/Tapestry%20Inc%20phone%20and%20website%20by-%20T_Schneider%20via%20Shutterstock.jpg)

With a market cap of $26.6 billion, Tapestry, Inc. (TPR) is a global accessories and lifestyle brand company operating across North America, Greater China, the rest of Asia, and other international markets through its three core brands: Coach, Kate Spade, and Stuart Weitzman. It designs and sells handbags, accessories, footwear, and ready-to-wear products through retail stores, outlets, e-commerce platforms, and shop-in-shop locations worldwide.

Shares of the New York-based company have significantly outperformed the broader market over the past 52 weeks. TPR stock has climbed 90.9% over this time frame, while the broader S&P 500 Index ($SPX) has increased 13.1%. In addition, shares of the company are up 9.7% on a YTD basis, compared to SPX’s marginal rise.

Focusing more closely, shares of the maker of high-end shoes and handbags have also outpaced the State Street Consumer Discretionary Select Sector SPDR ETF’s (XLY) 3.4% return over the past 52 weeks.

Shares of Tapestry surged 7.1% on Feb. 5 after the company reported Q2 2026 results that beat Wall Street expectations, with adjusted EPS of $2.69 and revenue of $2.5 billion. Investor sentiment was further boosted by strong operating performance, including a 620-basis-point expansion in GAAP operating margin, pro forma revenue growth of 18%, and standout 25% growth at the Coach brand. Additionally, Tapestry raised its full-year fiscal 2026 outlook, projecting EPS of $6.40 - $6.45.

For the fiscal year ending in June 2026, analysts expect TPR’s EPS to grow 10.6% year-over-year to $5.64. The company's earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

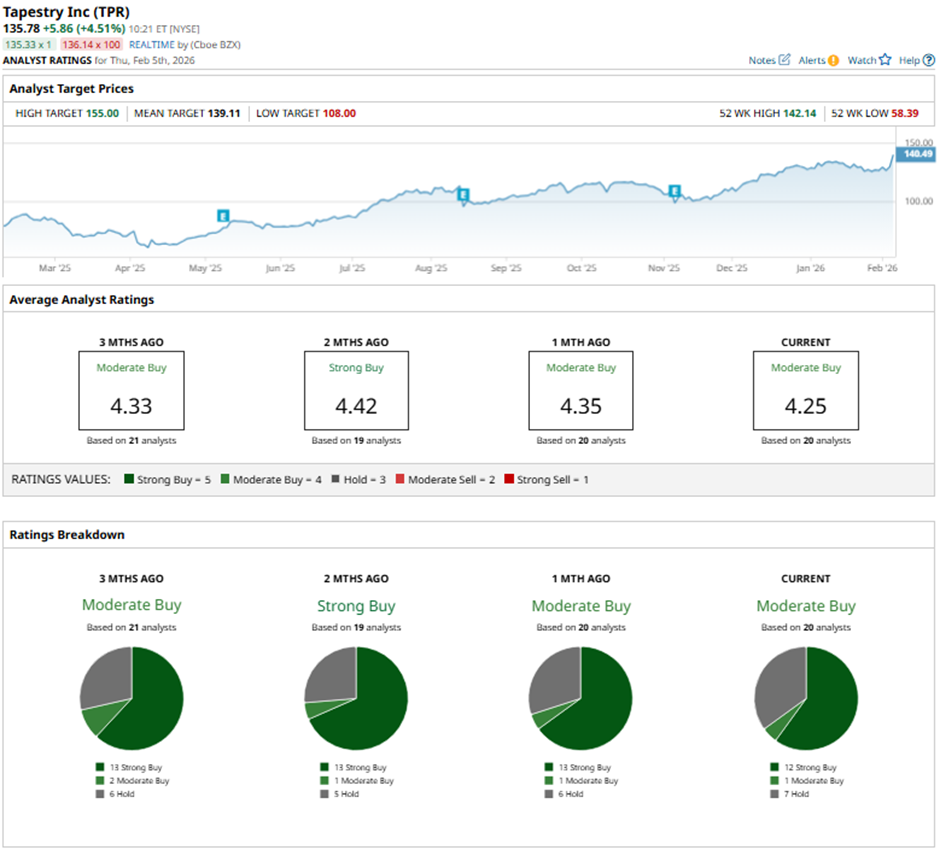

Among the 20 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 12 “Strong Buy” ratings, one “Moderate Buy,” and seven “Holds.”

On Jan. 30, UBS analyst Jay Sole maintained a “Hold” rating on Tapestry and set a price target of $125.

The mean price target of $139.11 represents a premium of 2.5% to TPR's current levels. The Street-high price target of $155 implies a potential upside of 14.2% from the current price levels.