Stocks finished at record highs Monday, as risk appetite continues to improve following a sweeping election win for former President Donald Trump and the likely control of both houses of Congress by his Republican allies.

The Dow Jones Industrial Average gained 304 points, or 0.69%, to finish the day at 44,293.69 and end above the 44,000 mark for the first time.

The S&P 500 advanced 0.1% to a record high close of 6,001.35 and cleared 6,000 for the first time, while the tech-heavy Nasdaq edged up 0.06% to end the session at 19,298.76.

"The clouds of uncertainty parted last week as former President Donald Trump decisively won the U.S. election, making him the second U.S. president to win non-consecutive terms (Grover Cleveland was the first to do it back in 1892)," LPL Financial said in its weekly market commentary.

"Investors welcomed the news with renewed risk appetite, bidding the S&P 500 to its 50th record high of the year on Friday."

The firm said that Trump's proposed economic policies, including deregulation, a likely extension of the 2017 tax cuts, a possible corporate tax rate cut, and proposed tax exemptions on tips, social security, and overtime pay helped underpin buyer enthusiasm.

"The immediate de-risking of when the election will be decided was another big factor behind the post-Election Day rally," LPL Financial said.

Updated at 3:12 PM EST

Late day slide

Markets are paring gains heading into the final hour of trading, with the S&P 500 now just up 3 points, or 0.06% on the session and the Nasdaq slipping into the red.

The post-election rally, which lifted the benchmark more than 4.6% last week, has also stretched valuations in a market that many see as over-reliant on a combination of Federal Reserve rate cuts, favorable government policy and fading inflation risks.

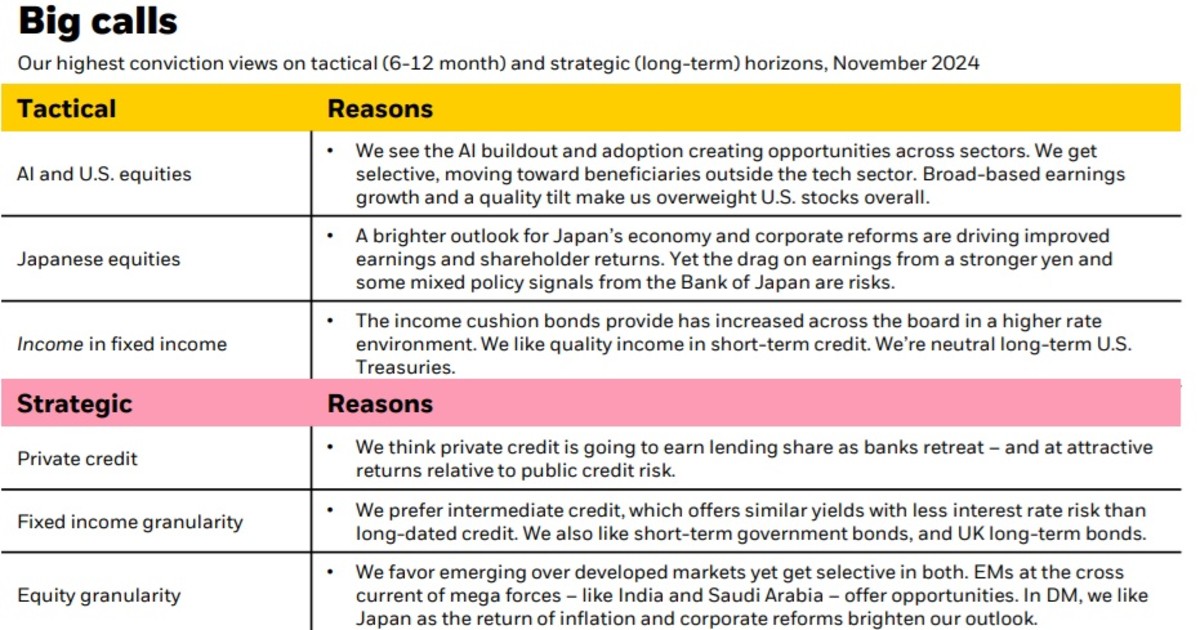

"We are in a world where multiple, starkly different outcomes are possible," said Jean Bolvin, the head of BlackRock's investment institute.

