By Lisa Featherngill and Melissa Linn

A Family Limited Partnership (FLP) or Family Limited Liability Company (FLLC) is a legal entity created among family members. FLPs and FLLCs provide an excellent vehicle to centralize the management of assets, protect against creditors, reduce administration expenses of investments, and expose younger family members to the investment and management of assets. In some states, the law favors FLLCs over FLPs.

Mechanics of an FLP

An FLP has a general partner, typically a parent, who controls the management of the partnership and is liable for all partnership debts. The general partner may be a corporation or limited liability company owned by the parent and therefore shields the general partner from unlimited liability.

The limited partners, typically children, have no control over management of the partnership assets, receive their pro-rata share of partnership income and are liable only to the extent of their investment in the partnership.

Distributions, transfers, and other administrative items are controlled by the Partnership Agreement. Based on case law around Internal Revenue Code Sec. 2036 (see Caution section below), it is often advised to have the children more actively involved.

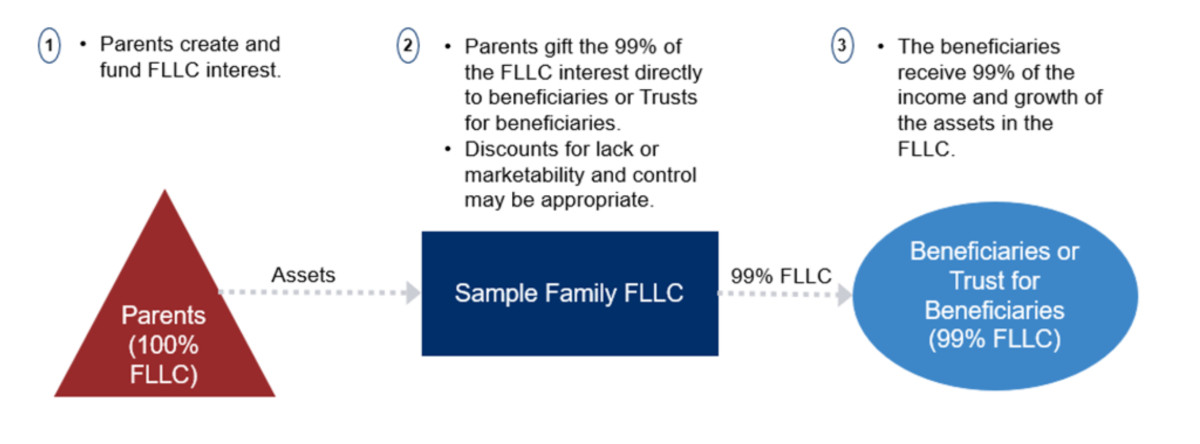

Mechanics of an FLLC

An FLLC has members instead of partners. Management of the FLLC is provided by the manager, who may be a member. Administration of the FLLC is outlined in the operating agreement. An FLLC is taxed similarly to an FLP (income is reported to members on a form K-1) but offers asset protection similar to a corporation.

Valuation discounts

Because the FLP or FLLC interest carries no ability to control, the value of the interest is not equal to the value of the underlying assets. The theory is that if someone offered you a $10,000 piece of property, but you had no control over its use, you would not pay $10,000 for it. This is referred to as a minority interest control discount.

Likewise, the ownership and transfer of interests may have restrictions attached. This is referred to as marketability discount and may cause the value of the partnership interest to be less than the underlying value. Valuation discounts are especially useful for taxpayers because they provide gift tax leverage; that is, more assets may be gifted under the annual exclusion or exemption than otherwise would be possible.

Example

Parents form an FLLC and transfer $100,000 to it. In return, they receive all the FLLC interests. The following year, the parents decide to give 99% of the FLLC interests to their children. The FLLC is appraised, and the appraiser informs the parents that the value of the FLLC should be discounted by 35% due to lack of control and marketability. Accordingly, the parents may gift FLLC interests worth $64,350 ($100,000 x .65 x .99) to their children that, due to the family context, may be worth $99,000 to them.

Lisa Featherngill and Melissa Linn

Caution

Ever since the IRS ruled that minority and marketability interests might be appropriate in the family context in the early 1990s, FLPs and FLLCs have been touted as vehicles to transfer wealth to younger generations at reduced federal gift and estate tax costs.

For years, the IRS presented several challenges to disallow the discounts taxpayers were taking on gift and estate tax returns. Beginning in the late 1990s, however, the IRS has succeeded in including underlying assets in the taxpayer's estate under Section 2036(a) of the Code, based on an implied retention of the right to enjoy the income. In addition, legislation and regulations have been proposed to eliminate discounts on intra-family transfers of FLPs and FLLCs. To date, none of these proposals have been enacted. However, they have been appearing with more frequency.

The bottom line is that FLPs and FLLCs are intensely factual cases. FLPs or FLLCs that hold assets for a bona fide business purpose and respect the formalities (formation and administration) have a much better chance at success.

FLPs and FLLCs are complex financial techniques that when designed too aggressively may attract the attention of the IRS. Clients considering an FLP or FLLC must do so with extreme caution and with the consult of qualified legal counsel.

Advantages

- Clear/systematic transfer to the next generation

- Discounting has gift and estate tax benefits, although see the caution below

- Allocate income to family members – be aware of the kiddie tax (under 18 or full-time students under age 24) at the parents’ tax rate

- Control for Donor (at least for a period)

- May provide a vehicle for educating younger generation

- May provide efficiency for management of assets

Disadvantages

- Lack of step-up in basis for gifted FLP or FLLC interests

- Tax returns and other annual maintenance

- Must be conducted as a business with regular minutes and meetings

- General partners exposed to liability unless owned by another entity

- Need to use trusts for transfers to minors

- Family dynamics of co-owning assets without rules of the road leads to long term issues

FLPs and FLLCs can be successful wealth transfer vehicles for families. They create structures that allow for discounted wealth transfer, education of the next generation, and efficient management of assets.

Caution should be taken to ensure that they are established and run as a business entity. The gifted interests will not get a step-up in basis and there will be more administrative maintenance such as tax returns, annual meeting minutes, and perhaps trust maintenance. You should consider all your options for wealth transfer with your CPA and estate attorney.

About the authors

Melissa Linn is a Senior Wealth Planning Strategist who specializes in having strategic conversations with clients to maximize opportunities and minimize unintended consequences. She develops customized wealth planning solutions for business owners, executives, and other high net worth clients. She joined Comerica in 2021 to cover the Southeast region after spending almost 16 years at Wells Fargo/Wachovia. Before joining Wachovia in 2006, Melissa worked at Deloitte and Stancil & Co focused on tax compliance and planning with high-net-worth families and business owners.

Lisa Featherngill leads a team of experienced and credentialed wealth planning specialists who develop customized wealth planning solutions for business owners and other high net worth clients. She joined Comerica in 2021 to lead the team and enhance the Wealth Planning offering after spending almost 25 years at Wells Fargo/Wachovia/First Union in planning leadership roles. Lisa spent the first 11 years of her career at Arthur Andersen in Washington, D.C., where she was a member of the Personal Financial Planning and Family Wealth Planning teams.

Editor's Note: The content was reviewed for tax accuracy by a TurboTax CPA expert for the 2022 tax year.