Stocks ended higher Wednesday, as investors looked to a key series of labor market data and Federal Reserve updates heading into Chairman Jerome Powell's speech at Jackson Hole to close out the week.

The Dow Jones Industrial Average edged up 55.49 points, or 0.14%, to finish the day at 40,890.49, while the S&P 500 added 0.42% to 5,620.85, and the Nasdaq Composite gained 0.57% to close out the day at 7,918.99.

Both indexes posted their ninth positive session out of the last 10, according to CNBC, and the broad-market S&P 500 ended the day less than 1% from its closing high.

Minutes of the Fed's July policy meeting were released on Wednesday and they showed a clear shift towards the “full employment” side of the central bank's mandate.

The minutes showed that a “vast majority” of Fed officials “observed that, if the data continued to come in about as expected, it would likely be appropriate to ease policy at the next meeting”.

"The Fed minutes underscore the debate that has ensued between the dual mandate Federal Reserve, with Fed officials debating whether there's enough confirmation to begin the easing cycle against concerns that perhaps inflation hasn't been quelled to the point of ensuring the continuation of the disinflationary path towards price stability", said Quincy Krosby, chief global strategist at LPL Financial.

Still, Krosby added, overall the FOMC appears comfortable enough - and concerned enough - "that initiating the easing cycle will help ensure that the economic backdrop, particularly the labor market, won't deteriorate at a marked pace."

Updated at 3:28 PM EDT

Fed cuts coming

Stocks are carrying modest gains into the final half hour of trading following minutes from the Fed's July policy meeting that show a clear shift towards the 'full employment' side of the central bank's mandate.

The minutes showed that a "vast majority" of Fed officials "observed that, if the data continued to come in about as expected, it would likely be appropriate to ease policy at the next meeting".

Coupled with the big revision to benchmark payroll data for the twelve months ending in March, bets on a 50 basis point rate cut next month in Washington have risen to around 40%, according to the CME Group's FedWatch.

The S&P 500 was last marked 14 points, or 0.25% higher on the session, while the Nasdaq gained 6- points, or 0.33%. The Dow was last up 15 points.

My three main takeaways from the Fed minutes:

— Mohamed A. El-Erian (@elerianm) August 21, 2024

There is a clear shift in the Fed’s policy emphasis to the employment component of its dual mandate.

This shift comes with increased “confidence” that the inflation target is now attainable given expectations that the… https://t.co/CD2q4IUoC0

Updated at 12:22 PM EDT

Slumping yields

Benchmark 10-year Treasury bond yields are extending their recent pullback and were last marked below their August 5 trough and trading at 3.782%, the lowest level of the year, with a $16 billion auction of 20-year bonds coming in the early afternoon session.

The U.S. dollar index, meanwhile, is also trading at year-to-date lows, and was last marked 0.25% lower on the session at 101.186, as traders react to the payroll revisions from the BLS.

"The revisions suggests a weaker labor landscape and helps explain the most recent findings from a New York Fed survey, that consumers are worried about job security and the ability to find new jobs," said LPL Financial's chief global strategist, Quincy Krosby.

"This report makes the next non-farm payroll report increasingly important as Fed Chair Powell continues to invoke the Fed's maximum employment mandate," she added. "Moreover, given the concerns over the underlying strength of the labor market, the preliminary report could lead to a more dovish Fed on September 18 should the September payroll announcement see the unemployment rate tick higher yet again."

The US Dollar Index is at its lowest level of the year while Gold is at an all-time high, up 22% year-to-date. $USD $GLD pic.twitter.com/iEavD2jzv9

— Charlie Bilello (@charliebilello) August 21, 2024

Updated at 11:00 AM EDT

Paring gains

Stocks are flatlining after the BLS jobs revision, with the S&P 500 now up just 1 point, or 0.02% on the session and the Nasdaq up 4 points.

Treasury yields are now moving lower, with 10-year notes trading at 3.797% and 2-year notes pegged at 3.947%, but we're not seeing much change in the CME Group's FedWatch odds of a September rate cut, with the chances of a 25 basis point reduction holding at around 70%.