"The decisive U.S. election outcome has stoked uncertainty about future U.S. policy (and) the decisive U.S. election outcome has stoked uncertainty," he added.

Updated at 12:18 PM EST

Crude slick

Global oil prices were lower across the board in early afternoon trading, with U.S. crude closing in on $68 per barrel, following a disappointing stimulus update from China that could tame demand in the world's biggest energy market.

"In addition, a Trump presidency is seen as relatively more bearish for energy markets," said ING's head of commodities strategy Warren Patterson. "However, the key risk to this view is if President Trump chooses to strictly enforce sanctions against Iran. This would erase the surplus expected over 2025."

Brent crude futures contracts for January delivery, the global pricing benchmark, were last seen $2.03 lower on the day at $71.85 per barrel while WTI contracts for December, which are tightly-linked to U.S gas prices, fell $2.16 to $68.22 per barrel.

W/ WTI oil now trading <$70/bbl just know that US @ENERGY is out of money to buyback more barrels for the SPR. #EFT #OOTT https://t.co/8l362a52eu

— Christine Guerrero (@SheDrills) November 11, 2024

Updated at 11:09 AM EST

Tesla $2 trillion?

Tesla shares hit the highest levels in more than two and a half years in early trading, passing the $350 mark for the first time since April of 2022 and extending its six month gain to around 103%.

Wedbush analyst Dan Ives, a longtime Tesla bull, boosted his stock price target to $400 in a note published Tuesday, arguing its AI business will be a principal beneficiary of a new Trump administration and drive its market value to as high as $2 trillion over the next 18 months.

Tesla shares were last marked 8.9% higher on the session in early trading and changing hands at $349.86 each.

Related: Top analyst overhauls Tesla stock price target amid post-election surge

Updated at 10:25 AM EST

Bitcoin sky high

Bitcoin prices hit a fresh all-time high of $83,146 in early trading, extending the digital currency's session gain to 8.5% and its six-month advance to around 36.5%, as investors bet on a friendly regulatory environment from a new Trump administration.

The President-elect has said he wants to have all future bitcoin mining take place in the United States, a move that would require massive amounts of domestic energy, and build a so-called 'national stockpile' of the world's biggest cryptocurrency.

If you're wondering what's happening with #Bitcoin...

— Jesse Myers (Croesus 🔴) (@Croesus_BTC) November 11, 2024

Yes, the incoming Bitcoin-friendly administration has provided a recent catalyst...

But, that's not the main story here.

The main story here is that we are 6+ months post-halving.

And that means a supply shock has… pic.twitter.com/XkwPoPxrj2

Updated at 9:35 AM EST

Solid open

The S&P 500 was marked 19 points, or 0.32% higher in the opening minutes of trading to hit a fresh-all time peak of 6,016.85 points

The Dow bumped 294 points from last Friday's close, with the mid-cap Russell 2000 rising 26 points, or 1.08%. The Nasdaq rose 67 points, or 0.35% to an intra-day record of 19,366.07 points.

"With the election and another rate cut in the rearview mirror, the question is whether bulls can keep pushing the market to new highs," said Chris Larkin, managing director for trading and investing at E*Trade from Morgan Stanley.

"Last week was a definitely a “risk-on” moment—the S&P 500 notched its best week in a year, and its second-biggest election-week gain since 1960. Small caps did even better, with the Russell 2000 rallying more than it has in any week since April 2020," he added. "Aside from any potential profit-taking after such a strong surge, this week’s inflation data may determine whether the market pads its gains."

S&P 500 Opening Bell Heatmap (Nov. 11, 2024)$SPY +0.32%🟩$QQQ +0.23%🟩$DJI +0.70%🟩$IWM +1.21%🟩 pic.twitter.com/0AbPJKSjwV

— Wall St Engine (@wallstengine) November 11, 2024

Updated at 9:14 AM EST

Nvidia on deck

Nvidia shares edged higher in early trading following a pair of price target upgrades from Wall Street analysts heading into the AI chipmaker's third quarter earnings later next week

Analysts are looking for a massive year-on-year revenue surge of 82%, to just under $33 billion, thanks in part to ongoing demand for its legacy Hopper chips and gains from its newly released line of Blackwell processors.

