KEY POINTS

- Kwon is currently serving his sentence in Montenegro

- Jump Trading president pleaded the Fifth when asked about a controversial 2021 agreement with Kwon

- The SEC sued Kwon for criminal fraud

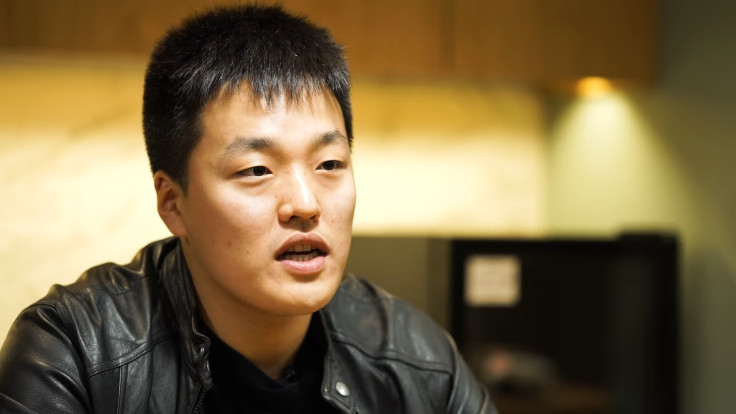

The U.S. Securities and Exchange Commission reportedly received help from whistleblowers to build its fraud case against South Korean crypto mogul Do Kwon and his blockchain firm Terraform Labs.

During a hearing at a Manhattan court last Thursday, lawyers for Kwon said that unnamed whistleblowers, one of them from Jump Trading Group, had helped federal regulators in building their fraud case against the Terra co-founder.

Referring to a "Jump whistleblower" who provided evidence to the SEC, defense lawyer Douglas Henkin attacked the regulator's credibility, saying officers had no direct, firsthand knowledge of the "secret" 2021 deal during the deposition.

Mark Califano, another lawyer representing Kwon, told the court that the major Wall Street regulator depended on a whistleblower for a major part of its case involving South Korean payment app Chai, which was founded by TFL co-founder Daniel Shin.

The SEC accused Kwon of deceiving investors by claiming that Chai used the Terra blockchain to settle payments when it actually used a traditional payment method.

Califano claimed that the whistleblower secretly recorded conversations with a Chai engineer where they talked about how the app worked. The lawyer described the individual as "incredibly biased" and said they had been caught lying multiple times.

Kwon has since denied committing fraud. Aside from the SEC's lawsuit, he also faces a similar criminal case from the U.S. Department of Justice over the spectacular collapse of Terra, which wiped out billions of dollars in investment in May 2021.

Kwon is currently serving his sentence in Montenegro for possession of fake travel documents.

His legal team tried to appeal his sentence in Montenegro but it was denied.

It was reported last month that the SEC investigated whether Kanav Kariya, the president of the quantitative trading firm Jump Trading, was involved in a secret agreement with Kwon. The probe was focused on whether Jump agreed to stabilize the peg of so-called algorithmic stablecoin TerraUSD to the U.S. dollar in May 2021 by acquiring a significant number of UST.

According to a deposition unsealed in October, SEC counsel Devon Staren asked Kariya, "And when you asked Do Kwon to lift the vesting conditions in exchange for Jump's agreement to buy up UST to restore the peg, Do Kwon agreed to that, correct?"

Instead of denying or confirming anything, the crypto executive pleaded the Fifth and refused to answer the question.