Activision CEO Bobby Kotick predicted that the UK would become a tech investment "Death Valley," as opposed to a European "Silicon Valley" should it block the big Microsoft-Activision merger. His comments may end up being prophetic.

A few weeks ago, the UK CMA sensationally voted to block Microsoft's merger with Activision Blizzard (ABK). The deal is worth almost 70 billion dollars and stands to give Microsoft control over franchises like Call of Duty, Candy Crush Saga, and World of Warcraft. The deal is one of the biggest ever made and certainly the biggest gaming acquisition ever made, and it has been fraught with regulatory constraints since its inception.

Whatever your opinion of the deal is, one thing is for sure: the ABK deal is increasingly creating a political headache for the UK government, particularly now that the European Union has unequivocally approved the Xbox-ABK deal. Prime Minister Rishi Sunak has espoused a philosophy of "deregulation" to promote investment. As many of the sputtering claims from Britain's political classes (of all sides) in the post-Brexit world, Sunak's declarations on regulation increasingly look hollow — uncredible platitudes to his party's Laissez-faire fantasists' wing. The UK is technically more regulated than ever, with the heaviest tax burden in decades — all from the purported party of "low tax."

These are just a few things coalescing at the wrong time for Sunak's government, with the ABK deal likely a tiny blip on the government's wider flaming heap of problems. For global investment into the UK, though, the ABK deal has become something of a focal point.

In any case, this piece isn't about whether or not the deal is good or bad, but it's an observation of how the ABK deal has become political and how Microsoft's options to get the deal through may increasingly lie with the government.

A tech investment "Death Valley"

If Sunak wants to make the UK an attractive place for the world's biggest and most innovative companies to do business, he needs to make it as profitable as possible to do so. In a world where it's easier to do business in the European Union, a bloc notorious for red tape, it could be argued that the government has utterly failed in its stated goals. Sunak and his ilk purport to make the UK a "deregulated" haven for tech investment, akin to Silicon Valley, with fast-paced innovation and high-tech jobs.

The UK government can technically overrule the CMA in some instances, but it's a mechanic not often used. We have little information on the government's thought process concerning the ABK deal and the CMA's block on the said deal. However, the government did feel the need to offer a vanishingly sheepish rebuttal of Microsoft President Brad Smith's comments that the UK was no longer as attractive as the EU to do business.

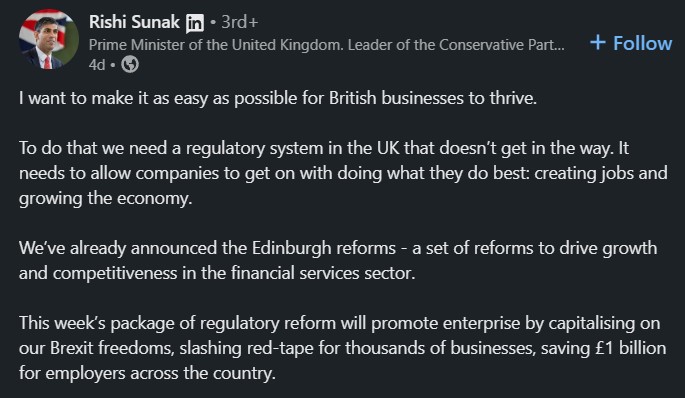

A few days after the CMA's decision, Sunak posted a significant treatise flanked by a giant red banner proclaiming to "reduce red tape" to boost business in the UK. Therein, Sunak described plans to "strategically steer" the CMA without offering further clarification. Today, that same CMA has been appearing in front of a government committee to explain its role as of late. This comes after some damning coverage in the hugely influential Financial Times and other business-oriented outlets, many of whom have criticized the CMA's handling of the ABK deal. It's perhaps not without a sense of irony that Sunak chose to post his proclamations on LinkedIn, a social network owned by Microsoft.

