Updated 2:25 pm EST

Big stock market winners and losers today:

The stock market may not be doing much, but, as my mentor used to say, there's always a bull market somewhere.

Clearly, Chinese stocks are the biggest winners, and Stellantis (see below) is a big loser. They're not the only ones making news, though.

Related: Midday stock movers: Nvidia, CVS Health, Carnival

For example, CVS Health shares are up 3% today on hopes that Glenview Capital, a major CVS Health shareholder, will meet with management to reinvigorate the struggling business.

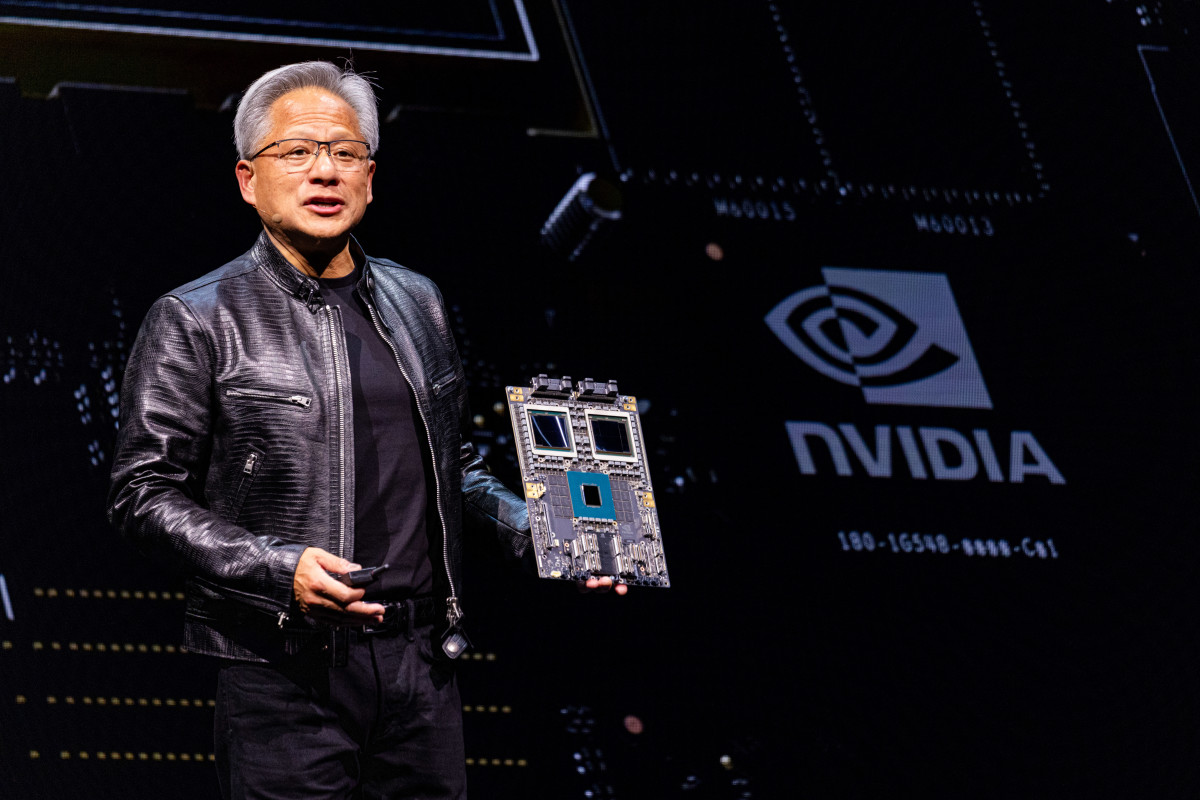

General Motors is down over 4% after rival Stellantis cut its guidance. Micron is down 4%. Nvidia is down 1.7% on concerns that China's leadership is telling companies to avoid purchasing Nvidia's H20 chips. Instead, they want them to buy artificial intelligence chips from their own manufacturers.

Updated 1:15 pm EST

The S&P 500 fails to follow in China's footsteps

Stocks are pretty much unchanged today. China's stellar returns this past week (see in this article further below) haven't translated into a big move in the S&P 500, at least not yet.

The S&P 500 is down less than 0.01%, the Nasdaq is up 0.08%, and the Dow Jones Industrial Average (DJIA) is down 0.28%. The Russell 2000 is up 0.27%.

Although we just finished the Q2 earning season, there's no rest for the weary. The third quarter earnings reports will be rolling in soon enough, so there is no time like the present to start your research.

TheStreet Pro's fund manager, Chris Versace, just put together a list of companies reporting in October that he owns in our multimillion-dollar portfolio. A few highlights:

October 8 – PepsiCo (PEP)

October 15 – Bank of America (BAC)

October 22 – Alphabet (GOOGL), Lockheed Martin (LMT), Microsoft (MSFT)

October 23 – Meta Platforms (META)

October 24 – Apple (AAPL), Amazon (AMZN), Labcorp (LH), Mastercard (MA)

You can view the full his full October watch list (and why) by clicking here.

Updated 12:33 pm EST

Carnival Cruise Line stunner kicks off earnings this week

Inflation may be taking a bite out of wallets, but that hasn't stopped travelers. Carnival reported a 15% spike in year-over-year revenue and a surge in profit.

