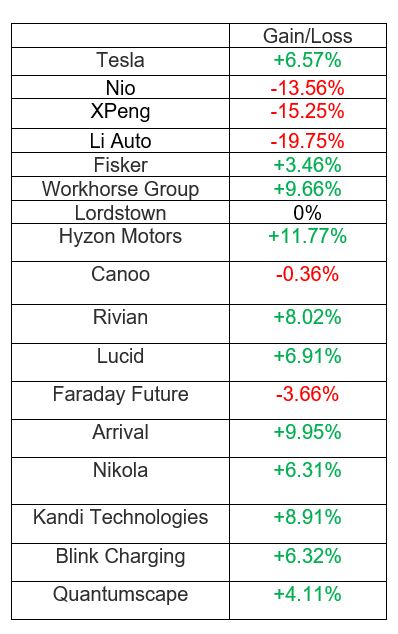

Earnings season proved salubrious for electric vehicle stocks, helping them advance in the week ending Oct. 29. Chinese stocks bucked the trend and came under significant selling pressure, reacting to President Xi Jinping cementing his control over the ruling Communists Party.

Now, here are the key events that happened in the EV space during the week:

Tesla’s Relief Rally: Tesla, Inc. (NASDAQ:TSLA) shares, which have come under significant selling pressure this year, rose over 6.5% this week. One of the reasons could apparently be CEO Elon Musk holding off on any further disposal of his stake in the company to fund his Twitter, Inc. (NYSE:TWTR) buy. Analysts believe the removal of the uncertainty around the Twitter deal could prompt traders to come piling back into the stock.

Tesla is planning a major expansion to its newly-opened Gigafactory in Berlin, local media outlet rbb24 reported, according to Teslarati. Tesla, which reportedly owns about 300 hectares of land on the property in Brandenburg, is planning to clear the area to expand the factory.

Rumors of a new Gigafactory in Mexico gained ground after Musk visited the country and met with government officials from the state of Nuevo León. Local outlet Mexico News Daily reported rumors of Tesla setting up a factory in Santa Catarina, which is a seven-hour drive from the EV giant’s headquarters in Austin, Texas.

A Reuters report suggested Tesla is facing a criminal investigation over self-driving claims regarding its electric vehicles. Another negative headline was the recall of 24,000 Model 3 vehicles in the U.S. over seat belt issues. As opposed to most recent recalls, which were rectified through over-the-air updates, this one involved a physical recall.

Lucid Opens First Retail Store In Saudi Arabia: Lucid Group, Inc. (NASDAQ:LCID) opened its first studio in the Middle East in Riyadh, Saudi Arabia. Earlier this year, the company announced the signing of an agreement with the Saudi government to supply 100,000 EVs over ten years. Lucid is part-owned by the Saudi sovereign wealth fund Public Investment Fund.

Toyota Unveils New bZ3 For Chinese Market: Toyota Motor Corporation (NYSE:TM) announced the Toyota bZ3, the second model in its bZ series EVs. It is a battery EV sedan jointly developed with China’s BYD Company Limited (PNK: BYDDF) (PNK: BYDDY) and will be made available for the Chinese market. The model is widely expected to be a rival offering to Tesla’s budget vehicle, the Model 3. The EV will be powered by BYD’s lithium-iron-phosphate battery and is capable of achieving a cruising range of over 600 km.

Faraday Future Taps Ex-Romeo Power Executive For CFO Role: Faraday Future Intelligent Electric Inc. (NASDAQ:FFIE) announced the appointment of Yun Han as chief accounting officer and interim chief financial officer, effective Oct. 25. Han was previously employed as SVP and chief accounting officer at Romeo Power, which was acquired by Workhorse Group, Inc. (NASDAQ:WKHS) recently.

Europe To Transition Fully To EVs By 2035: European legislators reached an agreement this week to phase out sales of internal combustion cars and vans by 2035. Representatives of the European Parliament and the European Council have agreed on the deadline in a bid to reduce net greenhouse gas emissions by at least 55% by 2030.

EV Stock Performances for The Week:

Read next: Best Electric Vehicle Stocks