The stock market is trading lower midday Monday, down from last week's new high.

The S&P 500 slipped 0.36%, while the tech-heavy Nasdaq Composite traded slightly below flat, down 0.06%. The Dow Jones Industrial Average lost 0.85%. The Russell 2000 Index fell 1.44%.

S&P 500 big stock movers today

Five S&P 500 stocks making big midday moves are:

- Kenvue KVUE +5.1%

- NVIDIA (NVDA) +3.2%

- Boeing (BA) +2.7%

- Super Micro Computer (SMCI) +2.6%

- Paycom Software (PAYC) +2.2%

The worst-performing five S&P 500 stocks with the largest midday drop are:

- Monolithic Power Systems (MPWR) -5.1%

- Builders FirstSource (BLDR) -4.9%

- Cigna Group (CI) -4.4%

- Target (TGT) -4.1%

- Lennar (LEN) -3.8%

Stocks also worth noting include:

Kenvue surges after activist investor takes stake

Kenvue jumped more than 5% after it was revealed activist investor Starboard Value has acquired a significant stake, the Wall Street Journal reported.

Starboard is pushing for improvements in Kenvue's share price, although specific details of their stake and plans have not been disclosed. Starboard's CEO, Jeff Smith, is expected to reveal more at an upcoming investor summit.

Kenvue is a consumer products company that spun off from Johnson & Johnson in 2023. The split from Johnson & Johnson (JNJ) was part of J&J's strategy to streamline its operations and concentrate on its pharmaceutical and medical device divisions.

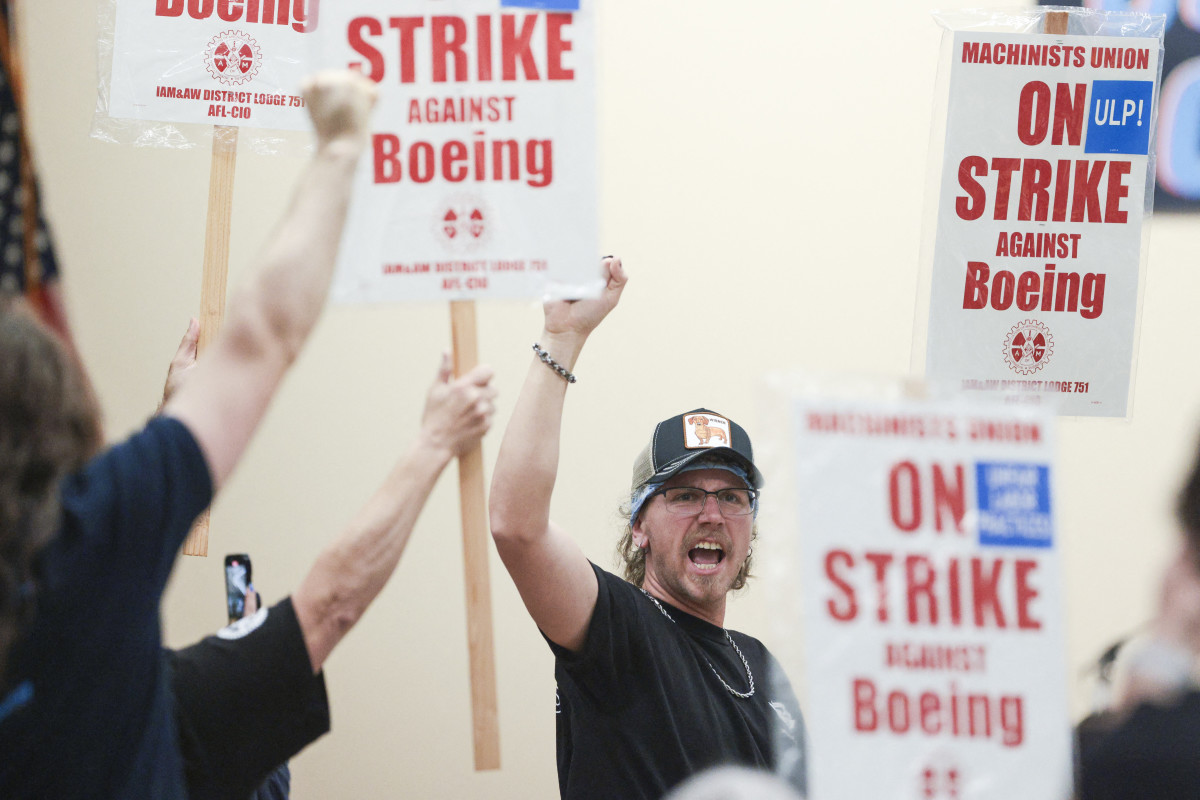

Boeing jumps on potential strike-ending contract proposal

Boeing added 3% after the company and its machinists’ union reviewed a new contract proposal that could end a month-long strike.

The updated offer includes a 35% wage increase over four years, a $7,000 signing bonus, guaranteed payouts in an annual bonus program, and higher 401(k) contributions.

The strike began on Sept. 13 after machinists rejected a previous deal offering a 25% wage increase. Boeing later made an improved offer with a 30% wage increase, which was also declined.

Boeing announced earlier this month that it would reduce its global workforce by 17,000 jobs, equivalent to 10% of its total staff. The company also expects to report a loss of $9.97 a share for the third quarter.

ASML falls on analyst update

ASML stock slipped 1.6% after Bernstein lowered its price target to $815 from $1,052 while keeping an outperform rating, thefly.com reported.

ASML posted a weaker-than-expected 2025 forecast last week. In a research note, the analyst cited ASML’s revised 2025 growth forecast, now set at 16%, down from the previous estimate of 25%.

More AI Stocks:

- Analysts update Meta stock price target with Q3 earnings in focus

- Veteran trader who called Palantir rally unveils new price target

- Open AI is burning cash (and losing billions!)

“While there continue to be strong developments and upside potential in AI, other market segments are taking longer to recover. It now appears the recovery is more gradual than previously expected,” ASML CEO Christophe Fouquet said.

Despite this adjustment, Bernstein noted that investors are still uncertain whether the cut is sufficient to position the company for a strong recovery next year. However, Bernstein believes the stock's recent selloff may be overdone.

Related: Veteran fund manager sees world of pain coming for stocks