Sales last fiscal quarter totaled $7.9 billion, an all-time Q3 high, while earnings were $1.27 per share, 12 cents ahead of analyst expectations. Ticket sales and onboard spending climbed mid-single-digit percentages.

Total cruise deposits were a fiscal third-quarter record, totaling $6.8 billion.

Related: What a longshoremen strike means for Carnival, Royal Caribbean, and other cruise lines

The strength made management optimistic enough to bump up its outlook. Its new guidance is for earnings before interest, taxes, depreciation, and amortization, or EBITDA, of $6 billion, up 40% from last fiscal year.

Looking further ahead, cumulative advance bookings for 2025 are running ahead of 2024

"With nearly half of 2025 booked and less inventory remaining for sale than the prior year, we are leveraging strong demand to achieve record ticket pricing," said management in their press release.

Updated 11:37 am EST

Walmart, big box retailers could face a port strike reckoning

Boeing workers aren't the only ones angling for a better union contract. Workers at major ports throughout America are also attempting to win better wages and benefits.

If they don't secure a deal soon, activity at key ports relied upon by large retailers like Walmart (WMT) could grind to a halt.

Related: Port strike strike could notably hit wallets of Walmart customers

North America’s largest longshoremen's union plans to leave the job on October 1st.

About $14 billion in goods made their way through these ports last week, suggesting a potentially big impact on retail chains like Walmart, which count on imports to fill their shelves.

It's likely not lost on the Longshoremen's union that we're on the cusp of the holiday shopping season- the key cog to retailers turning a profit every year.

For now, investors appear nonplussed. The SPDR Retail ETF XRT is down just 0.23% while Walmart is up 0.72%

Updated 10:21 am EST

Auto stocks tumble on bad news

It's a super not great day for auto stocks. Detroit powerhouse Stellantis (STLA) warned of underwhelming profits.

The car company says its adjusted operating income margin will be between 5.5% and 7% this year, down from prior double-digit expectations.

Stellantis also believes free cash flow will be between -€5 billion and -€10 billion.

The disappointing outlook is due to sluggish demand. Stellantis aims to limit dealer inventory to 330,000 units by year's end, up from the previous target of early 2025.

Related: Ford CEO says he's sick and tired of making 'boring' cars

Stellantis plans to reduce its North American shipments by 200,000, twice the previously targeted reduction.

The downbeat forecast follows Volkswagen AG's (VLKAF) lowered guidance last week. Volkswagen. Volkswagen expects to deliver 9 million vehicles globally in 2024, down 3% from 2023.

Stellantis shares are down 13%. Ford (F) and General Motors (GM) shares are down 2% and 2.8% on concern that struggles may be industrywide.

China stocks surge, Fed official speeches lurk, jobs data looms

Check back throughout the day for stock market updates.

Stocks open mixed. The S&P 500 opened lower by four points, the NASDAQ opened higher by 32 points, and the Dow Jones Industrials is up 0.45% in early trading.

Middle Kingdom mania. China stocks are back in vogue. Shares have zoomed higher after the regime highlighted stimulative policy in the wake of Fed rate cuts.

I'm Eyeing These 3 Chinese Stocks as the Bulls Lead Us Out of September

— James DePorre (@RevShark) September 30, 2024

China unleashed stimulus that could create opportunities in several speculative small caps; U.S. earnings season will kick off soon; and then we'll then look toward the next Fed meeting.…

The Shanghai Index surged 8% today, its best performance since 2008, and rallied about 23% from its mid-September low. The KraneShares CSI China Internet ETF KWEB owns Chinese software and information technology stocks. It’s up 37% since its late August low.

Fed officials will be busy this week. Sure, the September rate decision is over, but the media junket is in full swing. Chairman Powell is scheduled to speak at 1:55 pm EST on Monday.

He’s not alone. Fed heads Cook, Barkin, Bostic, Collins, Hammack, Musalem, Bowman, Kashkari, and Williams all have speeches on the docket this week. Pay attention to what they say because any insight into what happens when the Fed meets next in November could move the market.

Get ready. Jobs data lands this week, and everyone will be watching. The Fed’s rate cuts were partly, arguably largely, due to worry that unemployment is creeping higher. That’s true, but we remain at 4.2% unemployment – that’s pretty darn good.

Related: Jobs and Fed officials may rock stocks this week

If job losses tick higher, recession chatter will grow. Of course, economists will be parsing the numbers from ADP on Wednesday, jobless claims on Thursday, and unemployment on Friday for clues as to whether the Fed will go big again in November. If jobs data disappoints, the odds of another half-point cut could climb.

I’ve hesitated to say this at the risk of sounding hyperbolic, but with last week’s big GDP revisions, there is no denying it: This is among the best performing economies in my 35+ years as an economist. Economic growth is rip-roaring, with real GDP up 3% over the past year.…

— Mark Zandi (@Markzandi) September 29, 2024

Lower the bar. Evercore ISI and Truist did a wholesale reset on energy stocks, dropping price targets for most big E&P companies. The culprit? Increased fear that lower oil prices will last longer than previously thought. For example, Truist cut its ExxonMobil (XOM) target to $117 from $121, while Evercore lowered its target on Occidental Petroleum (OXY) to $63 from $67.

Related: The 10 best investing books, according to our stock market pros