Plenty of investors believe that the stock market’s rise from June 16 to Aug. 16 is just a bear market rally. After all, the S&P 500 is still down 17% year to date.

But legendary investor Dan Loeb, chief executive of Third Point, apparently isn’t one of them. His U.K.-listed Third Point Investor fund TPOU.L had a 48% net-long-equity exposure as of Aug. 31, according to the fund’s monthly report.

That’s the highest level for the fund since February, when it was 50%, according to MarketWatch

In an Aug. 17 letter to investors, which focused on the second quarter, Loeb explained a bit about his views on stocks.

“After taking our [equity] exposures to almost zero, in recent weeks we have identified several new positions and covered most of our single name shorts, bringing our current exposure back over 40%,” he wrote.

Disney

Wonderful World of Disney

“Our largest recent addition has been an investment in Disney (DIS), which we bought at near its 2022 lows after having exited at the end of 2021 and in the beginning of this year.

“We are pleased by the strength they are showing across business lines and the progress of Disney’s transformation from ‘analog’ to ‘digital’, following a blueprint familiar to us from past investments.”

For the quarter ended July 2, Disney’s revenue jumped 26% from a year earlier. Profit rose to 77 cents a share from 50 cents a year ago.

The letter to investors listed PG&E (PCG), Disney, Danaher (DHR), SentinelOne (S) and UnitedHealth (UNH) as the fund’s biggest long equity positions.

PG&E is a utility, Danaher makes medical and industrial products, SentinelOne is a cybersecurity company and UnitedHealth is a health insurer.

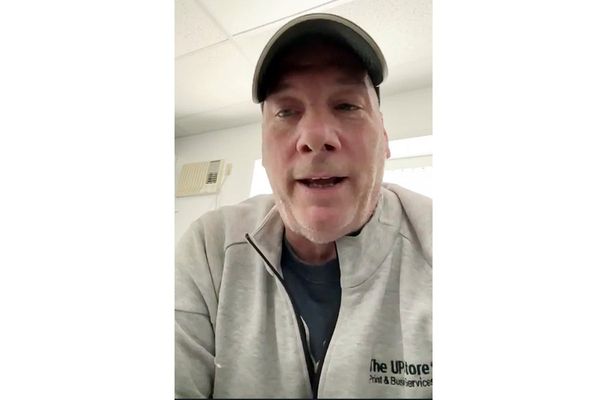

Burry the Bear

Turning to the bearish side of the street, Michael Burry the investor immortalized by Michael Lewis’ book-turned-into-movie “Big Short,” has been negative on stocks and other risk assets for months.

On Sept. 6-7, he took to Twitter to again warn of trouble. “No, we have not hit bottom yet,” he wrote in one tweet. “Watch for failures, then look for the bottom. 2 SPAC ETFs failing is not near enough.”

The S&P 500 has dropped 17% year to date, but rallied in the two months through Aug. 16. It’s not clear exactly what he means by “failures.” But it could be anything from bankruptcies by young and/or indebted companies to cryptocurrency meltdowns.

As for the special-purpose-acquisition-company exchange-traded-fund failures, the Defiance Next Gen SPAC Derived ETF and the Morgan Creek - Exos SPAC Originated ETF closed in August. The SPAC market turned into a speculative bubble that has now burst.

In another tweet, Burry offered a laundry list of negatives for financial markets.

“Crypto crash. Check

Meme crash. Check.

SPAC crash. Check.

Inflation. Check.

2000. Check

2008. Check

2022. Check.”