Does opting out of fiat by replacing it with Bitcoin offer a viable alternative?

The basics of the bill have already been covered here at Benzinga; the brief summary is that this is a $430 billion spending package, with most of the outlays aimed at addressing climate change and subsidizing renewables. A big part of the bill is also increased funding of the IRS: the agency that already has a $12 billion annual budget is earmarked for a further $80 billion.

Tax Foundation, a tax policy research nonprofit, has recently analyzed the bill, their main takeaway being that “By reducing long-run economic growth, this bill may actually worsen inflation by constraining the productive capacity of the economy.”

Central planning always fails

Underlying the deal is the old yet still-fashionable belief that government can and should tame prices and steer the economy. Nothing could be further from the truth: from Mises’ 1920 seminal essay titled “Economic Calculation in the Socialist Commonwealth” to 20th century failings of the Eastern bloc economies and many day-to-day experiences of the poor quality of state-provided goods and services, it’s clear that central planning simply doesn’t work.

The major problem that we face today is that central planning is an integral part of every economic transaction: money itself is heavily centrally-planned, through legal tender laws and central bank’s grip on the whole financial sector. The very fact that a Fed chair can turn markets around with a few sentences is all the proof we need that current financial “markets” aren’t market-based at all.

To stop inflation, stop inflating

The cause of price inflation - steadily increasing price levels in an economy - is always monetary inflation. Too much money chasing the same amount of goods. Or, as the great economist Milton Friedman eloquently put it: “Inflation is always and everywhere a monetary phenomenon in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output.”

Source: azquotes

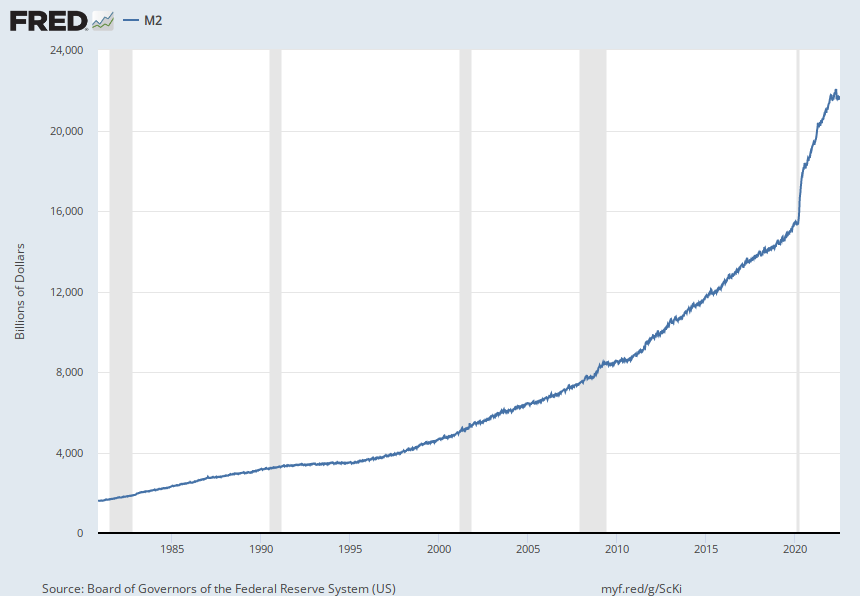

It should be no surprise after the monetary events of the past two years that the price inflation is getting out of hand. Let’s see how the money supply (M2 money aggregate) has been progressing:

There is now an additional six trillion dollars in circulation when compared to the end of 2019 - an increase of a staggering 40% over a period of 30-odd months. This is the inflation the government should be addressing; but it of course does not and, in fact, can not. The decades-long era of easy money policy and artificially low interest rates has caused a crippling debt addiction; for the government and the whole economy. The last time the federal budget was in surplus was in 2001, the US national debt has recently surpassed $30 trillion, and the total US debt of all sectors combined is nearing $90 trillion.

The powers that be - in this case let’s narrow it down to the government and the central bank - find themselves in a very tight spot. In order to stave off widespread bankruptcy and a severe economic depression that would follow, they need to keep on printing money. But to prevent price inflation getting out of hand, they need to do the very opposite - stop printing money!

Keeping the money printer running and devaluing the currency - and the snowballing debt burden along with it - is a politically more acceptable solution, so that’s what we can expect.

The likely effects of the IRA

The Inflation Reduction Act is simply a decoy: a great-sounding bill that looks like it is addressing inflation, while doing nothing of the sort and instead pushing forward purely politically-motivated programs. Fun fact: Congress bills can be named any way the legislators wish, it’s purely a marketing tactic that has no bearing on the actual effects of the bill.

A major part of the bill is focused on renewables. But the very fact that the renewable energy sector needs to be subsidized means that it is not competitive to other sources of energy, i.e. its costs are higher. The more this type of energy will be artificially propped, the higher the resulting pressure on price rises we can expect. A good example here is Germany, which underwent a so-called “green transition” over the past decade - it has resulted in a near-total dependency on Russian gas and exponentially rising household bills as we approach the winter.

The other major impact on people’s wallets will be the mammoth new funding to the IRS. The proposed 87,000 new agents are unlikely to focus on the wealthiest individuals and corporations, but - as has always been the case - on the lower and middle classes. The sixfold increase in the IRS’ budget seems like a desperate attempt to squeeze out the last few dollars from an economy that is already under huge distress. Entangling wage earners in the maze of IRS audits is a good way to further lower productivity and supply, which also leads to rising costs and higher inflation.

Opting out of fiat is the only solution

The IRA won’t help curb the inflation - only addressing the real culprit in the form of ever-increasing money supply would do that. This won’t happen, and in the long run, it’s likely that the US dollar will follow the fate of every fiat currency, i.e. demonetization and abandonment. But that doesn’t mean there is no hope for ordinary individuals and businesses. Since 2009, we have had an escape hatch: a new type of money that has no centralized entity, no flexible monetary policy that can be changed at whim. It’s no coincidence that when we compare bitcoin’s issuance with the dollar’s, the two are nearly the exact opposites. There will only ever be 21 million bitcoin, and an unlimited (and growing) amount of dollars. Bitcoin leads to increased purchasing power over the long term, while the dollar only leads to ever-higher inflation. Opting out from the latter to the former is the only realistic solution.