For awhile we were looking at a different Big Three through the first quarter.

Along with Nvidia (NVDA) and Meta Platforms (META), Tesla (TSLA) stock was one of the top three when it came to the robust outperformance in megacap tech.

FAANG has performed well, but this trio was by the far the best-performing group of the Big Tech stocks.

Tesla stock then lost luster. The electric-vehicle leader's shares tumbled when it reported earnings, falling almost 10% in a single session. Ultimately, the stock fell in six of seven trading sessions, falling almost 20% in that span.

Now, since hitting a post-earnings low of $152.37 on April 27, the stock has roared back almost 22%.

Don't Miss: Can AI Power Nvidia Stock to All-Time Highs?

Of course, it helps that other megacap tech stocks have also traded well. That and the overall stock market holding up nicely have finally started to give Tesla a lift.

The question now becomes: Will this stock run out of power again and need to recharge or will it surge further to the upside?

Trading Tesla Stock

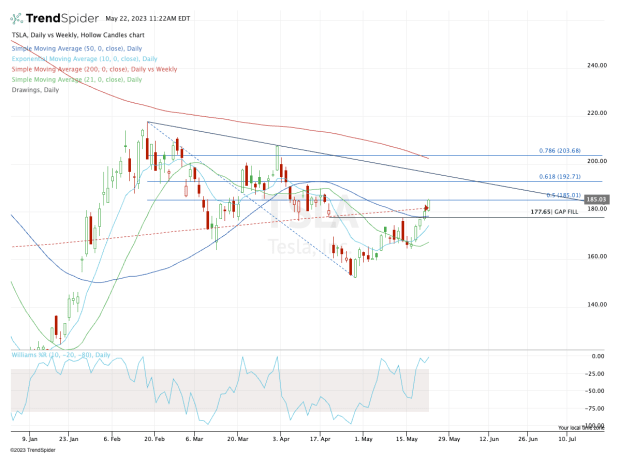

Chart courtesy of TrendSpider.com

At last check the stock is up 3% as it rides a five-day, 13% win streak.

Friday’s rally put Tesla stock above the 50-day moving average. Today’s rally puts it back above the 200-week moving average and thrusts it right into the 50% retracement (as measured from the April low to the 2023).

If Tesla stock does run out of gas -- in a manner of speaking -- investors should look for the 50% retracement to act as resistance. A break back below $180 could put $175 back in play.

A dip to this area could actually be attractive for the bulls. But if that level fails to hold, the mid-$160s could be next.

Don't Miss: Walmart Beat on Earnings; Now, It Needs a Breakout

If, however, Tesla stock can remain in play for the bulls, a further move up into the low-$190s is possible. In this area the shares will run into the 61.8% retracement near $193 and downtrend resistance.

A move above that could put the $200 to $204 zone in play.

In that zone, bulls will find the 78.6% retracement and the declining 200-day moving average.

If traders are long Tesla and actively in and out of the name, a rally to this zone would be a timely area to take some profits.

Should Tesla hit $200 in the short term, it would be worth reevaluating the setup. For now, though, Tesla stock remains in the bulls' control.