Job growth was slightly less strong from March 2023-2024 with a growth rate of 174K vs 234K as initially estimated. The benchmark revision does not inlcude the entry of immigrants-a potential source of an upward revision-next year when the next revision is published. Nor does it…

— Joseph Brusuelas (@joebrusuelas) August 21, 2024

Updated at 10:39 AM EDT

Job re-calc

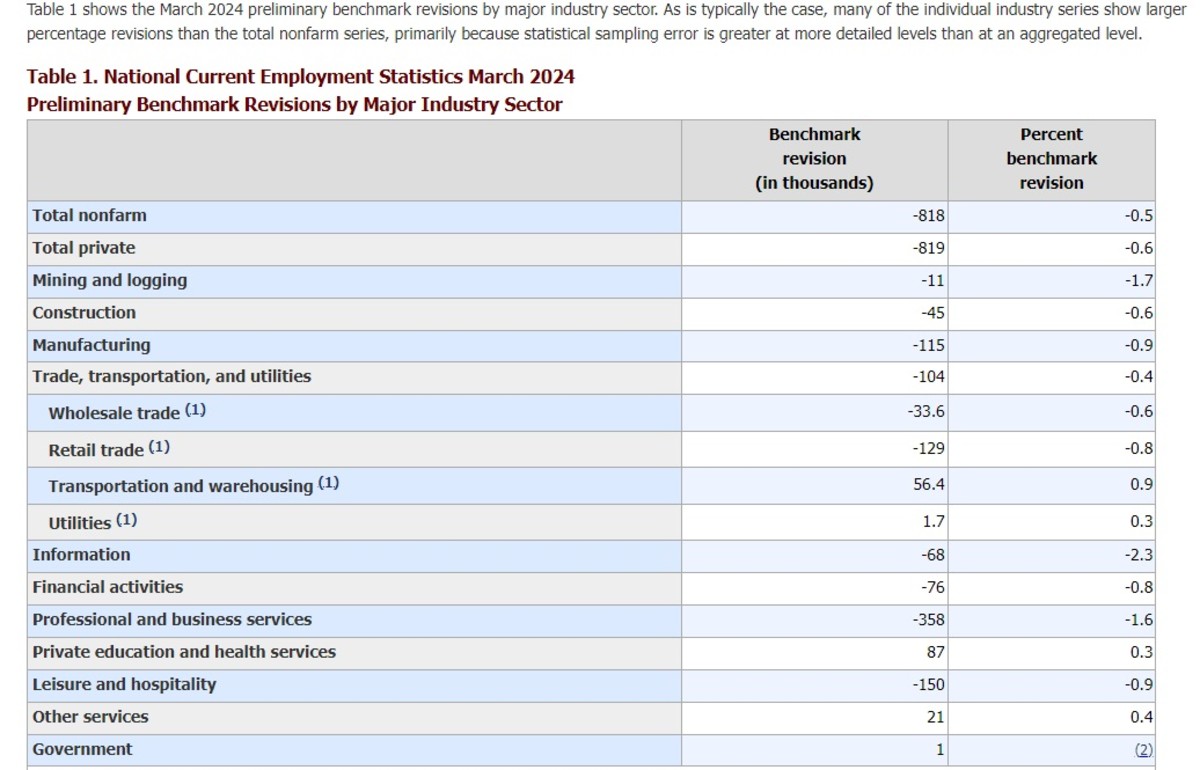

The Bureau of Labor Statistics trimmed around 818,000 jobs from its estimate of gains over the twelve months ending in March, a figure that was largely in-line with economists' forecasts.

The revision from the BLS' Current Employment Statistics report continues to suggest a firm labor market heading into the spring months, with overall employment to March of 2024 pegged at around 2.1 million.

Treasury bond yields were little-changed following the data release, with 10-year notes trading at 3.822% and 2-year notes easing to 3.977%.

Updated at 9:35 AM EDT

Muted open

The S&P 500 is back on the march in early trading, rising 10 points, or 0.19%, just after the opening bell. The Nasdaq, meanwhile, gained 33 points, or 0.19%.

The Dow was marked 82 points higher while the small-cap Russell 2000 gained 13 points, or 0.62%.

S&P 500 Opening Bell Heatmap (Aug. 21, 2024)$SPY +0.18%🟩$QQQ +0.15%🟩$DJI +0.28%🟩$IWM +0.69%🟩 pic.twitter.com/irFWZ7WUJj

— Wall St Engine (@wallstengine) August 21, 2024

Updated at 8:10 AM EDT

Ford's EV focus

Ford (F) shares edged higher in early trading after the carmaker unveiled that latest overhaul of its EV strategy will likely cost around $1.9 billion in writedowns and charges.

