Stocks finished lower Tuesday, as investors continue to track inflation risks ahead of a series of key labor market releases over the coming days.

The Dow Jones Industrial Average tumbled 395 points, or 1%, to 39,170.24, while the S&P 500 slipped 0.72% to 5,205,81, and the tech-heavy Nasdaq dropped 0.95% to 16,240.45.

The 10-year Treasury yield jumped to its highest level since Nov. 28 and oil prices also surged.

The Labor Department's Job Openings and Labor Turnover report for the month of February, better-known as JOLTS, showed 8.756 million unfilled positions, a modest nudge higher from January's 8.748 million that was largely inline with Street forecasts.

The so-called quits rate, meanwhile, held at 2.2%, suggesting ongoing confidence in the job market heading into the spring.

Updated at 12:15 PM EDT

More Mester Patience

Cleveland Fed President Loretta Mester cautioned Tuesday that the patch to bring inflation back to the central bank's 2% target won't be smooth, and needs more evidence of easing price pressures before she's ready to sign-off on near-term rate cuts.

Speaking at a National Association for Business Economics event in Cleveland, Mester said she needs to see "more data to raise my confidence" in terms of slowing inflation

Updated at 11:09 AM EDT

In fair Vernova, where we lay our scene ...

GE Vernova shares jumped higher in early Tuesday trading after the energy business spun-off from conglomerate General Electric (GE) made its debut on the New York Stock Exchange.

GE Vernova, which trades under the ticker symbol GEV, marks the final leg of GE's historic dismantling under CEO Larry Culp, following the listing of GE HealthCare Technologies GEHC on the Nasdaq late last year.

GE's legacy business, now known as GE Aerospace, will continue trading under the original GE ticker and will publish first quarter earnings on April 23.

Opening bell with @GE_Aerospace and @GEVernova! #GEBeginsAgain https://t.co/UysH6vXpoV

— General Electric (@GeneralElectric) April 2, 2024

Updated at 10:12 AM EDT

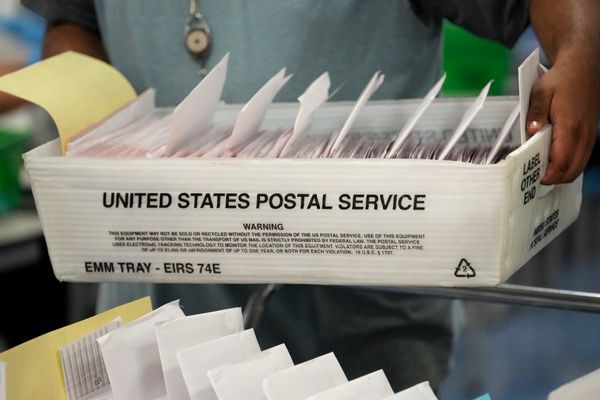

Jolted

The Labor Department's Job Openings and Labor Turnover report for the month of February, better-known as JOLTS, showed 8.756 million unfilled positions, a modest nudge higher from January's 8.748 million that was largely inline with Street forecasts.

The so-called quits rate, meanwhile, held at 2.2%, suggesting ongoing confidence in the job market heading into the spring.

Treasury bond yields extended gains following the data, with 10-year notes rising to 4.381% as June rate cut odds continue to fade. The CME Group's FedWatch now pegs the odds of a move at around 61.7%.

Stocks are also moving lower, with the S&P 500 marked 52 points lower, or 0.99%, while the Dow fell 438 points. The Nasdaq was down 232 points, or 1.42%.

US JOLTS: primary takeaway is that there is 1.4 jobs available for every individual looking for work. The American labor market remains historically tight. I expect a net change in total employment of 215k and a decline in the unemployment rate to 3.8% in Fridays March Jobs… pic.twitter.com/dReqNbE6jq

