If you have ever paid any attention to the commercials on television, or the ones that play before videos on YouTube, you would know that it is "love that makes a Subaru, a Subaru."

Though it may sound silly that it is simply 'love' that drives the buying public to its showrooms, it is resoundingly true that many people love their Subarus (FUJHY) for what it does for them.

💰💸 Don’t miss the move: SIGN UP for TheStreet’s FREE Daily newsletter 💰💸

According to new data from Consumer Reports released earlier this month, the constellation brand is at the top spot in the independent product testers' annual list of the year's most reliable automakers, dethroning a years-long reign that saw Toyota and its luxury arm, Lexus, swapping places at the top two spots.

Such an achievement brings buyers to Subaru dealers. Still, with President-elect Donald J. Trump heading to a second term at the Oval Office on January 20, the subject of tariffs has Subaru CEO rethinking his strategy in its largest market.

Trump's tariffs may hinder Subaru's U.S. growth

As Subaru warns of a possible impact from tariffs under an incoming Trump administration, the formidable automaker is looking to intensely boost its U.S. market share next year.

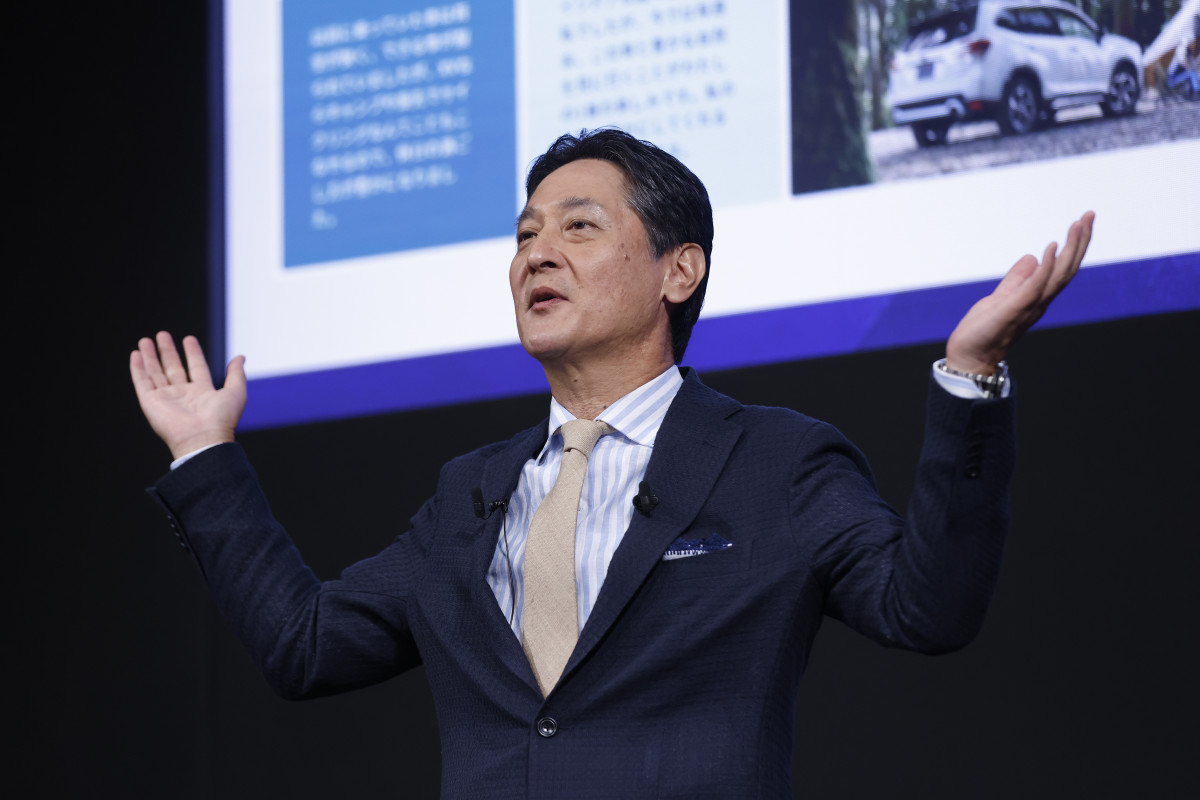

Subaru currently has a 4.2% market share within the greater U.S. auto industry, but its CEO, Atsushi Osaki, told Tokyo reporters that he wants a solid 5% market share. The brand known for its symmetrical all-wheel-drive systems is on pace to sell nearly 670,000 cars in the U.S. this year, a 6% increase from 2023.

“First, we hope to achieve a big target of 5 percent market share in the U.S.,” Osaki said during a Dec. 18 roundtable with reporters at Subaru Corp.’s global headquarters in Tokyo. “If the overall demand is 16 million units, 5% is 800,000 units. So, that is a big target for us.”

Subaru's reliance on Japanese production may be a problem

In order to deliver on that ambitious number, Osaki and Subaru are tasked with maneuvering through the uncertain environment of today's auto industry, especially regulations regarding EVs.

As the Chinese domestic auto market moves away from international brands, Subaru's competition is shifting more attention to the American market. Osaki notes that "Japanese, European, and U.S. carmakers are struggling in the Chinese market," resulting in automakers "shifting their focus closer to the U.S."

"[...] we expect competition to remain extremely tough next year," Osaki said.

One hurdle it must tackle is its auto production status, which leaves it vulnerable to potential tariffs — particularly if Trump's impulses affect Japan.

The United States buys a lot of Subarus, so much so that 70% of Subaru's global sales are cars sold in the United States. However, a much more worrying figure is that half of the metal it shifts in the States comes from its factories in Japan.

More Automotive:

- Toyota sales slide in Japan and China—what’s behind the decline?

- Jaguar’s controversial rebrand may have a silver lining after all

- S&P analysts issue stern warning about tariff effect on car buyers

Trump has singled out Mexico, Canada, and China as targets of his new tariff policy, but even as Japanese imports seem unaffected by Trump's policies, Osaki is not taking any chances.

“Tariffs on our exports from Japan have a huge impact on us,” Osaki said. “We are considering possible measures to respond to the proposed tariffs. One of the several options we are considering is to increase production capacity at the Indiana plant in the U.S.”

Subaru's Indiana plant, known internally as Subaru of Indiana Automotive, or SIA, is its sole factory in the States.

Originally built as a joint venture with Izuzu, it currently has an annual capacity of around 360,000 cars. However, the Subaru CEO notes that it can increase that number by adding additional shifts after hours and on the weekends, though he did not say precisely how much more it could squeeze out.

According to data publicly available on the SIA website, over 6,000 associates work on four models at the sprawling Indiana plant: the Subaru Ascent SUV, the Legacy sedan, the Outback station wagon-styled crossover, and select trim levels of the Crosstrek compact crossover. In 2023, the plant produced 298,837 cars and is projected to produce 377,500 vehicles by the end of this year.

Related: Subaru is bidding farewell to a fan-favorite model after 36 years

Subaru's Indiana factory will be getting some breathing room. Earlier this year, the automaker announced that 2025 will be the final model year for the Legacy midsize sedan, citing a shift in customer preferences that prefers crossovers and SUVs over sedans.

"Though the Legacy is the longest-running Subaru model line, its discontinuation reflects market shifts from passenger cars to SUVs and crossovers and Subaru’s transition to electrified and fully electric vehicles," Subaru said in a statement at the time.

In 2026, Osaki plans to bring production of its bestselling Forester crossover SUV to Indiana.

Subaru Corp. is traded on OTC markets as FUJHY and on the Tokyo Stock Exchange under ticker number 7270.

Related: The 10 best investing books (according to stock market pros)