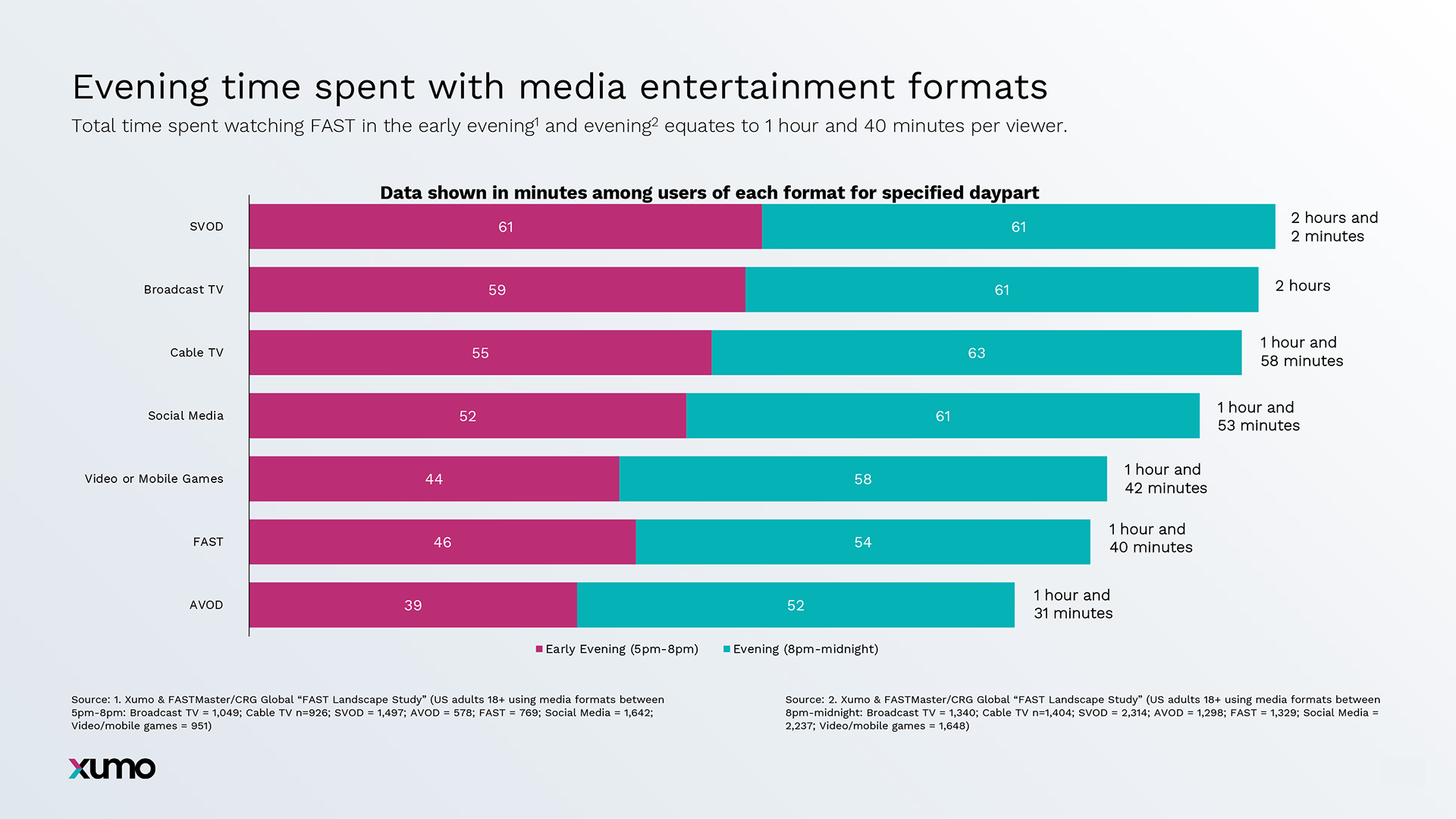

A new report from Xumo shows that FAST channels continue to gain traction in the video landscape with data showing that 33% of viewers now watch free ad supported streaming services in the evening and that the average FAST viewer is spending one hour and 40 minutes watching FAST channels in the evening.

The new report, which was produced by Xumo and FASTMaster Consulting, also reported that percentages of viewers watching FAST channels (33%) was close to the levels of broadcast (34%) and cable TV (35%) and AVOD (32%), but below SVOD (58%) and gaming (41%).

The study also found that FAST viewers were younger than other media, more diverse and generally happy with the viewing options they found on FAST channels.

“The findings of this report underscore the increasingly important role FAST plays in today’s entertainment landscape, dispelling myths and highlighting the diverse, engaged, and growing audience that finds value in our free and easy streaming,” said Stefan Van Engen, vice president, content programming and partnerships, Xumo, which is a joint venture from Charter and Comcast. “As engagement levels during primetime rival other major forms of entertainment, it’s clear that FAST is becoming a part of people’s everyday lives.”

Despite being a relative newcomer to the entertainment landscape, the findings reveal FAST is becoming a primary means of entertainment for today’s consumers and that time spent watching FAST channels is on par with other forms of entertainment. Specifically, the average FAST viewer spends one hour and 40 minutes watching FAST channels in the evening, whereas a gamer typically spends one hour and 42 minutes playing video or mobile games during this same timeframe. Consumers also said they scroll social media for one hour and 53 minutes, while cable TV customers spend one hour and 58 minutes watching cable network programming.

“There are many myths about FAST which are often bandied about by external onlookers, such as FAST viewers watch because they have no alternatives or they are a less desirable consumer for advertisers,” said Gavin Bridge, chief analyst, FASTMaster Consulting. “I am very happy that Xumo has sought to address this via research into who watches FAST, dispelling false narratives with facts and illustrating why FAST continues to grow and needs to be part of any marketer’s toolkit to maximize reach.”

The study also found that Pay TV customers watch more FAST than cord-cutters or cord-nevers. Nearly half (47%) of consumers that subscribe to a pay-TV service say they also regularly watch FAST. In comparison, 46% of cord-cutters report being regular viewers of FAST, while only 35% of cord-nevers say they do.

FAST viewers also trend younger and more diverse. While 46% of the U.S. adult population is between the ages of 18 and 44 according to the U.S. census, 58% of FAST viewers fall within that range. Additionally, Black viewers represent 20% of FAST’s audience, compared to 14% of the U.S. population. Similarly, 23% of FAST viewers have Latino origins, compared to 19% nationally.

The study also found that FAST viewers over-index on news, movies and crime TV. Together, these genres represent 58% of total viewing hours on Xumo Play, but only account for 11% of total channels.

Viewers had generally positive views of the medium. Nearly 70% of FAST users say they can always find something to watch on free streaming channels and more than half of FAST users say it is one of their favorite forms of entertainment.

The data in this report is from a market research project Xumo commissioned with FASTMaster Consulting, which collected responses from 4,000 U.S. adults among varied age, gender and ethnicity groups between the third quarter of 2023 to the first quarter of 2024.

The full report is available here.