Nvidia told investors in late August that Q3 revenue would be in the region of $32.5 billion, more than double the tally of the year-earlier period. However, the company faced some delays in shipping its new line of Blackwell processors amid design changes and supply-chain snarls.

Nvidia shares were marked 0.5% higher in premarket trading to indicate an opening bell price of $148.30 each.

Related: Analysts revisit Nvidia stock price targets with Q3 earnings in focus

Updated at 8:20 AM EST

No deal

Humana (HUM) shares slumped lower in early Monday trading after Cigna (CI) , said it won't pursue a takeover of its smaller health insurance rival.

Media reports had suggested that Cigna, which dropped a planned takeover last year, would revive its approach as the sector looks to lower costs amid surge in elective-care payouts. Cigna said Monday it would " only consider acquisitions that are strategically aligned, financially attractive, and have a high probability to close."

Humana shares were marked 6.3% lower in premarket trading at $270.01 each, while Cigna rose 9.5% to $350.10 each.

$CI Cigna confirms It Won’t Pursue Combination With Insurer Humana $HUM pic.twitter.com/nhK4hIrlQK

— InsideArbitrage (@InsideArbitrage) November 11, 2024

Stock Market Today

Stocks ended last week's election-fueled rally on a high note, with the S&P 500 notching its 50th record high close of the year as markets bet on a boost to corporate profits from the various trade, regulatory and tax proposals from a new Trump administration.

The tech-focused Nasdaq gained 5.74% for the week, a move that led the three major benchmarks and lifted its year-to-date advance to around 28.5%. Tesla (TSLA) shares topped $1 trillion in market capitalization and Nvidia (NVDA) consolidated its place over Apple (AAPL) as the world's most valuable company.

Markets are set for another round of gains, with all three major indexes called higher in premarket dealing, although trading volumes are likely to be muted given that bond markets will remain closed for Veterans' Day observances.

Action will pick up Tuesday, with the New York Fed's inflation-expectations reading and with Wednesday's Commerce Department reading of CPI inflation for October. Retail-sales figures are expected on Friday.

A relatively light calendar of earnings is on tap this week, with 11 S&P 500 companies expected to report third-quarter earnings, including Home Depot (HD) , Cisco Systems (CSCO) , Walt Disney (DIS) and Applied Materials (AMAT) .

With around 446 companies reporting so far this earnings season, collective S&P 500 profits are forecast to rise 8.6% from a year earlier to $527 billion, according to LSEG data. That tally is expected to rise to 10% over the final three months of the year.

Related: Fed Chair Powell digs in for a fight as markets debate Trump economic plan

Heading into the start of the trading day on Wall Street, futures contracts tied to the S&P 500, which is up 25.7% for the year and passed the 6,000-point mark for the first time on Friday, suggest a modest opening-bell gain of around 16 points.

Futures linked to the Dow Jones Industrial Average, which booked a five-day gain of 4.6% last week, suggest a 160-point opening bell boost while the Nasdaq is called 45 points higher.

Tesla shares are back in the driver's seat, rising 7.4% in heavy premarket trading volume to $344.52, the highest since April 2022. They topped the $1 trillion mark on Friday.

Trump Media & Technology (DJT) shares were also active, rising 5.7% to $33.73 each following Friday comments from the president-elect that he was not going to sell his stake in the parent of the Truth Social social-media platform.

Coinbase Global (COIN) shares surged nearly 17% to a year-to-date high of $316.58 each following another round of record prices for digital currencies, a key part of the group's trading platform, and a record of just over $82,000 for bitcoin.

More Wall Street Analysts:

- Analysts reboot Snap stock price target after earnings

- Analysts reset Meta stock price target after earnings

- Analysts update Reddit stock price target after earnings

In overseas markets, improved global investor sentiment helped the regional Stoxx 600 benchmark rise 1.17% in early Frankfurt trading. Britain's FTSE 100 rose 0.74% in London.

Overnight in Asia, last week's disappointing stimulus update from government officials in China pulled Hong Kong stocks lower, dragging the MSCI ex-Japan index 0.9% into the red by the close of trading.

Japan's Nikkei 225, meanwhile, ended the session 0.08% higher to take its year-to-date gain to around 18.8%.

Related: Veteran fund manager sees world of pain coming for stocks