Sierra Space closed a $290 million Series B funding round Sept. 26, bringing the space company's total investment to $1.7 billion, a number Sierra said is the "largest ever capital raise by a commercial space company." After the completion of this latest funding round, the company is now valued at $5.3 billion.

The firm will use the influx of capital to expand its global partnerships and accelerate the construction of its Dream Chaser fleet and commercial space stations.

Related: Elon Musk is frustrated about a major SpaceX roadblock

The funding round was led by several prominent Japanese companies, including the country's largest bank, MUFG.

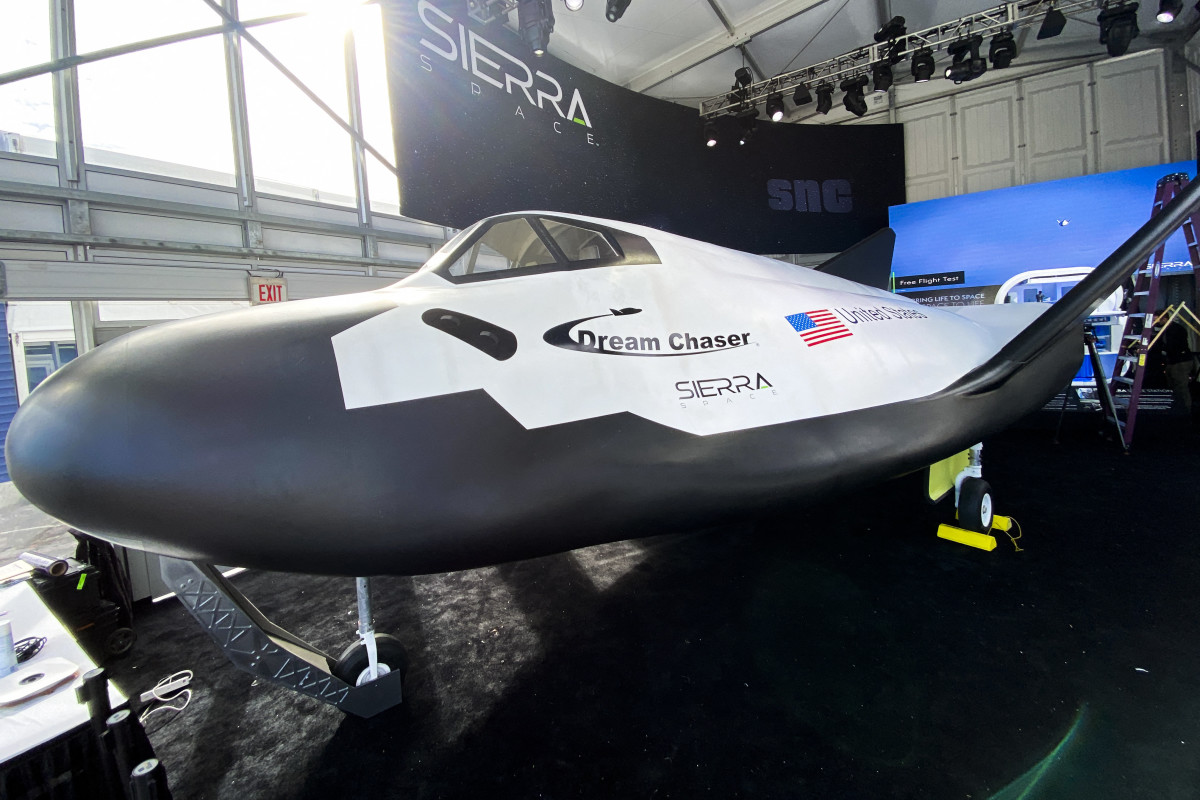

Sierra Space, best known for its Dream Chaser spaceplane, is looking to help guide society into what it has termed the "orbital age: the next industrial revolution driven by the underlying technologies that are commercializing space. It is an era of historical transformation marked by the transition from 60 years of human space exploration to human space commercialization."

The company has three main areas of focus to do this. The first involves the Dream Chaser, a vehicle that marks the only commercial, runway-capable spaceship, according to Sierra. The Dream Chaser, which is capable of transporting crew and cargo to and from space stations, has been backed by a NASA contract to perform cargo resupply missions to the International Space Station.

The company has a total of $3.4 billion in active contracts.

Sierra also hopes to build out space real estate, providing valuable habitats and destinations miles above the planet and emerging "as the largest real estate developer in space."

More SpaceX:

- Elon Musk is frustrated about a major SpaceX roadblock

- Elon Musk says SpaceX Starship is ready to launch; regulators don't agree

- Investor says $150 billion SpaceX valuation seems too good to be true

The company raised $1.4 billion in a Series A funding round in 2021.

CEO Tom Vice said at a conference in June that Sierra is a “revenue-generating, profit-generating company,” but the specifics of that remain undisclosed. He said at the time that the company has a "very strong balance sheet and long-term investors that give us the capital that allows us to invest in being a category winner.”

This effort to scale up its commercial space operations come as Elon Musk's SpaceX has spent the past several years dominating the commercial space market. SpaceX was valued at $150 billion in July, a number that some investors have said feels way too high, especially considering the fact that the company's market share will likely drop as other rivals, like Jeff Bezos' Blue Origin, get up and running.

“As we transition our revolutionary Dream Chaser spaceplane into operations for NASA cargo resupply missions to the International Space Station, we focus our capital deployment to the development and operations of the first commercial space station," Vice said in a statement, "the next step in our in-space infrastructure."

Get investment guidance from trusted portfolio managers without the management fees. Sign up for Action Alerts PLUS now.