All eyes are on Tesla (TSLA) as the electric-vehicle leader reported earnings on Wednesday after the bell.

The shares on Thursday opened 8% lower, bounced slightly, then took out the session low. Tesla stock at last check was off 9.5%.

The Austin company reported earnings and revenue results roughly in line with analyst estimates: Revenue grew more than 24% from a year earlier while profit sank 20%.

Tesla’s adjusted automotive margin came under pressure, narrowing to 18.3% in the quarter from 26.8% in first-quarter 2022 and from 22.2% in Q4 2022.

Don't Miss: Buffett's Berkshire Hathaway Is Breaking Out. Here's How to Trade It.

Chief Executive Elon Musk emphasized sales growth over margins on the expectation that a larger fleet size “will be able to generate significant profit through autonomy.”

Wall Street isn't buying it.

Earlier on, Tesla stock enjoyed a roaring rally off the Jan. 6 low — more than doubling from its low near $100. It's been a big winner this year and has helped fuel the stock market higher in 2023. But now, it’s starting to lose momentum.

That said, it's not too surprising that Tesla stock is losing momentum. Veteran and upstart automakers like Ford (F), Nio (NIO), Lucid Motors (LCID) and others have lagged this year’s stock-market rally.

Trading Tesla Stock on Earnings

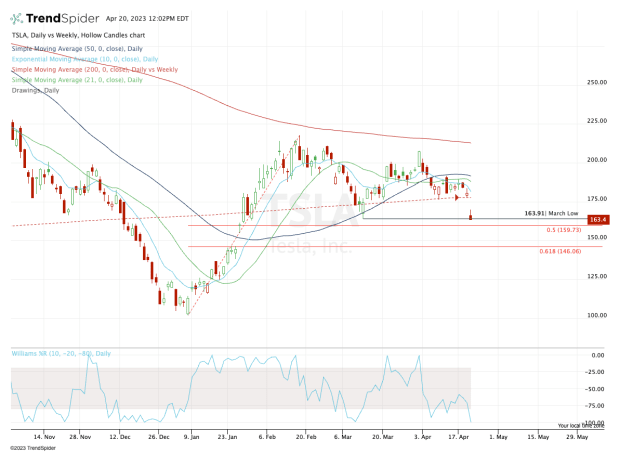

Chart courtesy of TrendSpider.com

Tesla stock is trading near a very key level on the daily chart: the March low of $163.91.

I could be wrong, but I think this $164 area is going to act as a key pivot, and the “keep it simple” traders can take a straightforward approach with it. Above $164 is constructive and below $164 is bearish.

This level is key for several reasons.

First, a break of the March low would trigger a monthly-down rotation, a bearish technical development.

Second, this was a key reversal level last month. Not only did the shares dip down to this level and then spike, the bounce sent Tesla stock back above the 50-day and 200-week moving averages, ensuring that stock closed above both measures.

Don't Miss: Walmart Leads Defensive-Stock Rally. Can It Continue Higher?

Below $164 and failure to regain it opens the door down to the 50% retracement near $159.75, followed by the much more notable zone near $146. That level contains the 61.8% retracement and gap-fill.

On the upside, the bulls want to see a move above today’s high at $169.70, opening the door to a potential gap-fill up at $177.65.

Near that area, the stock will also find its 200-week moving average, which had been key support since late January.

Will it become resistance in the event Tesla rallies that far? We’ll have to see.

Get investment guidance from trusted portfolio managers without the management fees. Sign up for Action Alerts PLUS now.