Don’t expect your morning cereal box to grow back to its former size or those missing paper towel sheets to return to the roll.

Last year, a number of consumer brands quietly shaved off a product’s weight or its size while keeping prices the same — in hopes that shoppers wouldn’t notice, according to a website tracking some of the changes.

The phenomenon, dubbed “shrinkflation,” exploded last year and there’s little sign of a slow down, even as inflation has eased for the past 10 straight months, according to the federal government’s latest consumer price index.

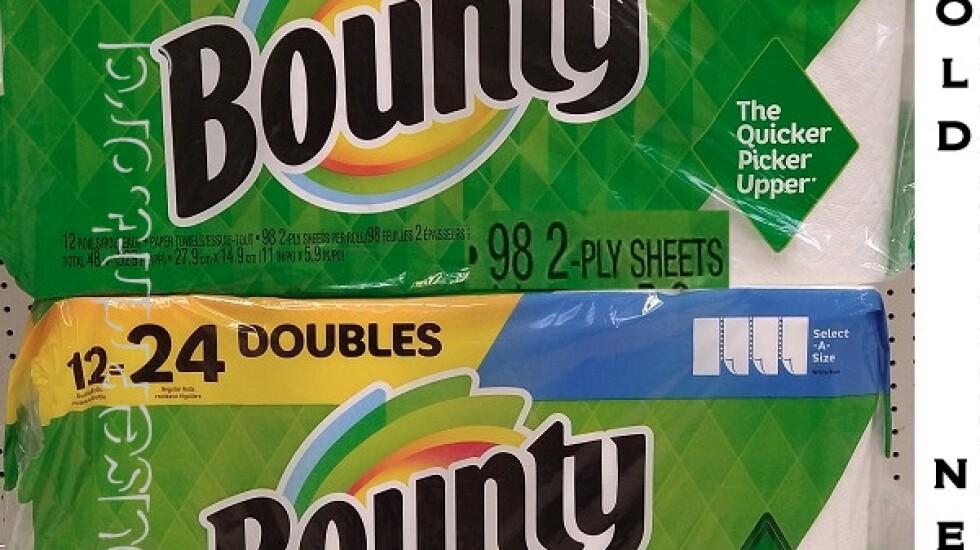

For example, 12-roll packages of Bounty paper towels dropped from 98 two-ply sheets per roll to 90 sheets, a decrease of about 8%.

Suave’s tropical coconut shampoo dropped from 30 fluid ounces to 22.5 fluid ounces, but kept the same price of $2.49.

Oreo Double Stuf cookies got lighter, too: The “family size” package shrunk from 1 pound, 4 ounces to 1 pound, 2.71 ounces.

Edgar Dworsky, a former Massachusetts assistant attorney general who runs two consumer-focused websites, Mouseprint.org and ConsumerWorld.org, has collected examples of shrinking products for years. Among the worst offenders: snack foods, cereals and paper goods.

He says the latest round of downsizing continues to affect how far shoppers’ dollars will go.

It comes as the consumer price index rose 4.9% in April compared with a year ago. While inflation is markedly down from a 40-year high of 9.1% in June 2022, it still remains elevated.

And many American households are not feeling financially secure, according to an annual survey by the Federal Reserve that was conducted in October and released last week. The percentage of people saying they were doing “at least okay” stood at 73%, a drop of 5% from the previous year. Fifty-four percent said price increases had affected their budgets “a lot.”

Dworsky has found a number of examples of shrinkflation over the past year.

A 12-pack of Charmin Mega toilet paper shed 22 sheets off each roll but still cost $14.29.

Huggies Little Snugglers diapers shrunk from 96 diapers per package to 84, while keeping the same $29.99 price.

And Cap’n Crunch’s peanut butter cereal dipped from 12.5 ounces to 11.4 ounces while also staying the same price.

Sometimes, consumers get hit with a smaller product and a price increase like with Kellogg’s Corn Pops, which had a new, 13.1-ounce “large size” version selling for 20 cents more than the old 14.6-ounce size, Dworsky found.

“Prices are going up and sizes are going down, so it’s a double-whammy,” he said.

Kellogg Company, the maker of Corn Pops; Mondelez International, the maker of Oreos; Unilever, the manufacturer of Suave; Kimberly-Clark, which makes Huggies; Quaker Oaks, the maker of Cap’n Crunch’s; and Procter & Gamble, which makes Bounty and Charmin, did not return requests for comment.

Chicago-based Mondelez reported its first quarter net earnings climbed 142% year-over-year and it gave shareholders $928 million in dividends and stock buybacks.

A 2022 consumer survey by business intelligence firm Morning Consult found many shoppers are noticing the shrinking products ploy and aren’t happy. Almost half (48%) said they switched to a different brand after noticing a downsized product.

“My sense is more people would prefer the company to be straight with them” about price increases, Dworsky said.