Berkshire Hathaway (BRK.A) (BRK.B) stock remained subdued in the back half of 2025 as markets digested the surprise announcement of Warren Buffett’s departure as chief executive on Dec. 31.

And while transitional uncertainty is undeniable, there are ample reasons to believe BRK.B shares, under the leadership of incoming CEO Greg Abel, will recover some of their lost ground in 2026.

Berkshire Hathaway stock is on track to close this year with a 12% gain, significantly below 18% for the benchmark S&P 500 Index ($SPX).

Berkshire Hathaway Stock Seen Recovering Under Greg Abel

R-360’s managing partner Barbara Goodstein recommends loading up on BRK.B shares at current levels primarily because ultra-high net worth investors remain bullish on the conglomerate holding firm.

At the time of writing, Berkshire Hathaway is trading down nearly 7% versus its year-to-date high, which Goodstein dubbed “a succession discount” in a recent interview with CNBC.

According to her, “the stock is trading below what it will become [in 2026] because everybody is waiting to see how Greg Abel performs.”

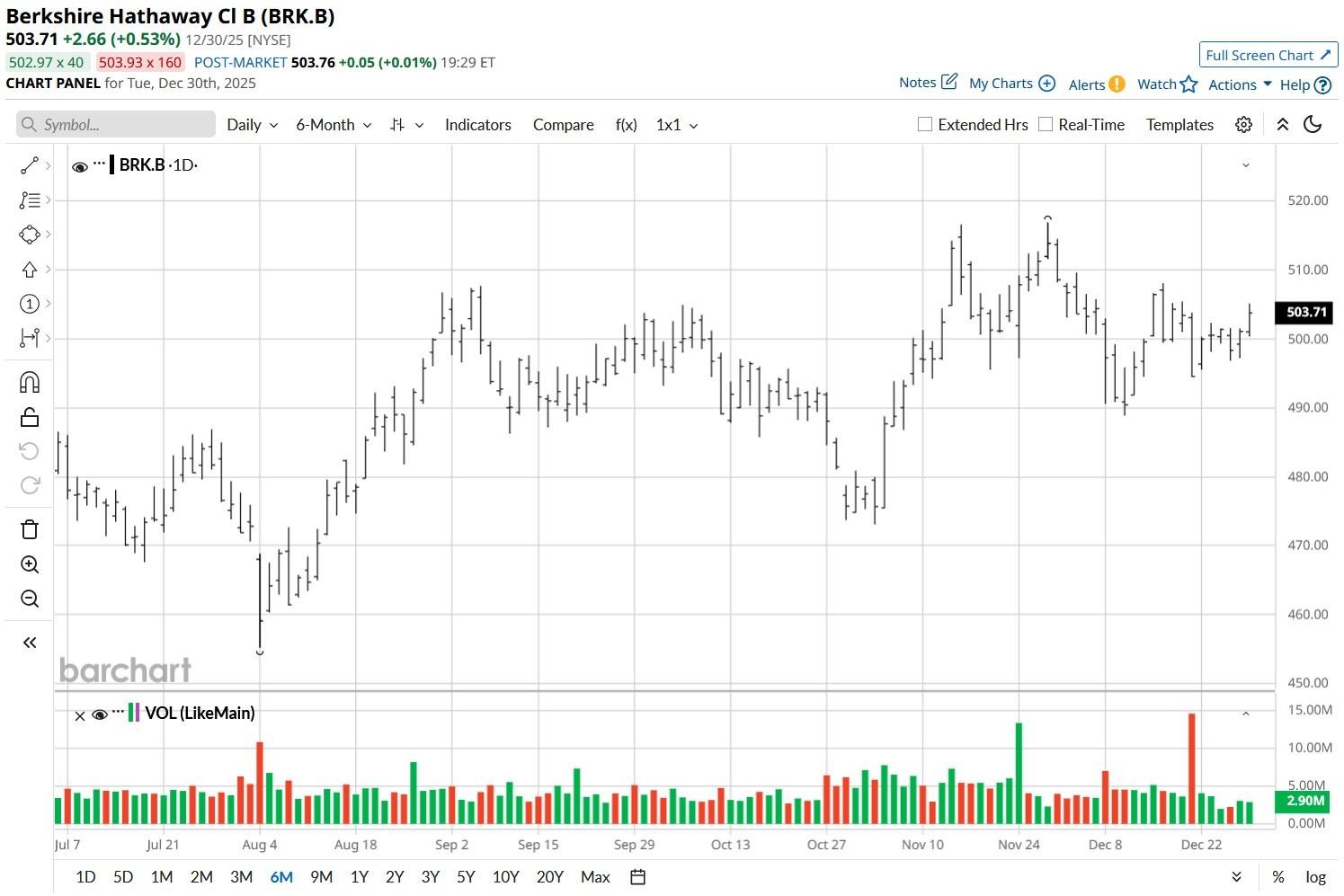

Note that BRK.B has recently pushed past its 200-day moving average (MA), signaling renewed confidence in its company’s future trajectory.

