For the first few months of the year, megacap tech stocks like FAANG, Nvidia (NVDA) and Microsoft (MSFT) were the only real leaders.

Now, we’ve seen better price action out of growth stocks like SoFi Technologies (SOFI), Upstart Holdings (UPST) and even the ARK Innovation ETF (ARKK).

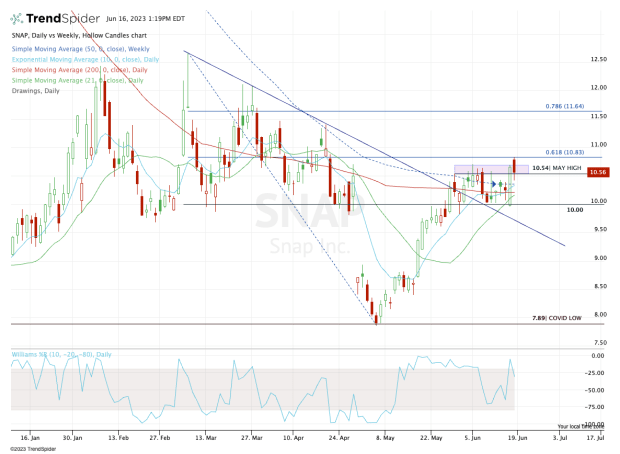

Is Snap (SNAP) going to join that list? The charts are finally showing some bullish momentum, although Snap is contending with a key resistance area.

Don't Miss: SoFi Stock Has Doubled in a Month; Here's the Trade

Still, we’re seeing better price action out of technology and growth stocks, as well as advertising and social media firms like Trade Desk (TTD) and Meta (META).

When Snap stock last reported earnings, it disappointed investors and the shares fell 17% in a single session. Five sessions later, the stock was down almost 25%.

Snap is now up almost 35% from those post-earnings lows.

Trading Snap Stock

Chart courtesy of TrendSpider.com

On the earnings dip, Snap quickly made its way down toward the covid-19 low at $7.86. This level held as support, and in short order the shares climbed back to the $10 area.

The $10 level earlier had been support, so traders reasonably could have seen it becoming resistance. Instead, Snap reclaimed this mark and continued to find it as support while it consolidated between $10 and $10.75.

On Thursday Snap stock rallied 4% and cleared the May high at $10.54 in the process. On Friday, the momentum continued in the morning as the shares hit multimonth highs.

Don't Miss: Alphabet Stock Lags in the FAANG Race. Can It Catch Up?

At last check Snap stock was less than 1% lower as it continues to struggle with the $10.75 area and the 61.8% retracement.

That leaves the stock in an interesting spot. If Snap stock can’t continue higher, the bulls must see how it handles the $10 support level and its numerous moving averages near this mark, including the 10-day, 21-day, 200-day and 50-week moving averages.

Worth noting is that Snap is set to close above its 50-week moving average on a weekly basis for the first time since October 2021.

On the upside, a move over this week’s high at $10.84 opens the door to the 78.6% retracement near $11.50. Above that and the $12 to $12.50 zone is in play.

Get exclusive access to portfolio managers and their proven investing strategies with Real Money Pro. Get started now.