One of the least attractive things about having a credit card is the dreaded late fees.

Late fees, the penalty that lenders (banks) charge when you don't make a payment on time, can stack up, particularly for individuals with large amounts of debt or multiple credit cards.

DON'T MISS: Roku and Walmart Take on Amazon in Creepy New Deal

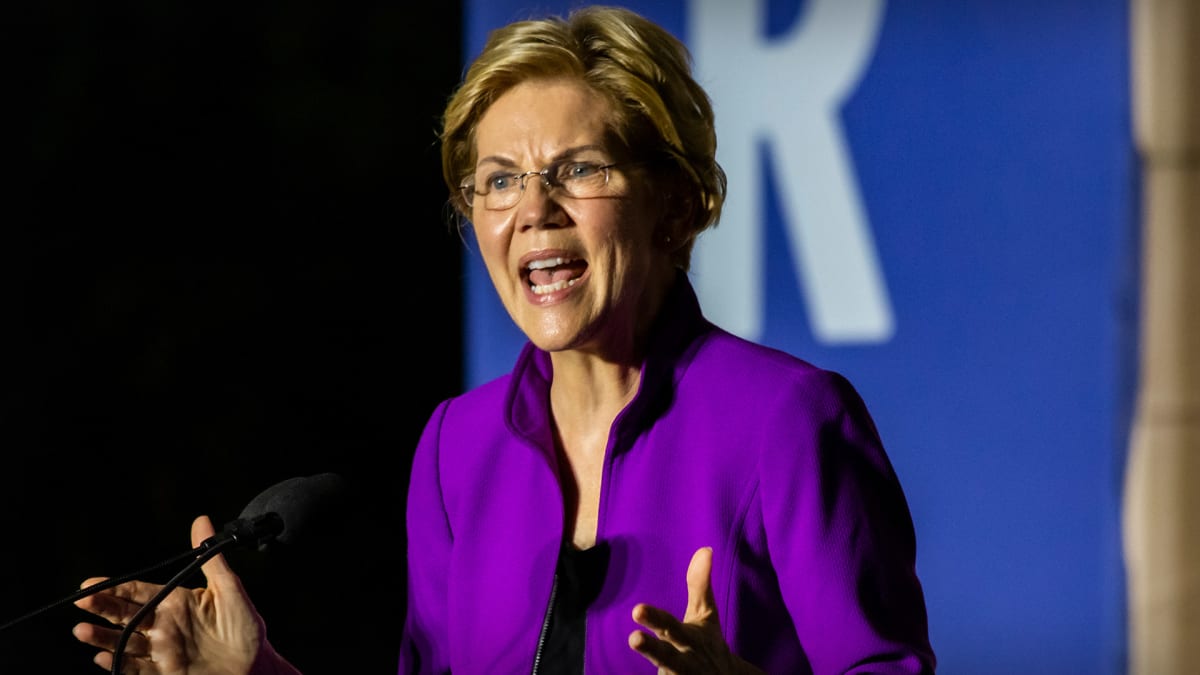

Late fees average $35 to $41 a month and usually depend on your balance outstanding. And while banks are legally permitted to charge late fees, Sen. Elizabeth Warren (D-Massachusetts) and several of her colleagues say the practice is predatory and hurts consumers who need help the most.

Sen. Warren Demands Answers About Late Fees

On May 9 Warren and six other senators -- Sherrod Brown (D-Ohio), Bernie Sanders (I-Vermont), Jack Reed (D-Rhode Island), Tammy Baldwin (D-Wisconsin), Richard Blumenthal (D-Connecticut) and Peter Welch (D-Vermont) -- sent 10 of the largest U.S. credit card providers a letter demanding insight into their late-fee practices. Responses are due by May 23.

An excerpt of the letter addressed to JP Morgan CEO Jamie Dimon reads:

Dear Mr. Dimon:

We write regarding the Consumer Financial Protection Bureau’s (CFPB) proposed rule to limit exorbitant credit card late fees and save American consumers billions of dollars,1 and to inquire about the role your company is playing in an ongoing effort by the [country’s] most powerful banks to quash that rule.

The 10 lenders in question are:

- JPMorgan Chase

- Bank of America

- Citi

- Wells Fargo

- U.S. Bank

- PNC

- Capital One

- American Express

- Discover

- USAA

Leonardo Munoz/VIEWpress via Getty Images

The questions the U.S. senators want answered are:

- How much money do you collect in credit card late fees each year?

- What proportion of these fees are collected from low-income earners (families with incomes below 200% of the federal poverty threshold)?

- What is the estimated annual cost of collecting late credit card payments?

- Do you agree with bank lobbyists who argue that this rule will hurt those it tries to help?

- Many banks have reduced or eliminated overdraft fees, another harmful junk fee, without raising costs for consumers. How do you reconcile this with the lobby’s argument that consumers will pay the price for limited late fees?

In February the Consumer Financial Protection Bureau, which Sen. Warren developed with the Barack Obama administration, tried to cap late fees to a maximum of $8 or no more than 25% of a minimum payment. The banks vehemently opposed the idea.

“Unlike the Bureau’s mischaracterization of late fees, consumers understand late fees and recognize the importance of late fees in promoting responsible consumer behavior and more efficiently allocating costs,” the American Bankers Association, Consumer Bankers Association and National Association of Federally-Insured Credit Unions said in a response to the proposal.

Sen. Warren has made a career out of high-profile scraps with large financial institutions.

She specifically ran against big banks in 2012, claiming "it was possible to run against the big banks without Wall Street money and still win." Warren also blamed Wall Street for the 2008 financial crisis, saying its fast-and-loose practices "wrecked our economy and destroyed millions of jobs."

Warren in 2013 tried to curtail banking influence on consumers by introducing legislation to further separate investment and consumer banks. And in 2016, she called for former Wells Fargo (WFC) Chief Executive John Stumpf to be "criminally investigated" over a fraudulent account-opening scandal.

Get exclusive access to portfolio managers and their proven investing strategies with Real Money Pro. Get started now.