Bond yields have shot higher since March 2022, when the Federal Reserve began raising interest rates.

The 10-year Treasury yield has soared to 4.67% Friday (April 26) from 1.72% Feb. 27, 2022. It even hit a 16-year high of 5% last October.

Strong economic growth and sticky inflation numbers have sparked the yield rally. While GDP officially expanded only 1.6% in the first quarter, the picture was rosy beneath the surface, economists said.

Both consumer spending and business investment registered smart gains in the quarter.

As for inflation, the personal consumption expenditures price index totaled 2.7% in the 12 months through March, exceeding the Fed’s target of 2%.

That means there’s a good chance that the Fed won’t cut interest rates this year, say experts such as Roger Aliaga-Diaz, Vanguard’s global head of portfolio construction.

Harvard economist Larry Summers sees a 15% to 25% chance that the Fed’s next move will be to raise interest rates.

Jim Davis/The Boston Globe via Getty Images

Fed rate policy’s impact on your investing

So what’s the significance of tight Fed policy for your investments? Answer: Now may be the perfect time to invest in bonds.

Yields are at levels you could only dream of 15 years ago, so you’d be locking in substantial, regular income. And, of course, bonds act as a diversifier to your stock portfolio.

Related: Thought you'd get a Fed interest rate cut in '24? Think again

“What owning bonds does is it gives you the positioning for a scenario where the economy goes into recession and risk is off,” i.e. stocks fall, said Chris Alwine, Vanguard’s global head of credit.

“In typical recessions, equities fall maybe up to 30%... That's where bonds come into play as a diversifier to equities, but also producing very respectable income today.”

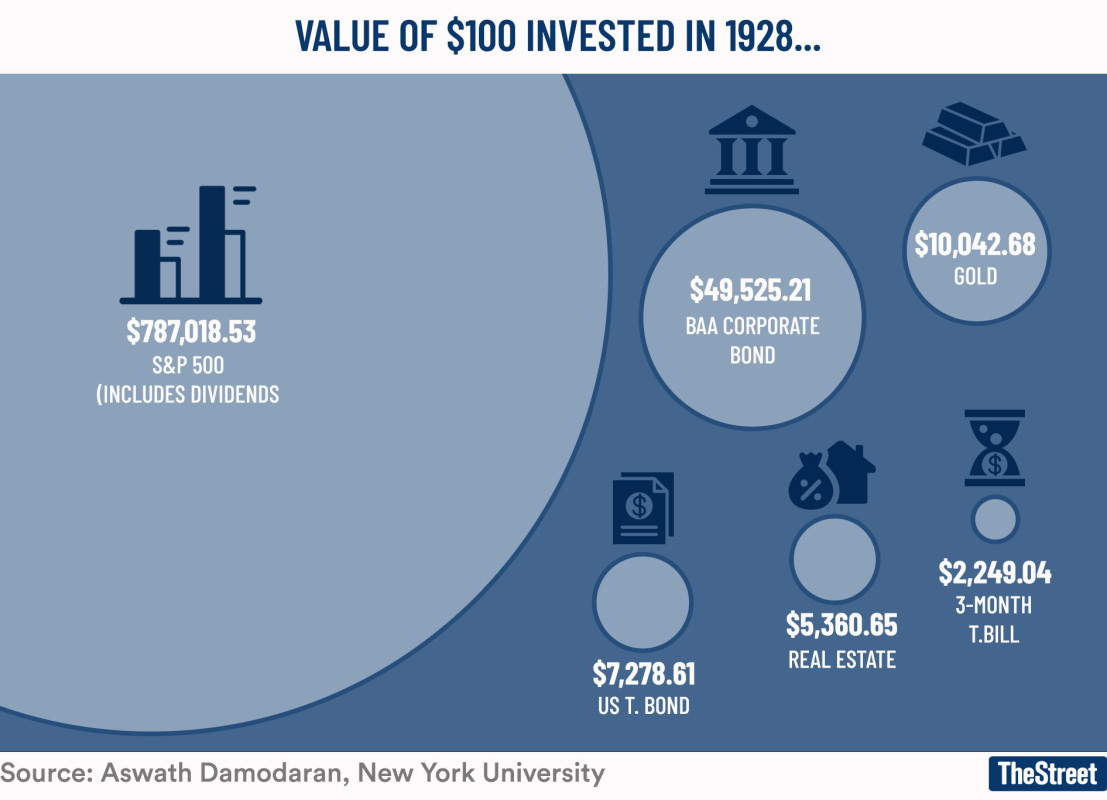

Stocks historically outperform bonds, but with the Fed going “higher for longer” on interest rates, you may have plenty of time to buy bonds with attractive yields.

TheStreet.com

How to invest in bonds

If you want bonds, perhaps your first decision is whether to purchase individual bonds or bond funds. If you’re a novice investor, it may be best to stick with funds to get a diversified bond portfolio managed by an expert.

But there’s a potential problem with bond funds. If interest rates keep going higher, the value of bond funds will slide, potentially causing investment losses if you decide to sell.

Related: U.S. growth slowdown, with inflation spike, raises early stagflation risks

If you choose a safe individual bond, you can hold it until maturity and almost certainly receive par value for the bond at that point. If you want the safest bonds, buy Treasuries. You can purchase them through an online brokerage. The five-year Treasury yielded 4.69% Friday.

More income, more risk

If you want more income, you’ll have to take more risks. But you can find relatively secure corporate bonds. The safest are S&P-rated triple-A, followed by double-A and single-A. I like single-A for the yields, but obviously, I’m taking some credit risk.

These are investment-grade bonds, which means rating agencies like S&P see a low risk of default.

A five-year single-A Bank of America bond yielded 5.56% Friday, surpassing the equivalent Treasury yield by 87 basis points.

More Economic Analysis:

- Watch out for 8% mortgage rates

- Hot inflation report batters stocks; here's what happens next

- Inflation report will disappoint markets (and the Fed)

You could opt for high-yield (“junk”) bonds. These are non-investment-grade securities with higher yields than investment-grade but are more vulnerable to default. They’re often issued by companies with financial problems. There’s a reason why they’re called junk.

Junk bonds are only for advanced investors who can examine companies’ finances thoroughly. I wouldn’t touch them, and you likely shouldn’t either.

If corporate bonds are a choice, try to choose companies from various industries to increase your diversification.

Related: Veteran fund manager picks favorite stocks for 2024