It’s golf season, which means Topgolf Callaway Brands MODG is in focus for both consumers and investors.

Investors may remember Callaway trading under the ticker symbol ELY. But in March 2021 the company merged with Topgolf, and the ticker on the new company became MODG in order to “reflect the company's leadership position in the Modern Golf ecosystem.”

Don't Miss: Coinbase Stock: Buy the Dip or Avoid After SEC Lawsuit?

While Topgolf Callaway stock has rallied more than 20% from the May low, the stock has struggled badly. The shares saw a three-day 21% drop after the company reported earnings on May 9.

Coming into the report, the stock had been up about 9.5% on the year. Now, even with the recent rebound, Topgolf Callaway stock is down about 1.5% so far in 2023.

From this year’s high, the shares are down about 25%. Does that leave an opportunity for the bulls?

Trading Topgolf Callaway Stock

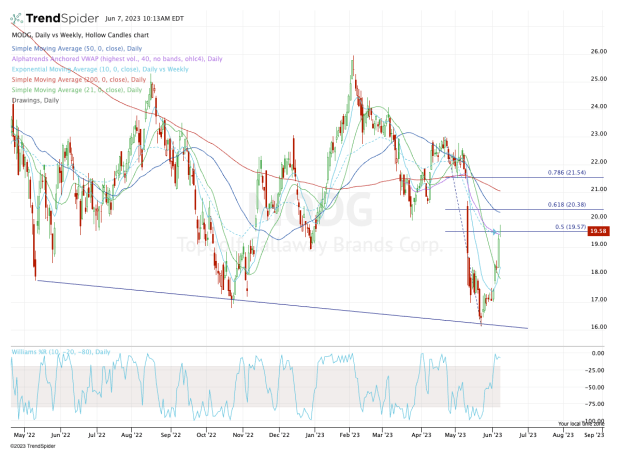

Chart courtesy of TrendSpider.com

Real Money’s Ed Ponsi took a swing at Callaway stock in mid-May and the stock has had nice follow-through since, as it nearly hit $20 on Wednesday June 7.

But it’s running into an area of potential resistance right now. The flip side of that is that if the shares can push through this area, it sets up the potential for more upside.

Regarding resistance, the stock has retraced 50% of the recent decline, from the April high down to the May low.

This measure is not arbitrary to me but it may be to others, who might prefer to measure from the 2023 high in February down to the recent low. I like that measure as well but I am looking at this downside leg — the April high to May low range — as a notable trading range.

Don't Miss: Dell's Dividend Yields 3% and the PE Multiple Is 8.5; Is It a Buy?

Further, the stock is running into the declining 10-week moving average and the daily VWAP measure. Traders who are long from notably lower levels thus may consider raising their stop-losses and/or taking some profits in this zone.

If Topgolf Callaway stock can push higher, the 61.8% retracement and the 50-day moving average come into play near $20.40, while the gap-fill and 78.6% retracement near $21.50 would be the next upside levels to watch.

As for buying a dip, keep an eye on the $18 area. Not only is that level the 50% retracement for the current rally, but it’s also where the 10-day and 21-day moving averages currently come into play.

Get investment guidance from trusted portfolio managers without the management fees. Sign up for Action Alerts PLUS now.