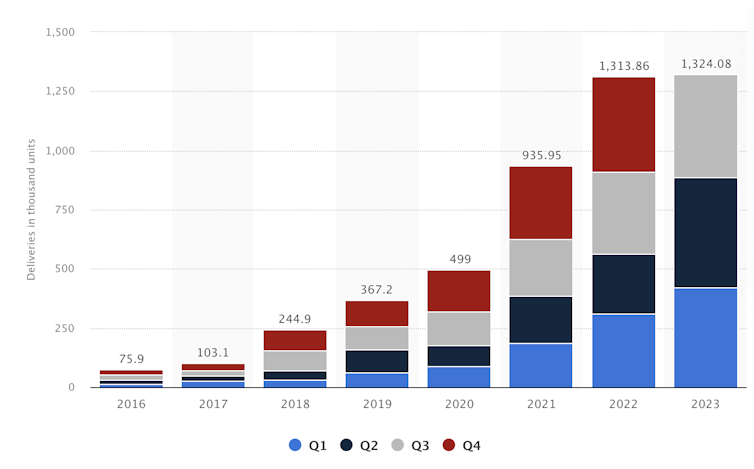

In 2019, Tesla was in the happy position of being a high-volume, premium-priced leader in the global electric vehicle (EV) market. Deliveries of 367,500 cars represented 50% growth over 2018.

That included 92,550 of the mid-sized Model 3 cars and 19,450 of the larger Model S and X vehicles during the fourth quarter, implying strong future growth and producing annual revenue of US$$24.5 billion (£19.4 billion).

The same year, Tesla announced the Cybertruck. This new futuristic-looking vehicle represented the company’s first move into light/pickup trucks. Deliveries were initially planned for 2021.

Yet the Cybertruck has been beset with delays over things like the weight, making it difficult to achieve an adequate battery range, and the surging cost of bulletproof glass – it will now only be available as an add-on. Deliveries finally begin on November 30, meaning 2024 will be the first full production year.

Tesla has simultaneously been managing a difficult transition. Formerly a disruptive entrant rewriting the rules, it is now an incumbent trying to protect sales volumes and profit margins. A hectic growth strategy has seen a new gigafactory in Shanghai that started output in early 2020, plus two others near Berlin, Germany and Austin, Texas, which both opened in 2022.

In 2023, Tesla expects to sell 1.8 million vehicles overall, roughly double 2021 sales. But things can change very quickly in this industry, and Tesla faces different challenges in its three main markets of China, Europe and the US. The big question is whether the Cybertruck can resolve them.

Tesla unit sales 2016-23

The market breakdown

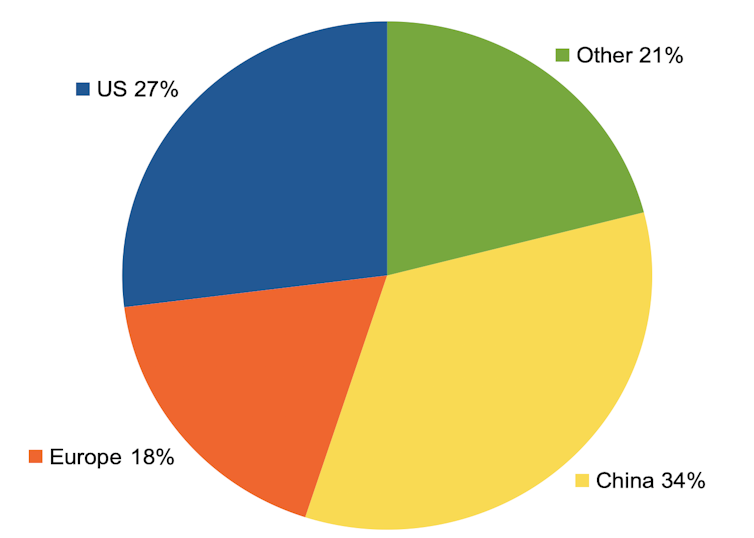

In China, Tesla faces multiple competitors, a looming overcapacity in battery production, and changing government rules on incentives and purchase taxes. It has consequently been engaging in “dynamic pricing”, slashing the cost of Model 3s and Model Ys.

This has boosted unit sales, but Tesla is now distant second behind Shenzhen-based BYD, in terms of hybrids and full EVs combined. Its EV share dropped from 15% in 2020 to 10% in 2022, and is still declining.

