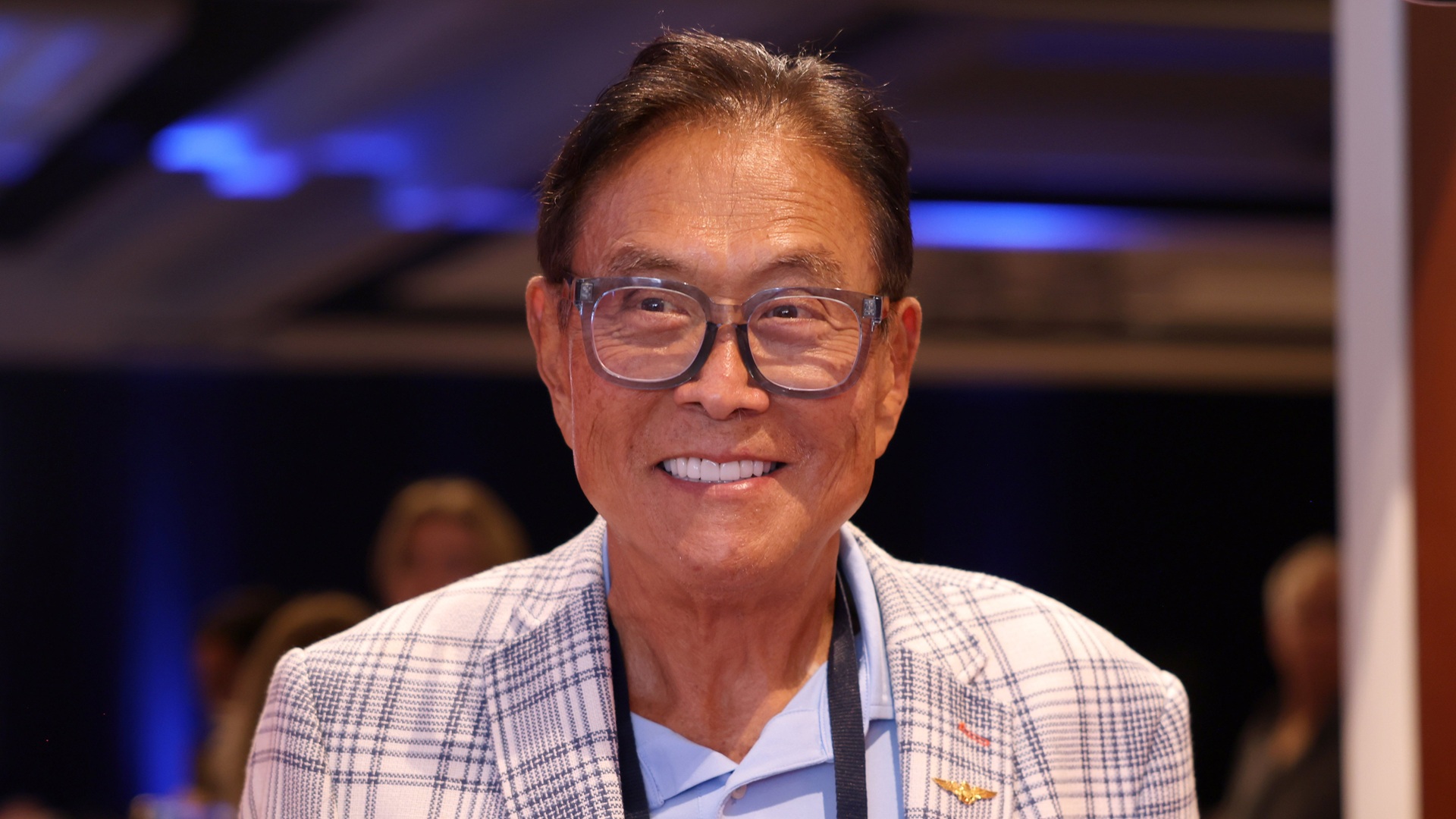

When it comes to gathering income, you’ve probably thought in terms of earning as much of it as possible — likely through a stable full-time job and some side hustles. Mostly, you’re concerned about how much you earn and what you can do with it to grow your wealth. But Robert Kiyosaki, famed financial expert and mastermind of the “Rich Dad, Poor Dad” empire, has parsed things even further.

