Tesla is expected to hold its Q4 earnings call later today at 5:30 p.m. ET (2:30 p.m. PT), but the company has gone ahead and released its report. Even though revenue fell 3% year-over-year to $24.7 billion, it exceeded Wall Street expectations with GAAP gross margin improved significantly to 20.1%, up from 16.3% a year ago.

This comes is good news considering how the dwindling demand for EVs in the last year. For Tesla, this comes after Tesla's announcement last week that it’s no longer going to be offering its AutoPilot feature with new vehicles sold in the U.S. and Canada — choosing instead to put one key aspect of this feature behind a subscription paywall.

Things have drastically changed since the federal EV tax credit expired last October, which enticed prospective EV shoppers with a $7,500 credit for new EVs. Tesla delivered 418,227 vehicles in Q4, bringing the full-year 2025 total to 1.636 million — which is 9% decline from 2024.

There's also other streams that Tesla focused on to combat the EV downturn, including things like its Powerwall rechargeable battery backup system for homes, autonomous Robotaxi service expansion, and more. Here's everything Tesla announced with its Q4 2025 report.

Tesla Q4 2025 earnings: At a glance

- Tesla reported $3.8B in annual GAAP net income on $94.8B in revenue, which comes out to a year-over-year decline of 3%.

- GAAP gross margin improved significantly to 20.1%, up from 16.3% a year ago.

- Deliveries totaled 1.64 million vehicles, a 9% decrease compared to 2024.

- Energy storage deployments generated $1.1B in quarterly profit, up 49% year-over-year.

Tesla Q4 2025 earnings: How to listen live

We’ll be live-blogging all the key announcements to come from Tesla’s Q4 2025 earnings call, but you can catch up with everything by listening to the livecast in real time. Once the Q&A session is over, an archive of the entire thing will be available online.

Tesla Q4 2025 earnings live webcast

Revenue growth last quarter

Interestingly, Tesla reported revenue growth with its Q3 2025 earnings report, recording a 12% year-over-year increase — but it came at a cost with dwindling margins from its electric vehicles. Despite this, the company did manage to deliver a record 497,099 vehicles for the third quarter alone. That's actually the highest quarterly total in the company's history.

Expired federal tax credit is a huge headache

Tesla's grasp on the EV market is fundamentally linked to the federal EV tax credit, which served as a primary incentive for shoppers to choose electric over traditional gas-powered vehicles. Now that it has expired, prospective buyers may be reluctant to pull the trigger on even the most affordable models, such as the Tesla Model 3.

Purchasing one today would cost you $36,990. For many, the $7,500 federal tax credit would have helped alleviate the financial burden of that price tag — but that safety net is gone.

Subscription models could be the future

One of the biggest incentives of buying a Tesla EV is Autopilot, a feature that offers Level 2 partial automation when it comes to driving. This essentially acts to provide the necessary braking and acceleration while in cruise control, but it also keeps the vehicle centered in a lane.

Tesla announced last week that future Tesla electric cars won't have all of Autopilot by default. They'll come with the usual cruise control functions of braking and accelerating automatically, but getting the lane centering feature will now require them to pay $99 a month.

It does beg the question about profitability, as this could be seen as a new revenue stream for the EV maker.

Heated competition, including affordable EVs

In just the last year alone, there's been a lot of competition around affordable EVs. For the longest time, the Tesla Model 3 has been heralded as the benchmark for its tech-forward features and low price point, but the landscape has shifted tremendously.

We've been able to test out a handful of the most affordable electric vehicles, including the 2026 Nissan Leaf that starts at $29,900. That puts the Tesla Model 3 at a disadvantage for those looking to spend as little possible to reap the long term savings of EVs. There's also the Chevrolet Equinox EV, a compact SUV that gets 315 miles of range and costs $35,995.

Possible expansion of Robotaxi to other markets

You might not know it, but Tesla recently reached a major milestone by launching its unsupervised Robotaxi service in Austin, Texas. Passengers can now hail a Tesla Model Y through the app for a ride without a safety monitor behind the wheel. This shift to a truly driverless experience marks a turning point for the company, moving from human-supervised testing to fully autonomous trips.

Tesla is expected to use tonight's Q4 2025 earnings call to discuss expanding this unsupervised service to other major markets, which could further showcase the scale of its AI-driven ride-sharing network.

Tesla Optimus bot could play a critical roll in the company's future

Tesla’s assembly lines could change dramatically in the coming years as the company's humanoid Optimus bot begins performing real-world factory tasks. Just last week, Elon Musk alluded to a future where "work is optional" and jobs are merely a hobby, driven by the rapid advancement of AI and robotics.

While the public has only seen the v2.5 prototypes, the upcoming Optimus V3 is already being hailed by insiders as a game-changer that could eventually eclipse Tesla's EV business entirely. The company could use its Q4 2025 earnings call today to shed more light on the production timeline for this next-generation bot.

