Five things you need to know before the market opens on Thursday August 10:

1. -- Stock Futures Higher With Inflation Data In Focus

U.S. equity futures moved firmly higher Thursday, while Treasury bond yields rose and the dollar retreated against its global peers as investors looked to a key inflation reading prior to the start of trading.

Stocks extended their recent run of declines yesterday, falling for six of the past seven trading sessions in August, as risk appetite remains challenged by weakening growth prospects in China, a still-hawkish Federal Reserve and the ongoing spike in domestic mortgage rates.

An overnight move by the Biden Administration to curb U.S. tech investments in China also has the potential to intensify trade and diplomatic relations between Washington and Beijing just as the latter is looking to kick-start its post-Covid recovery with renewed stimulus.

In the U.S., a well-received auction of $38 billion in new 10-year notes, which drew solid interest from foreign investors and better overall demand when compared to previous sales, eased concerns for any lingering impact linked to the Fitch Ratings downgrade of U.S. debt or the chances of a renewed inflation spike heading into the autumn months.

Thursday's July inflation report, due at 8:30 am Eastern time, is expected two show a second consecutive monthly slowdown in core consumer price pressures, a move that could allow the Federal Reserve to signal an ending to its rate-hiking cycle.

Benchmark 10-year note yields were marked modestly higher, at 4.012%, in overnight trading ahead of a $23 billion sale of 30-year bonds later in the session, while the U.S. dollar index was marked 0.3% lower against a basket of its global peers at 102.198.

WTI crude prices, which hit a 9-month high in overnight trading, were last marked 11 cents lower at $84.28 per barrel following Energy Department data showing a 5.9 million barrel increase in domestic crude stocks and the fastest rate of production -- 12.6 million barrel per day -- since March of 2020.

Heading into the start of the trading day on Wall Street, futures contracts tied to the S&P 500 are indicating a 25 point opening bell gain while those linked to the Dow Jones Industrial Average are priced for a 183 point advance. Futures tied to the tech-focused Nasdaq futures were up 107 points.

In Europe, the region-wide Stoxx 600 was marked 0.32% higher in early Frankfurt trading while Britain's FTSE 100 slipped 0.05% lower in London

Overnight in Asia, the MSCI ex-Japan index was marked 0.05% lower into the close of trading, lead by declines in South Korea and a flat session in Hong Kong, while the Nikkei 225 closed 0.84% higher at 32,473.65 points.

2. -- Core Inflation Easing Should Offset Headline CPI Gain

The Bureau of Labor Statistics will publish its July inflation reading prior to the start of trading Thursday, with investors looking for a possible slowdown in core consumer price pressures that could cement the case for an end to the Federal Reserve's rate hiking cycle.

Headline inflation for the month of July likely bumped modestly higher from its June reading, to an annualized rate of 3.3%, owing largely to base effects and a jump in global crude prices. So-called core inflation, which strips out volatile components like food and energy and its closely-tracked by the Fed, is expected to have risen 0.2% on the month and 4.8% on the year, levels that economists suggest are consistent with the central bank's 2% inflation target should their downward trend continue.

Used car prices are likely to provide a big drag downward in the July core inflation reading, with support from a downtick in rents and longer-term leases. Travel and lodging remain wildcards to the upside.

"Investors should expect a modest uptick in the annual inflation rate due to base effects but the uptick should not alter the Fed’s inclinations to pause unless we see something more dramatic," said Jeffrey Roach, chief economist for LPL Financial in Charlotte, North Carolina. "The Fed should be able to hold rates steady as the economy exhibits a bit more softness in economic growth."

3. -- Disney Shares Higher Following Mixed Q3 Earnings, Planned Price Hikes

Walt Disney (DIS) -) shares moved higher in pre-market trading after the media and entertainment group topped Street forecasts for its third quarter earnings and said it was on pace to exceed its $5.5 billion cost-cutting target.

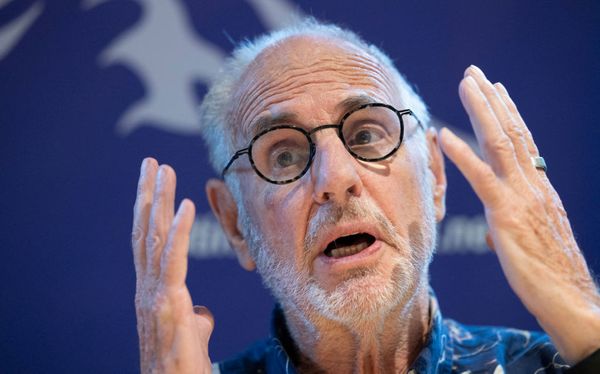

Disney posted adjusted earnings of $1.03 per share, well ahead of Street estimates, but fell light of revenue with a top line of $22.33 billion. Losses in its streaming group narrowed, however, to around $512 million and CEO Bog Iger reiterated that he sees the division turning a profit during the next fiscal year, which begins in October.

Iger also said Disney would launch an ad-supported service, priced at €5.99 ($6.58) and £4.99 per month in Europe and the U.K. respectively, and C$7.99 in Canada, on November 1. He also unveiled plans for a 27% price hike for the U.S. ad-free version of Disney+, and a 20% increase for the ad-free version of Hulu.

Disney shares were marked 1.5% higher in pre-market trading to indicate an opening bell price of $88.80 each.

4. -- Nvidia Sees Big AI Chip Orders From China

Nvidia Corp. (NVDA) -) shares edged lower in pre-market trading following reports that the tech group has booked around $5 billion worth of orders for its AI and gaming chips

London's Financial Times reported Thursday that China-based companies ByteDance, the owner of the popular TikTok app, Tencent and e-commerce giant Alibaba has orders around $1 billion worth of Nvidia's A800 processors, which are key components in artificial intelligence systems.

Another $4 billion in orders, slated for delivery in 2024, have also been booked for Nvida's graphics chips, the FT said.

The report, however, falls alongside President Joe Biden's Executive Order prohibiting some U.S. investments, in China, including in AI-related technologies, raising the specter of a counter-move by Beijing that could restrict U.S.-made imports.

Nvidia shares were marked 0.36% lower in pre-market trading to indicate an opening bell price of $424.02 each.

5. -- Novo Nordisk Warns Of Wegovy Supply Constraints In U.S. Markets

Novo Nordisk (NVO) -) shares moved lower in pre-market trading after the drugmaker said supplies of its blockbuster weight loss treatment Wegovy would remain restricted in the U.S. as it struggles to meet soaring demand.

Denmark-based Novo Nordisk said demand for the drug, which was showed to reduce incidents of serious heart problems as well as treat patients suffering from obesity, would remain well ahead of its ability to produce "for the foreseeable future", according to comments from CEO Lars Fruergaard Jorgensen reported by Retuers.

Novo Nordisk, which also makes the injectable weight-loss treatment Ozempic, raised its 2023 profit forecast for the second time this year Thursday, data yesterday showing the success of Wegovy in reducing heart risk, and sees operating earnings growth of between 31% and 37% when compared to 2022 levels, a 7 percentage point boost from its prior estimate.

Novo Nordisk shares were marked 1.7% lower in pre-market trading to indicate an opening bell price of $184.38 each.