Stocks finished lower Friday, following a record high close for the S&P 500 in the previous session, as investors reacted to a hotter-than-expected producer price inflation report and a surprise slump in housing activity.

The Dow Jones Industrial Average finished down 145 points, or 0.37%, to 38,627, while the S&P 500 lost 0.48% to 5,005, and the tech-heavy Nasdaq slipped 0.82% to 15,775.

The S&P 500 ended the week lower by 0.42%, according to CNBC, while the Dow slipped 0.11%. The Nasdaq tumbled 1.34%.

Producer price inflation ticked firmly higher last month, Commerce Department data indicated Friday, potentially confirming the hotter-than-expected CPI report published earlier this week.

“The upside surprise in the January PPI report echoes the month’s CPI report,” said Bill Adams, chief economist for Comerica Bank. “Labor-intensive service prices rose sharply at the turn of the year as businesses--and not-for-profit healthcare providers--passed on higher operating costs to their customers.”

Adams said that the downside surprise from the housing indicators in January looks mostly weather-driven, like the month’s weak retail sales and industrial production.

While the Fed is likely to look through the weakness in January’s activity, it will be concerned by the January CPI and PPI reports, he said.

"Momentum has built up in inflation over the last few years, and persists in many corners of the economy despite lower prices for gasoline, basic foodstuffs, and durable goods," Adams said. "January’s inflation data will reinforce the Fed’s inclination to lower interest rates only gradually in 2024."

Updated at 1:13 PM EST

Daly dose

San Francisco Fed President Mary Daly indicated the sees a good chance of three rate cuts this year, a view that is largely in-line with the central bank's December projections, but said more patience will be needed in ensuring inflation returns to its 2% target.

"We will need to resist the temptation to act quickly when patience is needed and be prepared to respond agilely as the economy evolves," Daly said in a speech to the National Association for Business Economics in Washington.

Mary Daly, president of @sffed delivering keynote speech for @nabe_econ policy conference in Washington DC. pic.twitter.com/NC8E262DIR

— Karen Nye (@KNyeEcon) February 16, 2024

Updated at 12:19 PM EST

Still the only game in town

Stocks are treading water into the mid-day session, with the S&P 500 clawing back from earlier losses tied to the January PPI report, and last marked just 1 point lower at 5,029.26 points.

That essentially puts it ahead of levels tagged prior to Tuesday's CPI report and keeps the benchmark firmly over the 5,000 point mark.

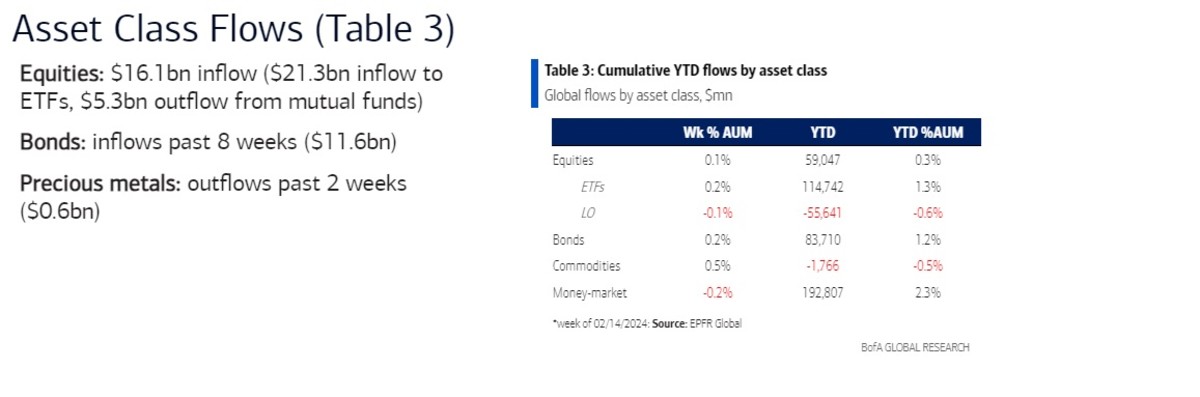

Interestingly, even amid the all-time highs and the (possibly) accelerating inflation pressures, Bank of America's weekly 'Flow Show' report indicates big investors are still plowing billions into stocks.

Updated at 11:32 AM EST

The summer of Fed content

Atlanta Fed President Raphael Bostic is doubling-down on his hawkish comments from last night, telling CNBC he still feels the economy may only need two rate cuts this year, with the first cut coming later in the summer.

Rate traders, who just a month ago put the odds of a March rate cut at 63.1%, have loped those odds down to just 10.5%, according to the CME Group's FedWatch tool.

The best odds for the first rate cut of the year are no better than a coin-toss in June, with new projections from Fed due in March that could push those bets further into the summer and possibly beyond.

Updated at 10:16 AM EST

Confident, kind of ...