EV slump is forcing other car makers to look elsewhere

It doesn't help that EV prices remain prohibitively expensive for most shoppers to even consider. The current market slump is forcing automakers to radically rethink their strategies — and Ford is leading the retreat.

The Michigan-based company recently announced it would discontinue manufacturing the all-electric F-150 Lightning, pivoting instead to EREVs (Extended Range Electric Vehicles). This next-generation Lightning will utilize a gas engine as an onboard generator to power the electric motors, extending the vehicle's range to a staggering 700 miles.

While Ford pivots to this middle-ground technology, Tesla remains all-in on pure battery power, setting up a massive showdown for consumer preference in 2026.

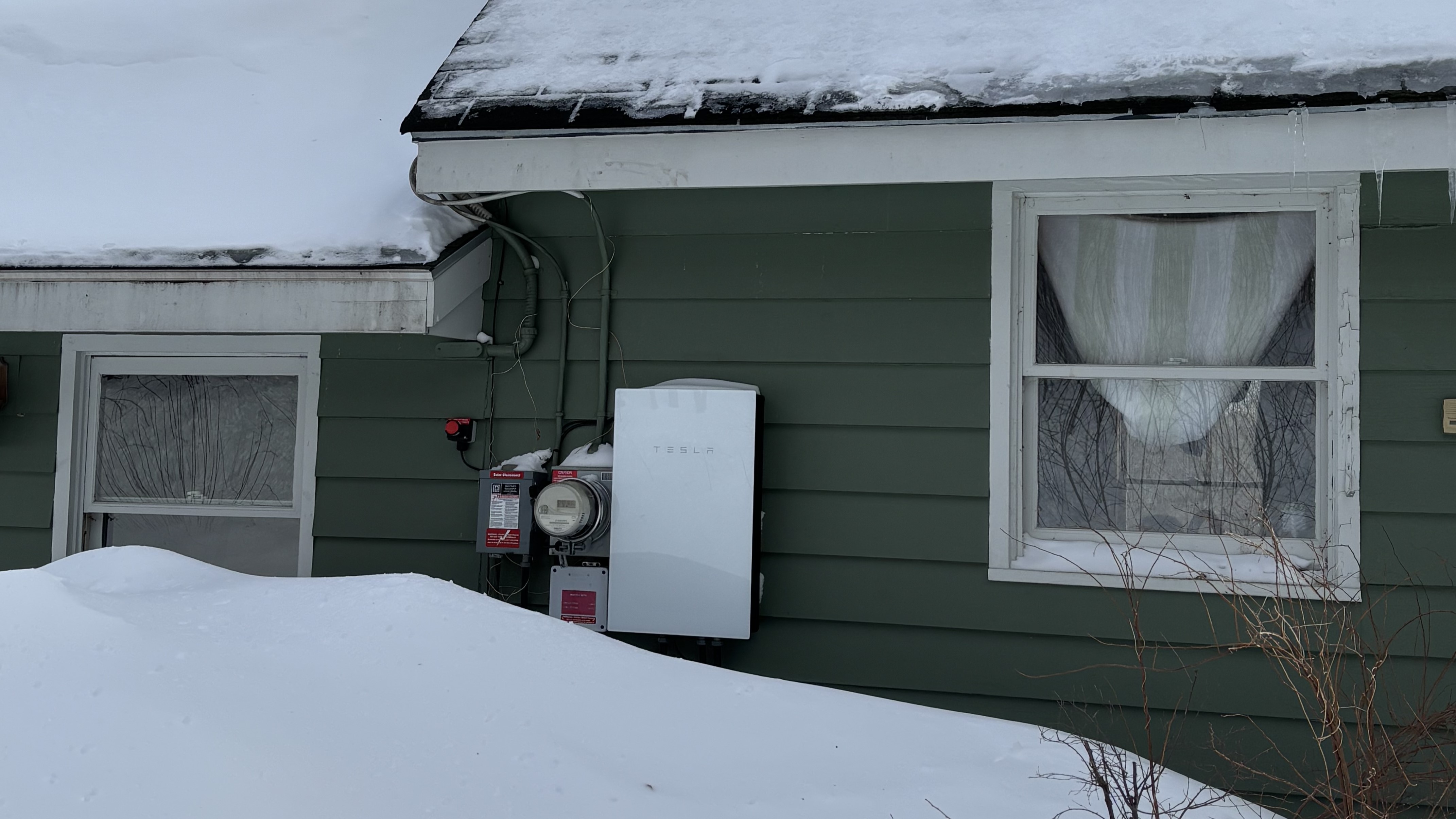

Forget EVs! Tesla wants to become a power company

While Tesla's established itself as a global automaker that specializes in making EVs, the company's actions in the last few years show bigger ambitions in becoming a power company. Its Powerwall rechargeable home battery system allows homeowners to take the power acquired by solar panels and store it for later use.

Through Virtual Power Plants (VPPs), Tesla's has a revenue stream where it could sell energy back to the grid during peak demand. Through these networks, Tesla has created a high-margin revenue stream by selling stored energy back to the grid during peak demand.

