U.S. telecom giants are continuing to push aggressively into fiber expansion and cloud partnerships, turning network scale into a long-term strategic advantage. In this competitive setting, AT&T (T) has aligned with Amazon Web Services (AMZN) and Amazon Leo, formerly known as Project Kuiper, to modernize and strengthen the nation’s connectivity backbone.

The partnership builds on an established relationship by combining AT&T’s expansive fiber footprint with AWS’s security, reliability, performance, and artificial intelligence (AI) capabilities. Given the increasing data traffic and complex enterprise demand, the companies hope to provide a more adaptable and resilient connectivity platform.

To advance that strategy, AT&T will connect AWS data center locations using high-capacity fiber, strengthening the cloud backbone that supports customers at scale. AT&T is also collaborating with Amazon Leo, Amazon’s low-Earth-orbit satellite business, enabling expanded fixed broadband for business customers in underserved areas where traditional networks lag.

The market responded favorably to the announcement, sending AT&T’s shares up 1.5% on Wednesday, Feb. 4. With investors warming to the strategy, attention now turns to whether this partnership can drive sustained momentum and unlock further upside for the stock.

About AT&T Stock

Headquartered in Dallas, Texas, AT&T is a global telecom and technology provider delivering wireless connectivity, broadband, and network services. With a market cap nearing $192.3 billion, the company supplies mobile plans, internet access, voice solutions, and managed connectivity, while also selling smartphones and devices through retail and digital channels.

AT&T’s recent stock performance reinforces the improving narrative. Over the past 52 weeks, T stock has gained 10.96%. Momentum accelerated over the past month with a 11.46% rise, while the most recent five trading sessions alone delivered an 3.5% jump.

Valuation still leans conservative, with T stock trading at 11.82 times forward adjusted earnings, a level below the industry average that points to a clear relative discount.

Income continues to anchor the investment case. AT&T pays an annual dividend of $1.11 per share, translating to a yield of 4.06%. The most recent quarterly dividend of $0.28 per share was paid on Feb. 2 to shareholders of record as of Jan. 12.

AT&T Surpasses Q4 Earnings

On Jan. 28, AT&T's shares jumped 4.7% after the company reported Q4 2025 results that exceeded expectations and issued stronger-than-expected guidance for the next three years.

Revenue rose 3.6% year-over-year (YOY) to $33.5 billion, beating Wall Street estimates of $32.7 billion. Adjusted EPS climbed 20.9% to $0.52, surpassing analyst forecasts of $0.46. Meanwhile, adjusted EBITDA rose 4.1% from the year-ago value to $11.2 billion, highlighting improving efficiency across the business.

Subscriber momentum added credibility to the results. The quarter produced 283,000 AT&T Fiber net additions and 221,000 AT&T Internet Air net additions. More than half a million combined advanced home internet net additions for the second consecutive quarter underscored sustained demand for high-speed connectivity.

Looking ahead, management expects consolidated adjusted EBITDA growth of 3% to 4% in 2026, improving to 5% or better by 2028. They forecast adjusted EPS of $2.25 to $2.35 in 2026, with a double-digit three-year CAGR projected through 2028.

Cash flow guidance adds another layer of confidence. Management expects free cash flow to grow by more than $1 billion in 2027 and approximately $2 billion in 2028, driven primarily by adjusted EBITDA growth, supporting dividends, reinvestment, and balance-sheet flexibility.

Analysts broadly align with management’s outlook. Consensus estimates call for Q1 2026 EPS of $0.55, reflecting 7.8% YOY growth. Longer-term forecasts project fiscal year 2026 earnings of $2.31, up 9%, followed by a further 10% increase to $2.54 in fiscal year 2027.

What Do Analysts Expect for AT&T Stock?

Deutsche Bank analyst Bryan Kraft recently raised his price target on T stock to $33 from $31 and reiterated a “Buy” rating. He cited the company’s strong Q4 2025 performance and emphasized the significance of the company’s new three-year guidance.

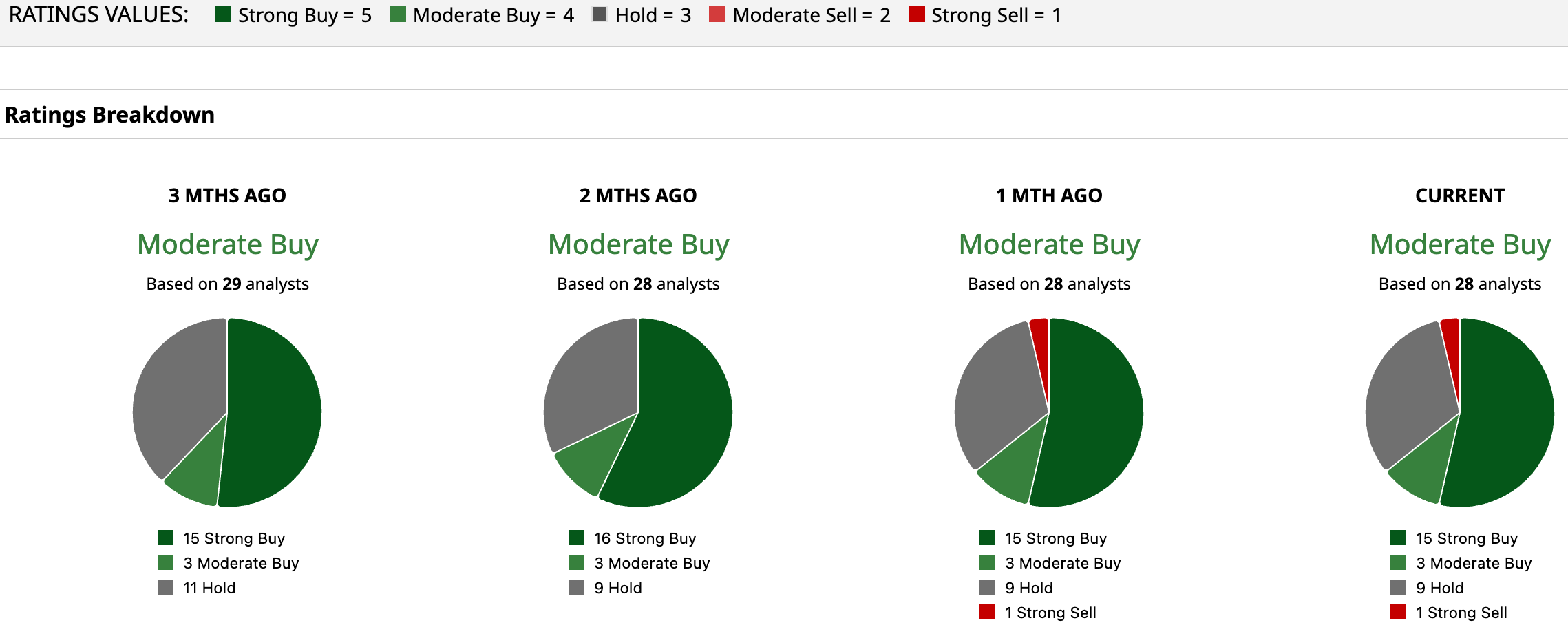

Overall, Wall Street has assigned T stock a “Moderate Buy” consensus rating. Out of 28 analysts, 15 recommend “Strong Buy,” three suggest “Moderate Buy,” nine advise “Hold,” and one issues a “Strong Sell.”

The average price target of $29.60 implies potential upside of 9%. Meanwhile, the Street-high target of $34 points to a gain of 25% from current levels.