The University of Michigan's benchmark survey of consumer sentiment, which is closely-tracked by Wall Street, ticked modestly upwards from January levels to 79.6 points this month, notching the highest levels since late 2021.

How that dovetails with an early February CNN poll showing nearly half of Americans (48%) "believe the economy remains in a downturn" remains to be seen, particularly now that inflation metrics are starting to run hot again.

*MICHIGAN PRELIM. FEB. CONSUMER SENTIMENT ROSE TO 79.6; EST. 80

— Christian Fromhertz 🇺🇸 (@cfromhertz) February 16, 2024

*MICHIGAN YEAR-AHEAD INFLATION EXPECTATIONS ROSE TO 3.0% VS 2.9% pic.twitter.com/cuxT4YtHkA

Updated at 9:08 AM EST

Nike cuts

Nike (NKE) shares moved lower in early trading, with declines outpacing the broader market, after the sportswear giant unveiled plans to cut around 2% of its global workforce in the face of fading consumer demand.

Nike, which outlined $2 billion in cost cuts late last year, will likely lay off around 1,600 people, with the Wall Street Journal reporting the first notices are likely to come as early as today.

Nike shares were last marked 1.25% lower at $104.79 each.

$NKE

— Mukund Mohan (@mukund) February 16, 2024

Oppenheimer downgrades Nike to perform from outperform Oppenheimer said it’s concerned the next several quarters for Nike look “sluggish.” “That said, as we re-examine closely the nearer-term outlook for NKE, we come away increasingly concerned that over the next several…

Updated at 8:39 AM EST

Hot factories

Producer price inflation ticked firmly higher last month, Commerce Department data indicated Friday, potentially confirming the hotter-than-expected CPI report published earlier this week.

Heading factory gate inflation rose 0.3% on the month, and 0.9% on the year, the report noted, with both tallies topping Street forecasts of 0.1% and 0.6% respectively.

Both the CPI report, as well as today's PPI report, will feed directly into the Fed's preferred inflation gauge, the PCE Price Index, which is expected in two week's time.

Stocks turned lower as a result, with futures tied to the S&P 500 giving back earlier gains to indicate an opening bell decline of around 7 points, with the Dow called 112 points lower.

Like the CPI data, US PPI #inflation just came in hotter than expected.

— Mohamed A. El-Erian (@elerianm) February 16, 2024

Month-on-month. the PPI rose by 0.3% in January (0.5% for core), above the consensus forecast of 0.1%, as the 0.6% increase in services offset the 0.2% fall in goods.

On an annual basis, headline and core PPI…

Stock Market Today

Stock markets worldwide have largely recovered from losses earlier in the week tied to the hotter-than-expected January consumer-price-index report, which forced a reset of Federal Reserve interest-rate-cut forecasts and a major pullback in U.S. equities.

Data Thursday, however, showed a surprise slump in January retail sales, offset by more resilient readings from the labor market. Those reports suggest the economy is holding its recent gains but isn't overheating to the point where it would trigger a pickup in inflation pressures.

That's enabled stocks to both recover their losses and focus firmly on both the ongoing surge in Magnificent 7 tech names and the stronger-than-expected fourth-quarter-earnings season.

Late Thursday comments from Atlanta Fed President Raphael Bostic, however, reminded investors that market forecasts for near-term rate cuts are still not aligned with the central bank's.

“My expectation is that the rate of inflation will continue to decline, but more slowly than the pace implied by where the markets signal monetary policy should be,” Bostic told an event in New York, adding he us "not yet comfortable that inflation is inexorably declining to our 2% objective."

That could put today's reading of producer-price inflation for January, due at 8:30 am Eastern time, in sharp focus as investors look for either confirmation that price pressures are accelerating or evidence that the cooling into last year will continue into the spring.

Benchmark 10-year Treasury note yields moved higher in overnight trading following Bostic's comments and were last changing hands at 4.267%, while 2-year notes were pegged at 4.608%.

The U.S. dollar index, meanwhile, was little changed against a basket of its global currency peers at 104.287 heading into the start of the New York trading session.

On Wall Street, futures tied to the S&P 500 suggest a 9 point opening-bell gain while those linked to the Dow Jones Industrial Average are priced for a 25 point decline.

The tech-focused Nasdaq, meanwhile, is set for a 90 point advance thanks in part to a big premarket gain for chip-design-equipment maker Applied Materials (AMAT) , which posted a better-than-expected fiscal-first-quarter-earnings update late Thursday.

In overseas markets, Britain's FTSE 100 leaped more than 1% in early London trading following a surprise reading for January retail sales, which suggested the economy could emerge from recession quickly. The regionwide Stoxx 600 rose 0.58% in Frankfurt and is on pace to end the week at a two-year high.

Overnight in Asia, the Nikkei 225 hit a 1990 high on the back of dovish comments on low rates and accommodating conditions from Bank of Japan Gov. Kazuo Ueda, with the index closing at 38,487.24 points.

Related: Veteran fund manager picks favorite stocks for 2024