Stocks ended mixed on Tuesday, as investors retreated to safe-haven assets amid a worrying escalation of rhetoric and positioning in the war between Russia and Ukraine.

The Dow Jones Industrial Average lost 120.66, or 0.28%, to finish the day at 43,268.94, while the S&P 500 gained 0.40% to close at 5,916.98 and the tech-heavy Nasdaq advanced 1.04% to end the session at 18,987.47.

Nvidia shares ended up 4.9% one day before the AI chipmaker is scheduled to report quarterly earnings and Walmart climbed 3% following its Q3 earnings beat-and-raise.

Meanwhile, Ukraine hit a Russian arsenal with US-made ATACMS missiles that it fired across the border for the first time, CNN reported.

The attack marks the first time Ukraine has used the longer-range American weapons to strike targets deep inside Russia.

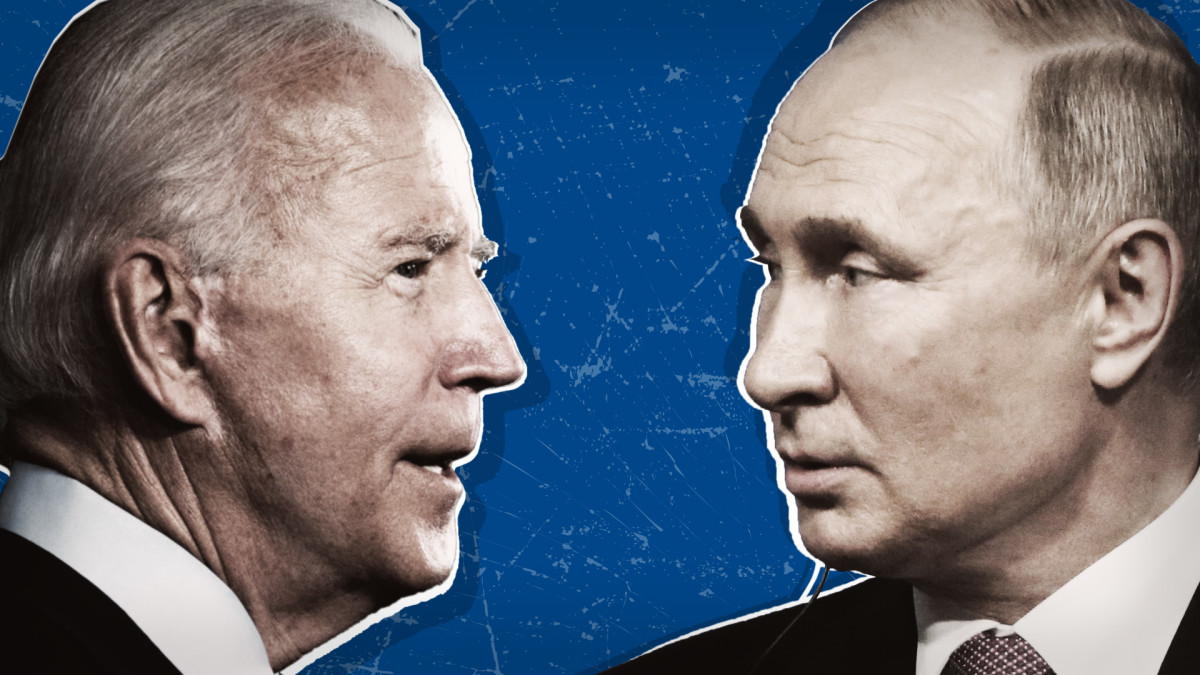

Russia President Vladimir Putin had approved a so-called nuclear doctrine in response to reports that U.S. President Joe Biden has allowed Ukraine to use American-made missiles to launch strikes on Russia-based targets.

U.S. State Department spokesman Matthew Miller said that since the war began, Russia has sought to “coerce and intimidate both Ukraine and other countries around the world through irresponsible nuclear rhetoric and behavior.”

He added that Washington has not seen any reason “to adjust our own nuclear posture, but we will continue to call on Russia to stop bellicose and irresponsible rhetoric.”

Updated at 11:36 AM EST

Edging green

U.S. stocks are paring earlier declines heading into the mid-day session, with the mid-cap Russell 2000 rising 3 points, or 0.12% and the Nasdaq up 86 points, or 0.46%. The S&P 500 benchmark was also last marked in positive territory, up 8 points, or 0.14%.

Walmart is the notable mover, rising 4% to $87.43 each and hitting a fresh all-time high of $88.29 earlier in the session following its Q3 earnings beat-and-raise.

It's roll in keeping consumer inflation in check, however, may prove more valuable over the coming months as the incoming Trump administration, and the President-elect's nominee for Commerce Secretary, Howard Lutnick, plot big changes to the U.S. tariff landscape for early next year.