BRK.B Shares Are Trading at a Discount Currently

Greg Abel is taking the helm at a time when Berkshire Hathaway has roughly $382 billion in cash and Treasury equivalents.

This unprecedented war chest allows him exceptional flexibility for opportunistic investments and strategic acquisitions that could materially lift the giant’s future performance.

Importantly, discounted cash flow analysis suggests BRK.B is currently trading about 35% below its intrinsic value, indicating material upside potential for patient investors willing to navigate the biggest leadership transition in corporate history.

Historically (over the past four years), Berkshire Hathaway stock has started the year with a 2.55% rally on average in January, which makes up for another strong reason to stick with it in the near term.

What’s the Consensus Rating on Berkshire Hathaway?

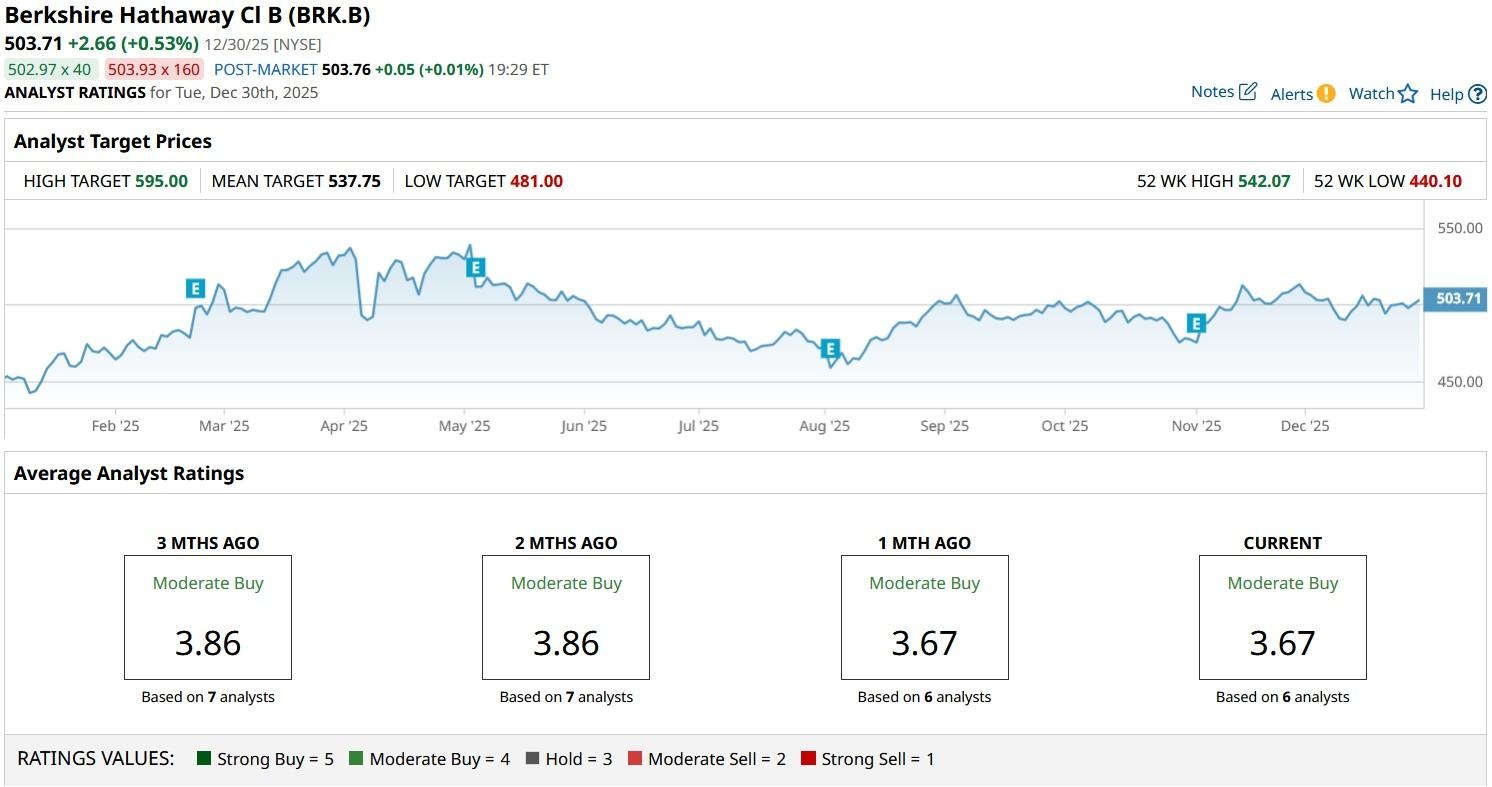

What’s also worth mentioning is that Wall Street analysts remain positive on BRK.B stock heading into 2026.

The consensus rating on Berkshire Hathaway shares currently sits at “Moderate Buy” with price targets going as high as $595 indicating potential upside of about 19% from here.

This article was created with the support of automated content tools from our partners at Sigma.AI. Together, our financial data and AI solutions help us to deliver more informed market headline analysis to readers faster than ever.