Car subscriptions are nothing new, but Tesla’s latest price hike is a genuine shock

I've already explained the outrage some people have about Tesla's move to charge $99/month to acquire the full power Autopilot in its EVs — something that was previously available for free. However, this switch to a subscription model isn't anything new. In fact, other car makers have been doing it.

The difference, though, boils down to the cost for this feature. I've tested General Motors' equivalent feature called Super Cruise Control. It works really well in EVs like the Cadillac Lyriq-V and Chevrolet Tahoe, allowing vehicles equipped with it to overpass slower cars all on their own. This feature is free to use for 3 years, which then costs $39.99 per month.

Tesla's asking $99 for its equivalent service and that's the bigger shock in all of the news.

More EVs embrace Tesla's NACS charging port — and it's a big deal

One of the most common concerns I hear from prospective EV buyers revolves around 'range anxiety' and where they will charge on the road. While I always recommend charging at home via Level 1 or Level 2, the fear of being stranded during a trip remains a significant barrier.

Interestingly, that barrier is vanishing as more EVs than ever now come equipped with native access to the Tesla Supercharger network. This isn't just about using bulky adapters. I'm referring to many new models that now ship with a factory-installed NACS (North American Charging Standard) port.

With vehicles like the Rivian R1S, Subaru Solterra, and Hyundai Ioniq 9 adopting this port natively, drivers gain seamless access to thousands of reliable chargers nationwide — a move that fundamentally changes the math for anyone on the fence about going electric.

Will the slate be cleaned later this year?

Affordable EVs aren't known to be high-margin drivers, yet they are the ones with the most mass appeal. Even though Tesla's Model 3 has reigned supreme in this category for years, the slate may finally be cleaned later this year.

I'm closely watching the Jeff Bezos-backed Slate Auto as it prepares to ramp production of the Slate Truck, a radically spartan, two-passenger EV with a 150-mile range at a price around the mid-$20,000 range. To achieve this, the company strips away nearly every modern convenience, featuring manual windows and a dashboard lacks a touchscreen entirely.

While these seem like major compromises, the attraction of a mid-$20,000 sticker price is undeniable. It will be interesting to see how Tesla responds to this disruption.

Rivian R2 could be the bigger threat for the Model Y — and Tesla should be worried

The Model Y sits at the heart of Tesla's lineup, offering a practical crossover SUV that's ideal for families thanks to its sleek tech, zippy performance, and competitive sub-$40,000 starting price. However, the road ahead looks increasingly difficult with the arrival of the Rivian R2 later this year.

Rivian’s mid-size SUV appears to inherit the best features of the larger R1S, including an advanced autonomy suite. This system has already proven its capability in reacting to dynamic traffic conditions, and with the R2’s new sensor stack, it may finally offer the 'hands-free' consistency that Tesla owners have been craving.

Tesla says it will wind down Model S and X production in the next quarter

Elon Musk announced that the company will be winding down production of its Model S and Model X vehicles next quarter, choosing instead to focus on autonomous platforms like its new Robotaxi service.

Musk says that Optimus 3 is "going to be a very capable robot"

Tesla's humanoid robot, the Optimus 3, is said to be unveiled in the next few months. It can learn by observing human behavior, instead of having to program it to perform certain tasks. "It's going to be a very capable robot," explains Elon Musk during Tesla's Q4 2025 earnings call.

The future is autonomous, not more consumer EVs

Tesla is doubling down on its autonomy efforts, operating under the belief that general transportation will be better served by autonomous platforms than traditional human-driven ones. This strategic pivot explains why the company is winding down production of legacy vehicles like the Model S and X in favor of the Cybercab.

As a purpose-built, driverless vehicle, the Cybercab is intended to play a central role in Tesla's vision of a high-margin, autonomous future.

Musk says that the Roadster will debut this April

Ironically, Elon Musk announced that Tesla plans to debut the next-generation Roadster in April. "It’s going to be something out of this world," Musk remarked.

It's a bold claim, especially considering the irony of Tesla’s primary narrative throughout its Q4 2025 earnings call by prioritizing autonomous driving and the Robotaxi.

"We will transition the Cybertruck line to just a fully autonomous line"

Tesla intends to pivot the Cybertruck from a personal vehicle into a primary autonomous platform, integrating it into the same operational ecosystem as its Robotaxi network. "We will transition the Cybertruck line to just a fully autonomous line," explained Musk while answering an investor question.

By transitioning its production lines to a fully autonomous focus, the company aims to transform the truck into an autonomous transport and logistics service. This shift reflects Tesla's broader strategy to leverage its AI software for future monetization opportunities across its entire fleet.

Margins stabilize, thanks to growth in Energy Generation and Storage

Tesla's gross margin climbed to 20.1%. That's important because it shows a nearly four-percentage-point increase year-over-year. Much of this is due to its Energy Generation and Storage division, which reached record profitability with a record $1.1 billion in quarterly gross profit — marking its fifth consecutive record quarter.