs.

“In sports, you are continuously generating content, and on top of it, there are all these constituents involved—the players, the team, the league, owners, managers,” Farrokhnia says. “And you can start creating unique assets that could be tokenized and monetized by leveraging the blockchain—whether that’s highlights of a game or a digital representation of the signed baseball that won the World Series. So it’s just quite a rich area for leveraging blockchain-based technology to start tokenizing many of these unique assets that can be continuously generated, and monetized and become collectible.”

If that sounds like a dizzying vision far removed from how most people think of sports, leagues are already getting ready for it. The NBA’s work with Top Shot (digital trading cards with values that shot into the tens and even hundreds of thousands of dollars) was just a taste. It’s since been joined by NFT projects from the NHL, NFL, WNBA and MLB.

“Top Shot, and NFTs broadly, they’ve sort of illustrated that there are new avenues specifically within a crypto-native environment that are well-suited to athletes and teams and their fan bases,” says Stephen McKeon, a professor of finance at Oregon who manages a crypto fund. “I think we’ll also see the rise of Web3-based communities around teams.”

In the case of MLB, there are plans to expand the league presence here even more through their partnership with FTX. According to Garden, the CRO, there’s also been talk of how to capture that idea of community by moving into “the experience front.” That would mean introducing a real-world component to their NFTs: Purchase an NFT of a particular highlight or player, and, along with the digital token, you could get a physical chance to, say, get on the field during batting practice.

The most optimistic players in crypto see this as just the beginning for a whole slew of blockchain-related opportunities in sports. Which also raises the opportunity for endeavors to fizzle out or crash. There could be too much, too soon, without sufficient regulation or guardrails.

Wiacek cautions that if the industry does overheat and fans become cynical, it could close off future opportunities for crypto “because we’re all going to be so negative and cynical about it by that point.”

While that is far from assured of happening, fans can certainly expect the crypto industry’s advance into sports to continue. There will be more ads, more endorsers, more arena and stadium names and, yes, more pronouncements of a glorious technological future.

As MLB’s Garden says, “I think the next big push for us will definitely have a metaverse component.”