Whales with a lot of money to spend have taken a noticeably bullish stance on Texas Instruments.

Looking at options history for Texas Instruments (NASDAQ:TXN) we detected 19 trades.

If we consider the specifics of each trade, it is accurate to state that 42% of the investors opened trades with bullish expectations and 31% with bearish.

From the overall spotted trades, 8 are puts, for a total amount of $367,380 and 11, calls, for a total amount of $756,645.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $180.0 to $230.0 for Texas Instruments over the recent three months.

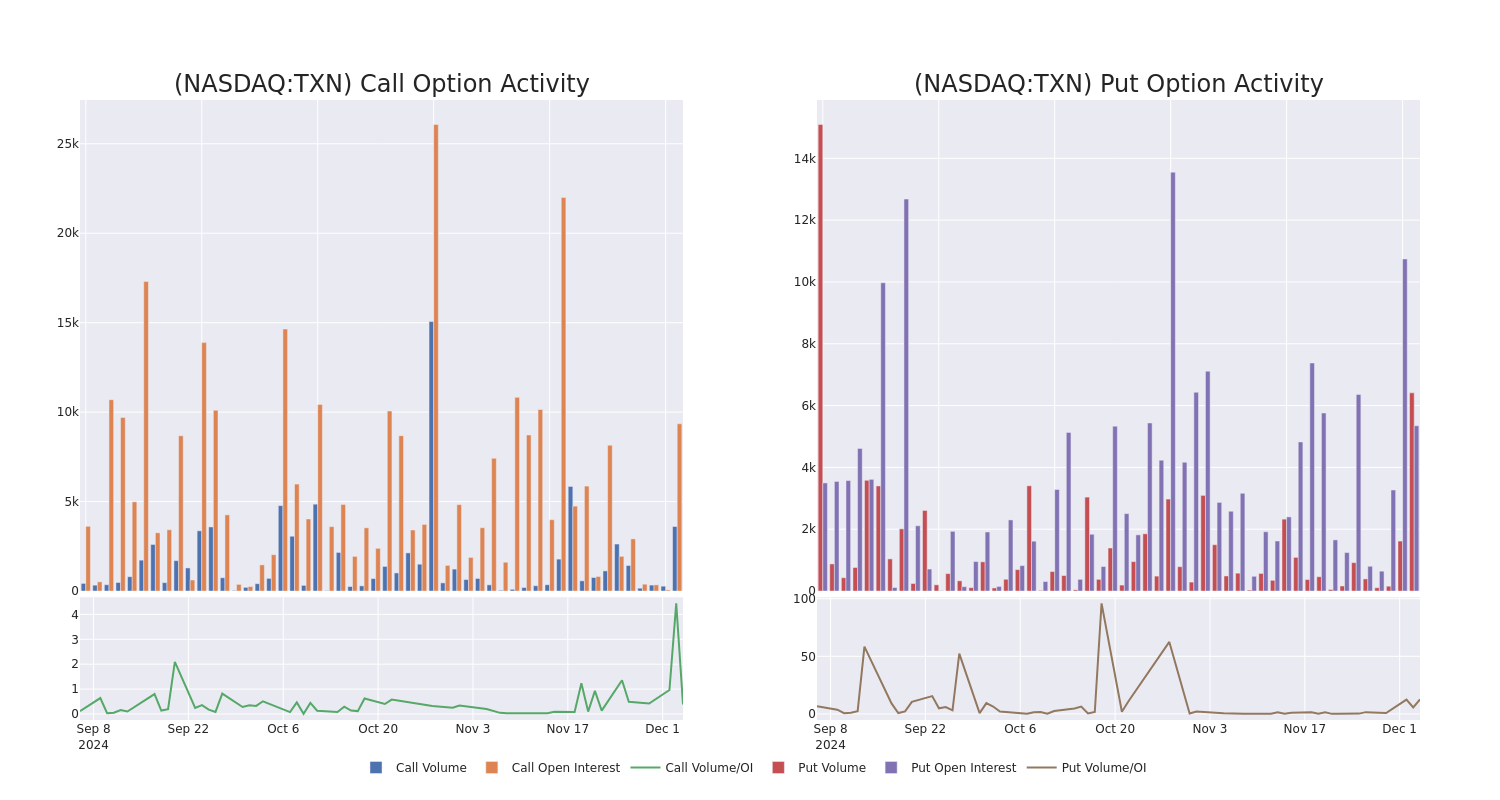

Insights into Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Texas Instruments's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Texas Instruments's substantial trades, within a strike price spectrum from $180.0 to $230.0 over the preceding 30 days.

Texas Instruments Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TXN | CALL | SWEEP | NEUTRAL | 04/17/25 | $12.85 | $12.5 | $12.68 | $200.00 | $139.4K | 467 | 306 |

| TXN | CALL | SWEEP | BULLISH | 04/17/25 | $12.75 | $12.3 | $12.59 | $200.00 | $109.9K | 467 | 89 |

| TXN | CALL | TRADE | BULLISH | 01/17/25 | $8.5 | $8.3 | $8.5 | $195.00 | $102.0K | 3.3K | 426 |

| TXN | CALL | TRADE | BEARISH | 01/17/25 | $8.45 | $8.25 | $8.25 | $195.00 | $99.0K | 3.3K | 122 |

| TXN | PUT | SWEEP | BULLISH | 12/13/24 | $0.71 | $0.7 | $0.7 | $190.00 | $84.2K | 225 | 1.8K |

About Texas Instruments

Dallas-based Texas Instruments generates over 95% of its revenue from semiconductors and the remainder from its well-known calculators. Texas Instruments is the world's largest maker of analog chips, which are used to process real-world signals such as sound and power. Texas Instruments also has a leading market share position in processors and microcontrollers used in a wide variety of electronics applications.

After a thorough review of the options trading surrounding Texas Instruments, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Texas Instruments's Current Market Status

- Currently trading with a volume of 2,248,354, the TXN's price is down by -0.5%, now at $196.24.

- RSI readings suggest the stock is currently may be approaching oversold.

- Anticipated earnings release is in 48 days.

Professional Analyst Ratings for Texas Instruments

Over the past month, 1 industry analysts have shared their insights on this stock, proposing an average target price of $215.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access. * Reflecting concerns, an analyst from Wells Fargo lowers its rating to Equal-Weight with a new price target of $215.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Texas Instruments, Benzinga Pro gives you real-time options trades alerts.