— Joseph Brusuelas (@joebrusuelas) April 2, 2024

Updated at 10:05 AM EDT

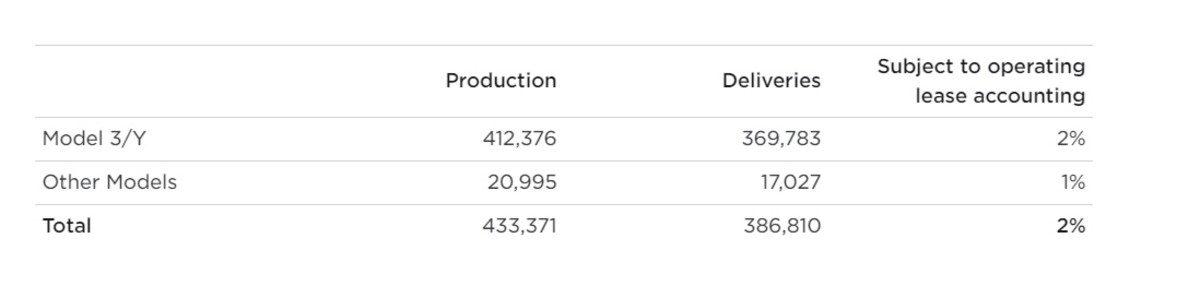

Tesla tumult

Tesla TSLA shares look set to test the lowest levels in a year Tuesday after the world's leading EV maker posted much weaker-than-expected first quarter deliveries.

Tesla's first quarter numbers were down 20% from the three months ending in December, and 6.5% from last year, at just 387,000, well south of Wall Street's 454,0000 forecasts.

Tesla shares were marked 7% lower following the release to indicate an opening bell price of $163.20 each.

Related: Tesla shares slump after disappointing first-quarter delivery figures

Updated at 8:20 AM EDT

Beware the bond

Treasury yields are back on the march, with benchmark 10-year notes rising to a late November high of 4.371% in early trading and 2-year notes changing hands at 4.722% on renewed inflation concerns and a pullback in June rate cut bets.

Gold prices are also nudging higher, hitting a fresh all-time peak of $2,281.50 per ounce, in the early trading session.

10-year yield at 4.37%, highest since November pic.twitter.com/nlJgfyhncI

— Eric Wallerstein (@ericwallerstein) April 2, 2024

Check back for updates throughout the trading day

A sharp move higher in Treasury bond yields on Monday, triggered by both last week's sticky February PCE inflation data and a stronger-than-expected ISM reading of manufacturing activity in March, pushed all three major indexes into the red by the close of trading.

The ISM reading also included a big leap in the survey's prices-paid component, suggesting inflation pressures are accelerating into the spring and could affect the Federal Reserve's interest rate cut forecasts.

The odds of a June cut in fact slipped to nearly 10 percentage points to 56.3%, according to the CME Group's FedWatch tool, while benchmark 10-year-note yields hit a multiweek high of 4.357% in overnight trading.

Markets will likely be eyeing today's February job-openings data, which the Fed closely tracks, as well as public comments from New York Fed Gov. John Williams, Cleveland Fed President Loretta Mester and San Francisco Fed President Mary Daly.

Global oil prices were also on the move, with Brent crude futures contracts testing the $90 a barrel mark, after a strike on Iran's embassy in Syria killed two top generals and several Revolutionary Guards.

Iranian Supreme Leader Ayatollah Ali Khamenei has vowed to avenge the attack, which Iran has blamed on Israel, in a move that could escalate the region's months-long conflict.

On Wall Street, health insurance stocks were the notable early movers, with UnitedHealth (UNH) falling nearly 4% and Humana (HUM) down 8%, after the U.S. government kept its Medicare Advantage payouts unchanged, further pressuring the sector's profit margins.

Related: Humana tumbles, UnitedHealth and CVS slide on Medicare Advantage hit

In broader markets, futures contracts tied to the S&P 500 suggest a 24 point opening-bell decline while those linked to the Dow Jones Industrial Average are indicating a 230 point pullback.

The tech-focused Nasdaq, meanwhile, is priced for a decline of around 96 points.

In Europe, the benchmark Stoxx 600 returned from the four-day Easter holiday break to rise 0.06% in early trading. Factory activity data are showing the region is still in contraction, demonstrating slow improvement from its long winter lull.

Britain's FTSE 100, meanwhile, was marked 0.31% higher in early London dealing.

Overnight in Asia, Japan's Nikkei 225 closed 0.09% higher in Tokyo, while the regionwide MSCI ex-Japan index rose 0.75% thanks in part to big gains in Hong Kong and Taiwan.

Related: Veteran fund manager picks favorite stocks for 2024