The UK CMA took some tough questions from the UK parliamentary oversight committee in a hearing covered by FossPatents on Twitter, which you can view in complete video form from EverbornSaga here. Indeed, the UK CMA came out almost immediately with a defense of its decision on Twitter following the European Commission's approval of the deal, which came across as oddly precious. I was unable to find another example where the CMA felt the need to "respond" to a contradictory regulatory decision from the EC. The only real reason they would feel the need to do so is to manipulate the optics — and given the sensitive nature of UK-EU relations both inside and outside the country, the CMA has somewhat put itself on the back foot. Many elected parliamentarians and commentators in business are questioning the CMA's logic on the block, which focuses on the nascent "cloud gaming market," of which Microsoft only can serve five thousand users at once.

Indeed, Microsoft threw a somewhat uncharacteristic tantrum when the deal was blocked, calling into question its investments in the country and pointing to the EU as a better place to do business. The BBC even wrote an article with the headline, "Is the UK a bad place for tech firms?" in response to the comments, examining a raft of recent problems the UK has created for Big Tech. The CMA oddly blocked Facebook from acquiring Giphy last year, a platform that delivers small, pixellated animated gifs to Instagram and other platforms. Is the CMA worried about competition in the gif economy too? The UK is also exploring legislation to kill end-to-end encryption, which has led to threats to leave the market from companies like WhatsApp and Signal. The UK's crown-jewel tech firm, ARM, also opted for a listing on the New York Stock Exchange instead of London, which has been seen as hugely embarrassing for Sunak and the Tory government at large.

These are just a few points of "chaos" the Tory government has created for the tech sector in the UK in recent years, disregarding the absolute post-Brexit clusterfuck that is hiring and importing from the UK's closest trading partner.

Satya Nadella on Microsoft-Activision dealCould you ever see an age where you sell the product in the US if it was approved, sell the product in Europe, but not sell it in the UK if they did not approve it? Satya:"Let's wait, for all to play out."https://t.co/GLYW4pXvg6 pic.twitter.com/6slqgx2ShuMay 16, 2023

In the current political landscape of disingenuous partisanship, neither "side" has really taken a public stance on the Activision-Blizzard deal. I suspect this is simply because there are far more pressing matters impacting the UK right now, but if one party breaks cover, the other party will predictably take the opposite stance. I could see a spin on one side that reads something like "overzealous regulator kills UK jobs!" and in the other ear, "weak EU bows to American megacorp!" But much like Brexit itself, the consequences of these decisions could have real-world implications for the UK. Microsoft CEO Satya Nadella today, with a wry smirk, said, "We'll wait and see how it will play out" when asked by CNBC if it could pull Xbox products out of the UK if the CMA continues to block the deal. What a staggering and predictable own goal that would be.

Whatever happens in the public sphere, behind the scenes, the CMA's questionable math and omissions have made both Microsoft and Activision incredulous. I suspect that there's little chance Microsoft or Activision will abandon the deal, given how much money is at stake. With the CMA digging its heels in, things could get pretty nasty down the line.

Libertarian fanfiction

The vision sold to the public and Tory MPs was that Brexit would lead to something of a deregulation paradise, where the Glory of Capitalism™️ would bring down prices, create jobs, and produce innovative technologies that would boost the economy. The reality has unsurprisingly been quite the opposite.

Based on cold-hearted math and eyes-wide reality, Brexit has been a cover-to-cover, unmitigated disaster for the United Kingdom thus far, with even the vaguest post-EU "opportunities" entirely squandered by the current government. The UK economy is set to perform worst out of the so-called G7 group of developed nations, with inflation at 10%, set to miss Rishi Sunak's own targets of "halving" it by the end of 2023. The invasion of Ukraine has impacted energy prices, which has given food stockists a license to arbitrarily raise prices in some cases while being forced to do so in others. UK strike action has been near-constant as staff seeks higher wages to offset a spiraling cost of living crisis that has seen the ruling government suffer the worst local elections loss for over two decades. A cycle of dodgy insider deals with a revolving door of costly tax-payer-funded health system privatization has brought the health service to its breaking point. At the same time, Covid-era contracts-for-your-mates have seen billions of pounds mysteriously vanish from the UK treasury. All of this is against a backdrop of madmen across the North Sea threatening to trigger a nuclear apocalypse rather than lose a war they started for ill-defined, psychotic reasons.