He has identified four distinct income quadrants, each representing an area of your financial — and sometimes personal — life to focus on.

Through his book “Rich Dad’s Cashflow Quadrant: Rich Dad’s Guide to Financial Freedom,” Kiyosaki describes a framework that helps readers identify their sources of income, with the goal of becoming more independent and self-directed in their personal finances. While major decisions should always be made in consultation with a trusted adviser, this approach does offer something to think about.

Income as an Employee

Kiyosaki describes the first income quadrant as rooted in a need for conventional forms of financial security — namely, being an employee. As he lays it out, employees trade their time for money and, ideally, stable benefits packages. This mentality is certainly understandable — especially in today’s economy — but Kiyosaki reminds readers of the flip side of the exchange: When you stop working, the money dries up.

Another downside of being an employee is having less control over your time and taxes. Your earning potential is also capped by salary structures. Ultimately, Kiyosaki is interested in people finding ways to earn money through their passions in life.

“‘The path is the goal,'” he wrote. “In other words, finding your path in life is your goal in life.”

Still, it’s difficult to focus on life goals if you’re constantly anxious about covering necessities, so some balance may be in order. In other words, don’t quit your day job just yet.

Learn More: The No. 1 Way Americans Become Millionaires Is Pretty Boring — and Easy To Do

Read Next: 6 Things You Must Do When Your Savings Reach $50,000

Income From Being Self-Employed or a Business Owner

According to Kiyosaki, people with a passion for doing things their own way often move from being employees to starting their own businesses. He places doctors, lawyers, consultants, freelancers and small business owners in this quadrant.

While these individuals gain more freedom to set their own hours and pursue their personal visions, Kiyosaki cautions that they often face similar tax disadvantages while working longer hours. And that problem about money stopping when the work stops? It still applies.

“People who earn income through a job — either as an employee or as a sole proprietor or small business owner — lose roughly 50% of their money through taxes,” he wrote. “Earned income is … highly taxed.”

While his claim about losing 50% of income to taxes does not apply universally, his broader point is that people in the first two quadrants often forfeit autonomy and earning potential.

Income From Being a Big Business Owner

The mark of a successful business owner is the creation of systems that generate income even without constant personal involvement. These businesses continue turning a profit even if the owner takes a vacation.

This group includes franchise owners, CEOs who have developed strong management teams and entrepreneurs who have built self-sufficiency into their operations.

Income From Investing

One of the most effective ways to generate income is by learning how to invest wisely, early and often. According to Kiyosaki, investors generate passive income through assets such as stocks, bonds, real estate or businesses they do not actively manage.

Cash flow from investing continues regardless of whether someone is working at a desk or relaxing on the beach.

Three Other Types of Income

In addition to the four income quadrants, Kiyosaki identifies three types of income to pay attention to:

- Earned income: Money from a regular job or active role in managing a business.

- Portfolio income: Profits from buying and selling assets such as stocks.

- Passive income: Ongoing cash flow from assets such as rental properties, royalties or businesses that do not require daily oversight.

Even if you don’t plan to follow Kiyosaki’s advice exactly — perhaps you’ve never dreamed of being a CEO — he makes a compelling case for diversifying income through investments and ensuring money continues to come in even when you’re not working. And advice to pursue your passions is rarely unwelcome.

More From GOBankingRates

- 12 Costco Deals for 2026 To Grab as Soon as Possible

- 5 Luxury SUVs That Will Have Massive Price Drops in Spring 2026

- 5 Clever Ways Retirees Are Earning Up to $1K Per Month From Home

- 9 Low-Effort Ways to Make Passive Income (You Can Start This Week)

This article originally appeared on GOBankingRates.com: The 4 Types of Income Robert Kiyosaki Says You Should Focus On