Tesla, Inc (NASDAQ:TSLA) was trading over 3% lower on Wednesday after a bearish day in the general markets caused the stock to close Tuesday’s session down 5%.

The EV giant continued to lay off some of its employees on Tuesday, cutting 200 salaried and contract workers from its Autopilot team in California. CEO Elon Musk confirmed earlier this month he planned to reduce Tesla’s salaried workforce by 10% over the next three months, with a 3 to 3.5% reduction taking place in the near-term.

The broader tech sector has been hit hard recently, with soaring inflation and heightened fear of a looming recession forcing some consumers to cut spending on items considered to be non-essential.

The downturn in consumer spending ripples through businesses, who rely most heavily on customers who have a high level of disposable income.

In preparation for a recession, these companies begin to protect their balance sheets with layoffs and restructuring, while throwing speculative or underperforming divisions on the back-burner in an attempt to outlast the competition.

There is light at the end of the tunnel, however, at least for the largest tech companies because during a recession small or start-up companies can become illiquid or near bankruptcy, which makes the latter acquisition targets.

During the last global recession, which occurred between 2007 and 2009, the largest tech companies such as Apple, Inc (NASDAQ:AAPL), Microsoft Corporation (NASDAQ:MSFT), Alphabet, Inc (NASDAQ:GOOG) (NASDAQ:GOOGL) and Meta Platforms, Inc (NASDAQ:META) acquired over 150 smaller companies, according to a report by Forbes, helping them to grow larger and stronger once the economy recovered.

For investors, the difficult part is deciding when to begin buying stock in companies such as Tesla, to profit from the eventual upswing. Traders, on the other hand, will look to profit from the volatility currently present in the market, with bullish traders attempting to time the shorter-term uptrends and bearish traders profiting from the more predictable and longer-term downtrends.

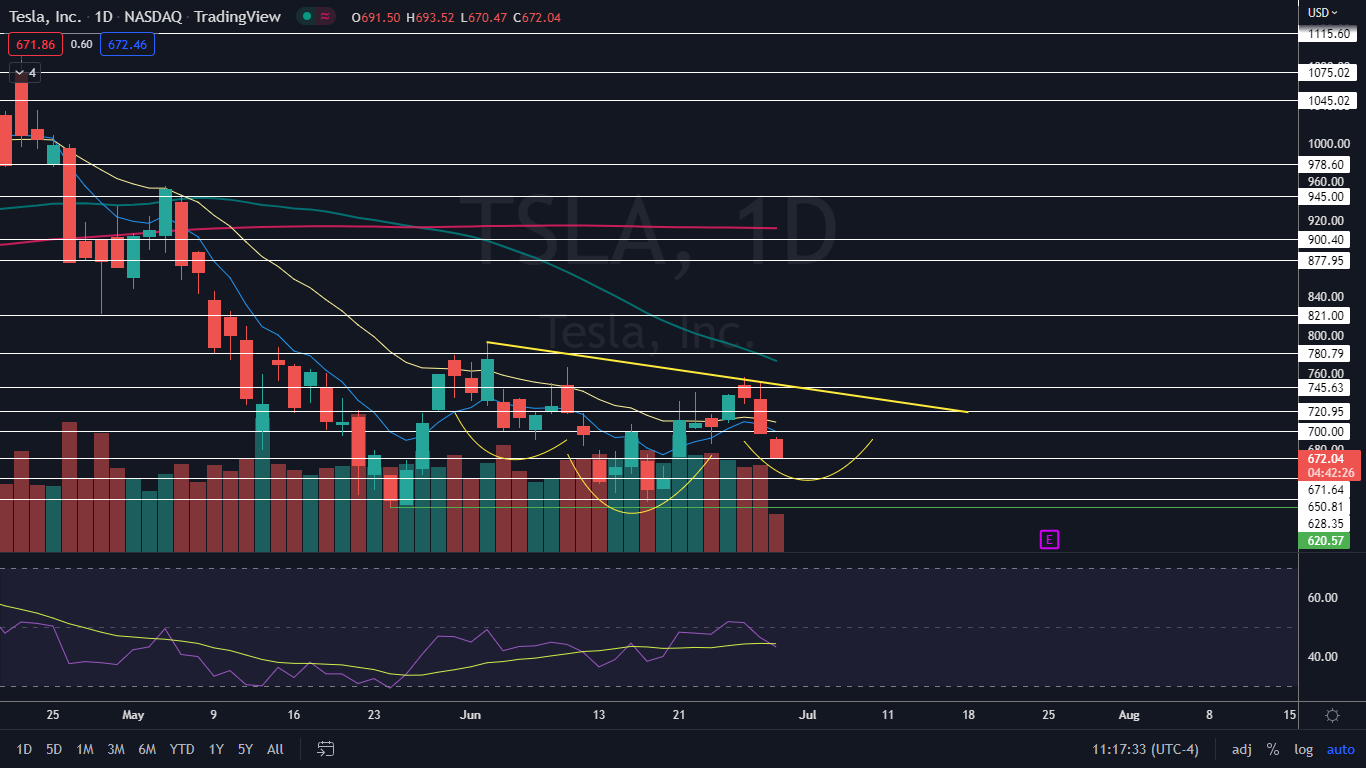

From a technical standpoint, Tesla could be headed for another run to the upside, if the bullish inverted head-and-shoulders pattern continues to print over the coming days. For long-term investors, it’s not clear whether the bottom is in or whether more downside could take place over the coming months, or even years.

Want direct analysis? Find me in the BZ Pro lounge! Click here for a free trial.

The Tesla Chart: Tesla’s most recent retracement to the downside could be an attempt to form the right shoulder of an inverted head-and-shoulders pattern, with the left shoulder created between June 2 and June 9 and the head between June 10 and Monday. If Tesla completes the pattern, by rising back up to the downward sloping neckline and is then able to break bullishly above that trendline, the measured move is about 11%, which suggests Tesla could soar up toward $857.

- If Tesla is rebounds and breaks above the neckline, traders will want to see that happen on higher-than-average volume to indicate the pattern was recognized by the algorithms. If Tesla continues to trade lower and falls under the lowest price in the head of the pattern, which is 626.08, the head-and-shoulder will be negated.

- From a bearish perspective, Tesla negated its uptrend on Wednesday when the stock fell below the most recent higher low of $685.91. In order to confirm a downtrend is on the horizon, bearish traders can watch for Tesla to rebound and print a reversal candlestick, such as a doji or shooting star candlestick, below the most recent higher high of $756.21.

- If Tesla closes the trading session near its low-of-day, the stock will print a bearish kicker candlestick, which could indicate lower prices will come again on Thursday. If the stock is able to close the trading day with a long lower wick, it could indicate higher prices are in the cards.

- Tesla has resistance above at $700 and $720.95 and support below at $671.64 and $650.81.

See Also: Elon Musk's 6-Day Silence On Twitter Unlikely To Be About Tesla, Analyst Says