Shares were weaker in Asia on Friday, tracking a decline on Wall Street following mixed earnings reports from big companies and more signals the U.S. economy may be slowing.

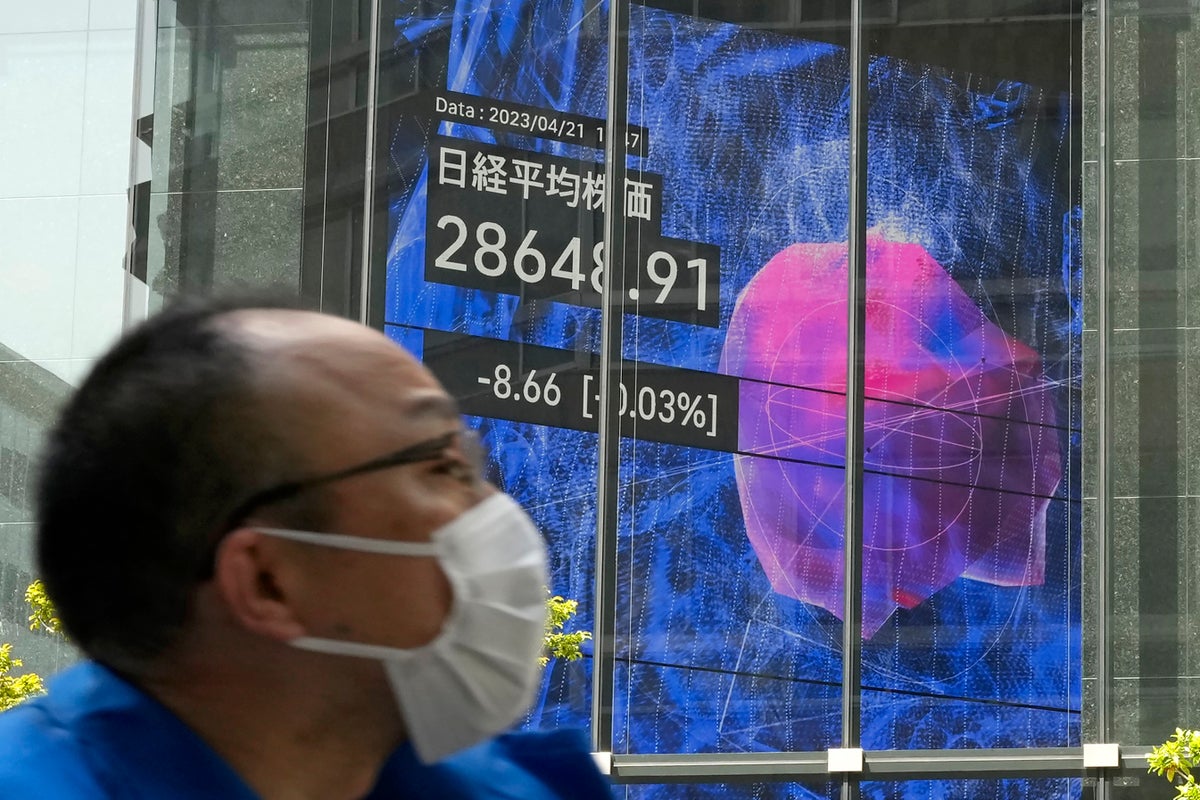

Tokyo's Nikkei 225 index lost 0.3% to 28,584.70. The Kospi in Seoul dropped 0.7% to 2,545.27. Hong Kong's Hang Seng gave up 1.2% to 20,150.53.

The S&P/ASX 200 in Sydney lost 0.4% to 7,333.40, while the Shanghai Composite shed 1.3% to 3,324.29.

On Thursday, the S&P 500 fell 0.6% to 4,129.79 after drifting listlessly earlier this week. The Dow Jones Industrial Average slipped 0.3% to 33,786.62, while the Nasdaq composite dropped 0.8% to 12,059.56.

Tesla weighed heavily on the market for a second straight day on worries about how much profit it’s making on each of its electric vehicles. It dropped 9.7% after reporting revenue for the first three months of the year that fell short of analysts’ expectations as it repeatedly cut prices on its models.

Several banks also dropped after reporting weaker profits and revenue than expected, including KeyCorp and Zions Bancorp. The spotlight has been particularly harsh on smaller and mid-sized banks amid worries their customers may pull out deposits following the second- and third-largest U.S. bank failures in history last month.

Zions fell 4.9%, and KeyCorp dropped 2.7%. Truist Financial fell 3.8% after reporting weaker profit than expected.

AT&T sank 10.4% after it reported slightly weaker revenue than analysts forecast, though profit squeaked past expectations. Analysts also pointed to weaker cash flow than some expected. It was the worst day for its stock in two decades and its second-worst since late 1983.

In the bond market, yields fell following a couple of reports on the U.S. economy.

Slightly more workers filed for unemployment benefits last week than the week before, a potential signal that a still-strong job market is starting to soften under the weight of much higher interest rates. The number of continuing claims for jobless benefits also rose to the highest level since November 2021, according to Rubeela Farooqi, chief U.S. economist at High Frequency Economics.

A separate report said that manufacturing trends in the mid-Atlantic region weakened by much more than economists expected.

They helped drag the yield of the 10-year Treasury down to 3.53% from 3.59% late Wednesday. The two-year yield, which more closely tracks expectations for the Federal Reserve, fell to 4.14% from 4.25%.

The Fed has intentionally been trying to cool the economy by raising interest rates in hopes of reining in high inflation. It’s an effective but blunt tool that slows the broad economy, raising the risk of a recession and hurting prices for investments.

The housing market was one of the first sectors to bend under the weight of much higher interest rates, as mortgage rates quickly climbed. A report on Thursday said sales of previously occupied homes slowed in March but remain above its bottom hit at the start of this year.

Wall Street's losses Thursday were offset by big gains from companies whose earnings topped analysts' expectations.

Lam Research, a supplier for the semiconductor manufacturing industry, rose 7.2% after it reported profit and revenue for the latest quarter that beat Wall Street’s forecast.

The majority of companies have been topping profit forecasts so far in the early days of this reporting season.

Analysts were forecasting this would mark the sharpest drop in S&P 500 earnings per share since the pandemic was pounding the economy in 2020. Profits are under pressure as inflation remains high, interest rates are much higher than a year ago and portions of the economy slow.

In other trading, benchmark U.S. crude oil lost 8 cents to $77.29 per barrel in electronic trading on the New York Mercantile Exchange. It declined $1.87 to $77.37 per barrel on Thursday.

Brent crude, the international pricing standard, shed 8 cents to $81.03 per barrel.

The U.S. dollar fell to 133.88 Japanese yen from 134.24 yen. The euro weakened to $1.0958 from $1.0970.