“We are committed to innovating in America, creating jobs and delivering incredible new electric and hybrid vehicles that make a real difference in CO2 reduction,” said CEO Jim Farley. “We learned a lot as the No. 2 U.S. electric vehicle brand about what customers want and value, and what it takes to match the best in the world with cost-efficient design, and we have built a plan that gives our customers maximum choice and plays to our strengths.”

Ford shares were last marked 1.6% higher in premarket trading to indicate an opening bell price of $10.85 each.

BREAKING: $F just updated markets on their EV strategy. They are taking a $400 Million charge and attempting to launch some new vehicles by 2027. In other words, they're behind by another 2 years and $TSLA domination (as they said prior) and still in 3rd place in market share at…

— squawksquare (@squawksquare) August 21, 2024

Updated at 7:40 AM EDT

Retail therapy

Retail stocks are the biggest movers in the premarket, with Target soaring as much as 15% following a blowout secibd earnings report that included a boost to its full-year profit forecast.

Discount retailer TJX (TJX) , which owns Marshalls, HomeGoods and TJ Maxx, also topped Wall Street forecasts for its Q2 earnings and lifted its same-store sales forecast. The stock was last marked 1.9% higher

Macy's (M) , however, slumped 9.2% after the upscale retailer trimmed its full-year sales forecast, citing a "more discriminating consumer and heightened promotional environment" that ate into second quarter profit.

Related: Target stock soars as retailer chases Walmart with surprise Q2 profits

Stock Market Today

Stock investors have been focused on Powell's address to the central bank's annual symposium for much the past week as they seek clarity about the Fed's autumn interest rate path amid a resilient economy and easing inflation pressures.

Wall Street ended its eight-day win streak last night as late-afternoon selling pulled the S&P 500 11 points lower on the session in thin August trading as the market move snapped the longest run of gains for the benchmark since November of last year.

Markets will have more to focus on over the coming days, however, with a big release from the Bureau of Labor Statistics later in the session that will revamp its monthly estimates of job creation between April 2023 and March 2024.

Economists think the BLS could pare its 12-month total by as much as 1 million, a move that would add further fuel to bets that the Fed will begin the first of its rate cuts at its September meeting in Washington.

DRW: “.. For the sake of today’s revision, I will add that the 12-month average for payrolls as of March 2024 is +242k, indicating +2.904 million increase in the year up to and including that month.” #NFP 🇺🇸 pic.twitter.com/Fli05nVMGG

— Carl Quintanilla (@carlquintanilla) August 21, 2024

Minutes of the Fed's July policy meeting, when rates were held steady at between 5.25% and 5.5% for the twelfth consecutive month, will be published at 2 pm Eastern Time.

Benchmark 10-year Treasury bond yields were marked around 3 basis points lower heading into today's session and trading at 3.814% while 2-year notes slipped to 3.996%.

Heading into the start of the trading day on Wall Street, futures contracts tied to the S&P 500, which is now up 1.35% for the month, are priced for a 6-point gain.

The Dow Jones Industrial Average, meanwhile, is called 52 points higher while the tech-heavy Nasdaq is slated for a 15-point bump.

Stocks on the move include JD.com (JD) , which is down nearly 7% in premarket trading after Walmart (WMT) confirmed its divestment from the China-based online retailer.

Toll Brothers (TOL) jumped 1.1% after the homebuilder topped Wall Street forecasts for its third-quarter earnings and boosted its full-year profit forecast.

Related: Target earnings in focus as Walmart tightens grip

Target (TGT) , meanwhile, surged nearly 9% after the retailer posted stronger-than-expected second quarter earnings that included solid same-store-sales gains and an improved full-year profit forecast.

More Wall Street Analysts:

- Analysts reboot Amazon stock price targets after earnings

- Analyst reboots Rivian stock price target on updated plans

- Analysts reboot Arm Holdings stock price target following earnings

In Europe, markets were modestly firmer heading into the midweek, with eyes on U.S. jobs data, with the Stoxx 600 rising 0.25% in Frankfurt and Britain's FTSE 100 gaining 0.18% in London.

Overnight in Asia, the regional MSCI ex-Japan benchmark fell 0.46% into the close of trading, while the Nikkei 225 in Tokyo was marked 0.29% lower by the end of the session.

Related: Veteran fund manager sees world of pain coming for stocks