Whales with a lot of money to spend have taken a noticeably bullish stance on Tesla.

Looking at options history for Tesla (NASDAQ:TSLA) we detected 550 trades.

If we consider the specifics of each trade, it is accurate to state that 50% of the investors opened trades with bullish expectations and 39% with bearish.

From the overall spotted trades, 95 are puts, for a total amount of $5,307,401 and 455, calls, for a total amount of $33,594,810.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $10.0 to $710.0 for Tesla over the recent three months.

Analyzing Volume & Open Interest

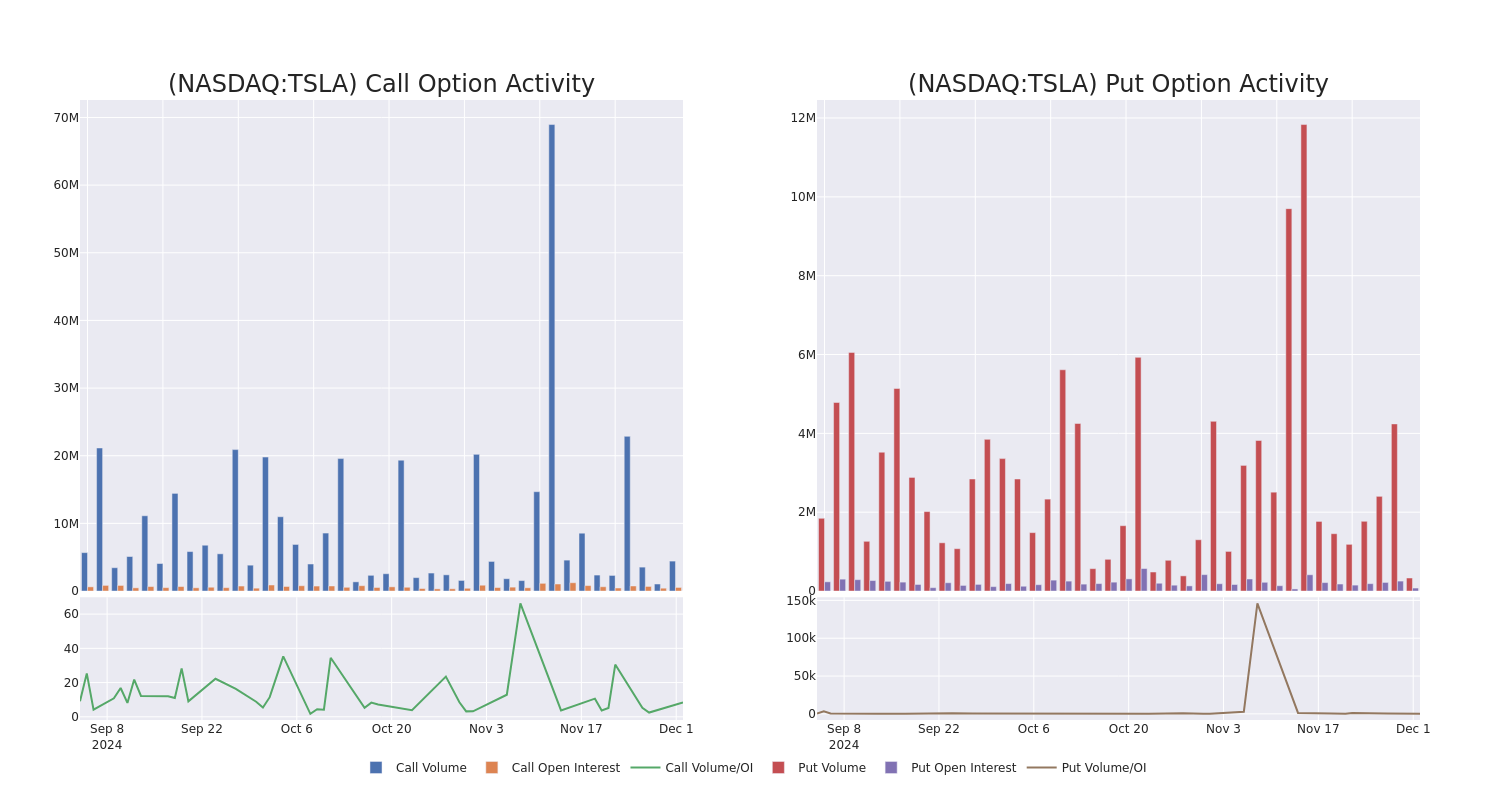

In terms of liquidity and interest, the mean open interest for Tesla options trades today is 6256.28 with a total volume of 4,704,015.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Tesla's big money trades within a strike price range of $10.0 to $710.0 over the last 30 days.

Tesla 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TSLA | CALL | TRADE | NEUTRAL | 03/21/25 | $49.85 | $49.25 | $49.58 | $350.00 | $118.9K | 7.5K | 372 |

| TSLA | CALL | SWEEP | BULLISH | 12/06/24 | $7.85 | $7.75 | $7.85 | $360.00 | $114.2K | 44.1K | 44.1K |

| TSLA | CALL | TRADE | BULLISH | 01/15/27 | $55.0 | $54.7 | $54.98 | $710.00 | $109.9K | 4.5K | 1.3K |

| TSLA | PUT | SWEEP | BULLISH | 12/20/24 | $18.5 | $18.4 | $18.4 | $360.00 | $97.5K | 1.6K | 811 |

| TSLA | CALL | TRADE | NEUTRAL | 03/21/25 | $78.15 | $77.5 | $77.81 | $300.00 | $93.3K | 12.7K | 239 |

About Tesla

Tesla is a vertically integrated battery electric vehicle automaker and developer of autonomous driving software. The company has multiple vehicles in its fleet, which include luxury and midsize sedans, crossover SUVs, a light truck, and a semi truck. Tesla also plans to begin selling more affordable vehicles, a sports car, and a robotaxi. Global deliveries in 2023 were a little over 1.8 million vehicles. The company sells batteries for stationary storage for residential and commercial properties including utilities and solar panels and solar roofs for energy generation. Tesla also owns a fast-charging network.

After a thorough review of the options trading surrounding Tesla, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of Tesla

- Currently trading with a volume of 25,416,622, the TSLA's price is up by 3.31%, now at $356.57.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 51 days.

Professional Analyst Ratings for Tesla

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $350.8.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access. * Consistent in their evaluation, an analyst from B of A Securities keeps a Buy rating on Tesla with a target price of $350. * An analyst from Stifel persists with their Buy rating on Tesla, maintaining a target price of $411. * Showing optimism, an analyst from Roth MKM upgrades its rating to Buy with a revised price target of $380. * Consistent in their evaluation, an analyst from Jefferies keeps a Hold rating on Tesla with a target price of $300. * Maintaining their stance, an analyst from RBC Capital continues to hold a Outperform rating for Tesla, targeting a price of $313.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Tesla, Benzinga Pro gives you real-time options trades alerts.