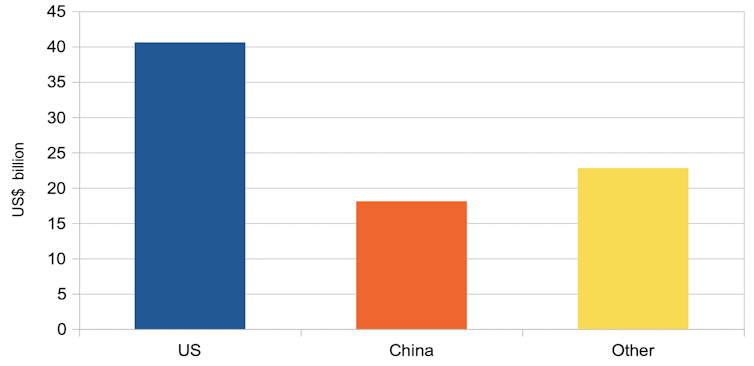

Tesla revenues by region (2022)

In Europe, Tesla has also been cutting prices in 2023, while broadly sustaining its volume-premium balance. This is the big challenge for any rising producer: producing in higher volumes reduces costs, but erodes exclusivity and therefore the ability to retain premium pricing.

By early 2023 Tesla had captured about 20% of the EV market, substantially outperforming both volume and premium rivals and increasing share by around 2 percentage points year on year.

The Cybertruck probably won’t unlock more growth in Europe, however. US pickups are a marginal product there, seen as unsuited to many European cities. Indeed, Paris is considering higher parking charges for EVs weighing over 2 tonnes, which would include the reputedly 3.3-ton Cybertruck.

Tesla vehicle sales by region (2022)

It is in the US that this vehicle really matters. Again, Tesla cut prices significantly there in early 2023. The company’s ability to put pressure on rivals this way reflects its production experience and famous ownership of its supply chain. Tesla’s unit sales in the US are up 26% year on year, but like in China it is losing share to competitors: down to 57% from 67% a year ago.

The US pick-up segment is important to Tesla’s efforts to retain its premium brand positioning by expanding the product portfolio. but pick-ups are also vital source for the US “big three” manufacturers’ profitability. Non-EVs are dominated by Ford (F-series), GM (Chevrolet Silverado) and Stellantis (Dodge Ram).

Those incumbents have not wasted time since the Cybertruck was announced. Ford launched the F-150 Lightning in May 2021, and by 2024 expects output to be 150,000 units per year. The niche GMC Hummer EV pick-up was launched by GM in 2022. GM’s Silverado EV will also be on the market by mid-2024, as will the Dodge Ram in pure EV and range-extender formats.

Other disruptive new entrants have also been busy, although companies such as Lordstown Motors and Canoo have struggled. Most prominent, though still not profitable, is California-based Rivian with its R1T electric pick-up and R1S SUV variant. Rivian is expected to produce about 50,000 vehicles in 2023 overall.

Cybertruck prospects

Tesla has the luxury of a reported 2 million reservations for the Cybertruck, with a five-year waiting list. Nonetheless, the vehicle will test whether the company can continue combining volume with premium pricing.

There will now be two models, since the lowest-spec single-motor variant seems no more. The premium tri-motor Cybertruck will likely be priced at US$80,000. Some innovations in the two models, such as stainless-steel body panels, appear to be more marketing hype than engineering logic.

The styling is polarising, and may not appeal to a traditionally conservative segment. The performance claims are impressive, but possibly unnecessary - the ability to tow 6.4 tonnes will rarely be useful.

The Cybertruck will have a battery-technology edge for now, and access to the widespread and reliable Tesla supercharger network. Tesla aims to produce 200,000 units in 2024 and potentially 250,000 the year after. If that can be sustained, then the company will again have achieved premium positioning on a volume product.

At this stage, however, there are concerns. Early pre-production models were reported with multiple quality issues around the fit and finish, including large, variable panel gaps, and bubbles or other defects in the plastic film applied to the exterior panels. Those in the industry may recall the Ford Edsel. Unusual styling along with multiple initial production problems resulted in one of the classic industry disasters for this supposedly state-of-the-art car in the late 1950s.

A lot is riding on the Cybertruck. It will be increasingly difficult to achieve powerful growth on the back of the Model 3/Ys and Model S/Xs. Tesla has talked about introducing an entry-level EV at circa £18,000, but has not always delivered on past promises.

If this hasn’t appeared by 2025, Tesla will have an ageing product line and a need to inject more excitement into the brand. It will be protecting its market share against a host of new rivals and resurgent legacy brands. Without a big Cybertruck success, the company will find it ever harder to straddle the volume-premium divide.

Peter Wells does not work for, consult, own shares in or receive funding from any company or organisation that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.

This article was originally published on The Conversation. Read the original article.