Related: Walmart issues inflation warning as Trump preps massive tariff hikes

Updated at 10:09 AM EST

Still growing

The Atlanta Fed's GDPNow forecasting tool pegs current quarter growth at around 2.6%, up from its prior forecast of 2.5% but still shy of the 3% pace that was likely tallied over the three months ending in September.

Still, the overall pace, which is largely in-line with headline inflation last month, suggests solid momentum heading into the final months of the year, which could find support from robust consumer spending over the holiday period.

US Atlanta Fed GDPNow Q4: 2.6% (prev 2.5%)https://t.co/GIJHH2ZMsR pic.twitter.com/ONMKgzvmtV

— LiveSquawk (@LiveSquawk) November 19, 2024

Updated at 9:40 AM EST

Red open

The S&P 500 was marked 29 points, or 0.47% while the Nasdaq fell 46 points, or 0.5%.

The Dow was off 320 points while the mid-cap Russell 2000 fell 18 points, or 0.81%.

S&P 500 Opening Bell Heatmap (Nov. 19, 2024)$SPY -0.54%🟥$QQQ -0.51%🟥$DJI -0.77%🟥$IWM -0.80%🟥 pic.twitter.com/swynS4Tvhi

— Wall St Engine (@wallstengine) November 19, 2024

Updated at 8:44 AM EST

Housing stops?

Housing starts slumped lower again in October, Commerce Department data indicated, suggesting the elevated level of mortgage rates and a Federal Reserve keen on patient rate cuts will keep builders on the sidelines into the end of the year.

October starts were down 3.1% to an annual rate of 1311 million units, just shy of Wall Street forecasts, while permits for the building of single-family homes fell 0.5% to an annual rate of 968,000.

Weak res investment. Housing starts are below the level of completions. This means that units under construction will continue to decline for the foreseeable future. In October, units under construction fell 1.9%, and off 12.8% over the last year, weakest pace since 2011. pic.twitter.com/qSu3HExTZZ

— RenMac: Renaissance Macro Research (@RenMacLLC) November 19, 2024

Updated at 7:18 AM EST

Walmart beats

Walmart shares are set to open at a fresh all-time high after the world's biggest retailer posted stronger-than-expected fiscal-third-quarter earnings and boosted its full-year profit outlook.

The group sees full-year earnings in the range of $2.42 to $2.47 a share, a 4-cent improvement from the lower end of its prior forecast, with net sales rising as much as 5.1% from the same period last year.

Walmart shares were marked 3.75% higher in premarket trading to indicate an opening bell price of $87.18.

Related: Walmart stock sees fresh record high on Q3 earnings, holiday profit outlook

Stock Market Today

Russia President Vladimir Putin approved a so-called nuclear doctrine in response to reports that U.S. President Joe Biden has allowed Ukraine to use American-made missiles to launch strikes on Russia-based targets.

The new Russian doctrine declares that any conventional attack on Russia that is supported by a nuclear power can be considered a joint attack and could be justified with a nuclear response.

“The use of western non-nuclear missiles by Kyiv against Russia, under the new doctrine, could provoke a nuclear response,” said Kremlin spokesman Dmitry Peskov during a press briefing in Moscow.

The potential escalation of the conflict, which is deep into its second year, sent shares in Europe lower, with the Stoxx 600 falling 1% in early Frankfurt trading and Britain's FTSE 100 down 0.4% in London.

JIM WATSON / AFP / Mikhail Svetlov/Getty Images

A flight-to-safety trade also triggered a rally in U.S. Treasury bonds, sending yields on 10-year notes around 8 basis points lower from Monday levels to 4.357% and 2-year notes 9 basis points lower to 4.213%.

The U.S. dollar index, which tracks the greenback against a basket of six global currencies, was marked 0.14% higher at 106.431.

The cautious action looks set to spill over onto Wall Street as well, with futures contracts tied to the S&P 500 suggesting a 20 point opening bell decline for the benchmark and the Dow Jones Industrial Average called 240 points lower.

Related: Top Wall Street analyst unveils unexpected S&P 500 price target for 2025

The tech-focused Nasdaq, meanwhile, is priced for a more modest 45-point pullback with Nvidia (NVDA) rising nearly 1% in premarket trading.

Walmart (WMT) shares were also active, rising 1.63% ahead of the retail giant's fiscal-third-quarter earnings prior to the opening bell, as investors looked to a key reading on consumer spending into the holiday period.

More Wall Street Analysts:

- Walmart analysts reset stock price targets ahead of Black Friday

- Analysts revamp Cisco stock price targets after earnings

- Analysts revisit Applied Materials stock price targets after Q4 earnings

In overseas markets, stocks were broadly positive following on from last night's solid close on Wall Street, and prior to the news out of Russia. The regional MSCI ex-Japan benchmark rose 0.67% into the close of trading and the Nikkei 225 closed 0.51% higher in Tokyo.

Related: Veteran fund manager sees world of pain coming for stocks