Shares of Kohl’s Corporation (NYSE:KSS) are trading much lower on Tuesday. There is a good chance a new downtrend is forming.

This is why our team of technical analysts has made it our Stock of the Day.

There is a lot of bearish news coming from the company. It missed earnings. It also announced that CEO Tom Kingsbury will step down in January.

Kohl's reported Q3 earnings of 20 cents per share. This was well below the 28 cents the Street was looking for.

The revenue was a miss as well. Sales declined 8.8% over the past year. The $3.507 billion was below estimates of $3.638 billion.

Even more concerning to some analysts was the decline in operating margin. It was down 120 basis points to 2.7%.

Operating margin is an important metric. It is the number of cents a company profits on each dollar of sales after all costs are considered.

If operating margins are expanding, it means the company is becoming more profitable. If the margins are contracting, like they are for Kohl's, it means the company is becoming less efficient and profitable.

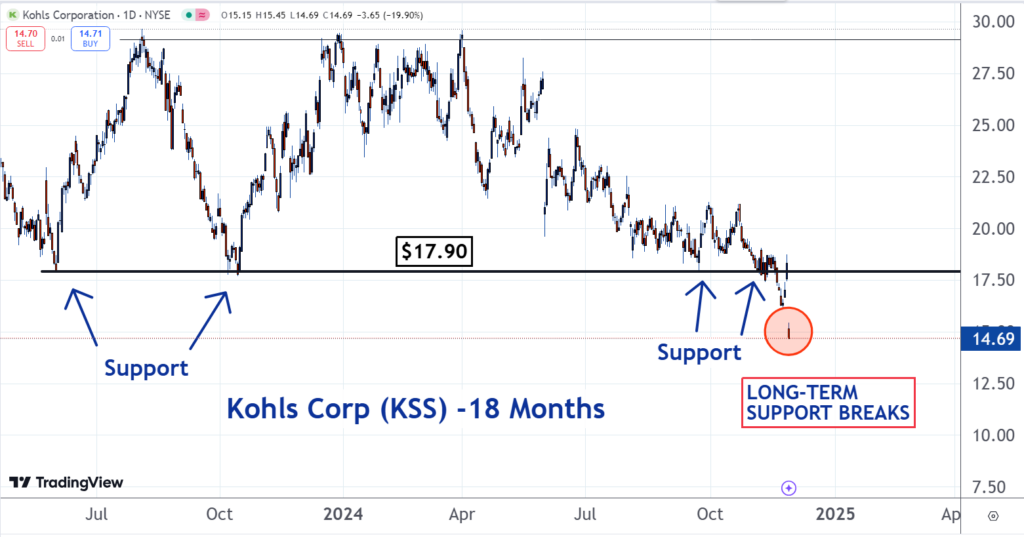

As you can see on the chart, the technical picture for Kohl's looks bearish as well. The stock has broken long-term support around the important $17.90 level.

Sometimes, support levels can remain intact for a long period of time. This is called ‘market memory'. $17.90 first became support for Kohl's in May 2023.

Support is a large concentration or group of investors and traders who are looking to pay the same, or close to the same price for new shares. This is why market selloffs tend to pause or end when they fall to support. There is enough demand to absorb all of the supply.

When support breaks, as it has with Kohl's, it illustrates an important dynamic.

It means that the large group of buyers who created the support are out of the market. They have either finished or canceled their orders.

With this large amount of demand out of the way, sellers will be forced to be aggressive to attract buyers. They will need to push the price lower and this could force the stock into a new downtrend.

It may be about to happen with Kohl's.

Read Next:

Image: Shutterstock