Uber (UBER) has been on fire this year, up more than 50% so far in 2023 and recently touching 52-week highs.

When compared with Lyft (LYFT), Uber has been dominant. While Uber is up big this year, Lyft is down about 25% so far in 2023.

The outperformance is magnified when we zoom out to the one-year measure. Uber stock is up 70% over the past 12 months, while Lyft is down more than 50%.

Don't Miss: Netflix Stock Has Lagged FAANG in 2023. Time to Play Catchup?

It helps that Uber stock rallied almost 30% in a four-session stretch from April 28 to May 3. It rallied 10% ahead of the earnings report, then rallied 16% in two days after reporting better-than-expected results.

Given the stock’s powerful burst, it only makes sense that Uber needs to cool off a bit before resuming its rally. Consolidation can take form through price (via a pullback) or through time (via sideways, choppy trading).

Let’s look at one major buy-the-dip area in Uber stock.

Trading Uber Stock

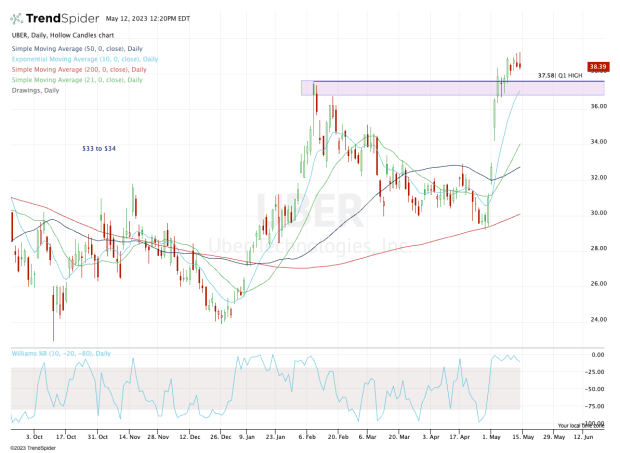

Chart courtesy of TrendSpider.com

Uber stock made a monstrous push off the 200-day moving average. And even as it petered out in the $36 to $37 area in February, this area did not act as resistance amid the current rally.

In fact, Uber stock pushed through this zone and ultimately topped out at $39.23.

In the next few days, the bulls would love to see a pullback to the prior breakout zone of $36 to $37 and the first quarter high of $37.58. In other words, buyers would be looking for this prior resistance level to act as support.

If it happens soon — as in the next few days — there will be the added benefit of the rising 10-day moving average. After such a powerful rally, this measure will act as support if tbulls maintain active control of the stock.

Don't Miss: Disney Stock: Here's When to Buy the Dip Off the Earnings Report

In many cases, pullbacks and dips are incredibly healthy. Not only do they give the stock a chance to rest, but buyers get an opportunity to reload their long positions.

If support doesn’t come into play in this area, a harder fade could put the $34 to $35 area in play.

On the upside, short-term traders would likely trim on any move back into the $38.50 to $39 area, while fishing for a larger move north of $40.

Action Alerts PLUS offers expert portfolio guidance to help you make informed investing decisions. Sign up now.