Yes, the government has far more significant things to worry about than Call of Duty.

Whether the status quo over the world's biggest shooting franchise is preserved or not, there are far bigger, far more impactful things going on within the United Kingdom that demand some form of sensible, capable attention — an attentiveness the UK's political class seems woefully lacking in. That's why we're supposed to have regulators, regulators that regulate the regulators, and democratically elected Parliamentary ministers whose responsibility is to regulate the regulators who regulate the regulators.

The video https://t.co/9yPGJ49FJf pic.twitter.com/KCumNhuOpRMay 16, 2023

Microsoft's operating profit in the UK is "only" in the hundreds of millions in the UK, which is a minuscule portion of its global operating profit. Despite this, Microsoft is a huge investor in UK jobs, with thousands of employees working in different departments. Rare, Ninja Theory, Playground Games, and others are based in the UK, with Microsoft investing in reams of other UK studios on a third-party basis. Brad Smith's threats to "reconsider" investment in the UK might have just been political theatre. Still, after the bruising SoftBank's ARM just gave to the London Stock Exchange, I suspect the government may think twice about calling Microsoft's bluff.

Before Brexit, the UK enjoyed a privileged position within the bloc, acting as a financial go-between brokering deals between different nations. After Brexit, the UK is economically floating into the Atlantic, directionless, with political classes struggling to offer a serious vision for what its future looks like. Vague aspirations to become Europe's "Silicon Valley" fly in the face of technologically-ignorant anti-encryption legislation and aggressive and inconsistent regulatory rules have left major firms with a sour taste. All the post-Brexit UK ruling classes have shown the world thus far is a complete lack of understanding of how the tech sector works, which isn't precisely becoming of an import-dependent nation so desperately in need of outside investment. I'm still reminded of our previous tech minister's laughable inquiry, where she asked why Microsoft hasn't yet "banned" the concept of algorithms — as if Microsoft was the omnipresent central authority on such things.

For something like cloud gaming to actually take off, you need the backing of mega-corporations like Amazon and Microsoft to get over that initial hump of investment before profit. Few companies in the world have the global infrastructure necessary to set this stuff up, and Apple and Google's payment duopoly — actual monopolies that threaten innovation — prevent small players from making their businesses financially sound. The European Union's remedy of forcing Microsoft to offer ABK's games license free to smaller companies is the correct decision to help the industry grow and thrive and offer a credible alternative to Apple and Google's dominance on mobile platforms. The CMA's decision flies in the face of all logic and reason, baffling experts on all sides.

None of this is an argument against regulation. It's an argument in favor of sound regulation. Nobody with a sound mind would argue against competition regulation, given that it's the basis of our economy and one of the few incentives to innovate and compete on consumer prices. Conspiring companies can artificially inflate prices and harm competitors who may have great products but get crushed before reaching the mass market. When regulation is working correctly, it is supposed to lead to consumer benefits. The CMA's decisions here have a real risk of harming UK consumers. While I find it unlikely Microsoft will pull its operations out of the UK in their entirety to see this deal through, I could envision some kind of solution that results in UK Xbox fans losing out on Xbox Cloud Gaming or losing out on ABK games in Xbox Game Pass. It would be a predictable self-own.

The CMA has done some great and vital work in the past, but on the ABK deal, it's clear that it has barked very loudly up the very wrong tree. The headache for the UK is that everybody in tech has now seen, plain as day, that the UK doesn't "get it" on tech. Furthermore, Rishi Sunak's pledges of "innovation and investment through deregulation," good or not, exist only as libertarian fanfiction in a LinkedIn post, serving nobody but Sunak's overactive imagination.